Lego City:

With the US holiday behind us, the true trading week starts today with the major fundamental news hitting the wires being a report citing that OPEC has continued to boost Crude Oil production despite its issues.

The price of oil came under pressure overnight, sold hard throughout the session after secondary sources cited in OPEC’s monthly report stated huge supply increases despite the forecast slowdown in demand, most notably from the Chinese market.

“OPEC trimmed its estimate of 2016 world oil demand growth by 40,000 bpd to 1.25 million bpd, citing slower growth in China.”

With freshly highlighted concerns over the supply/demand balance of Crude combined with the technical picture, moves like this happen.

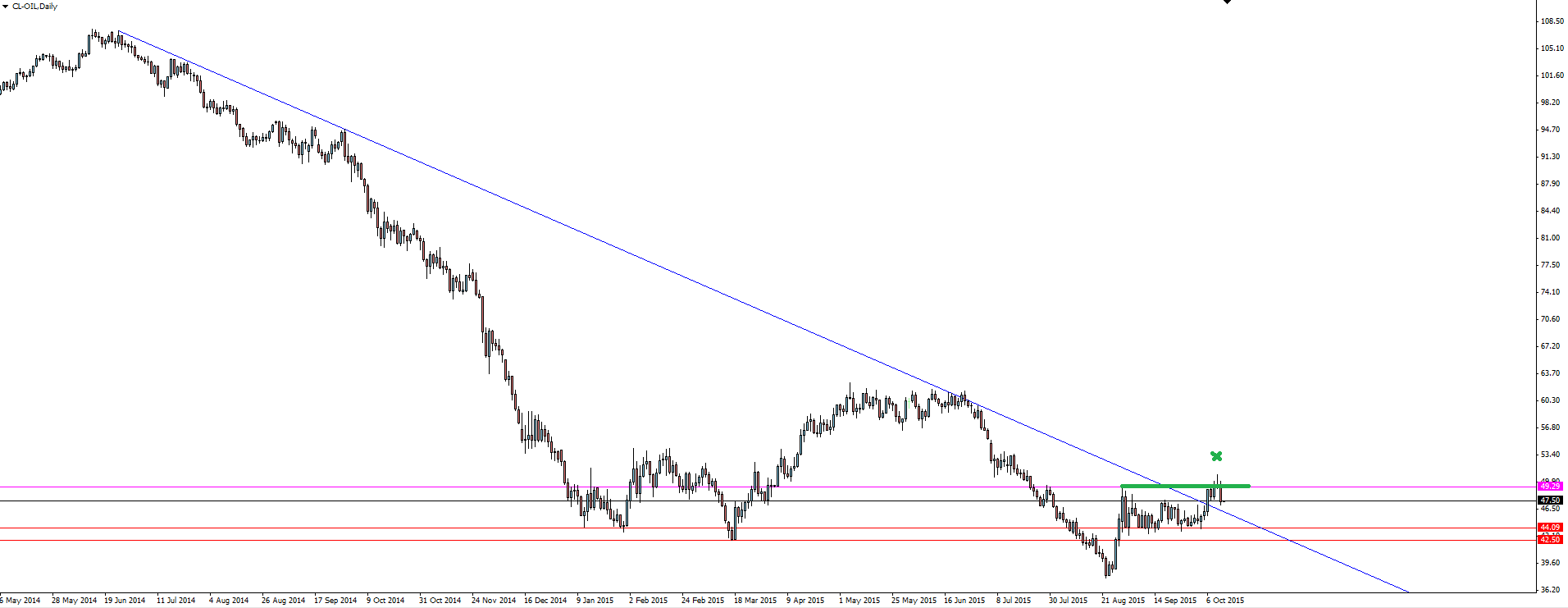

Oil Daily:

If you’re bearish Oil, you can’t go wrong with the price action on the daily chart. Price trying to break the major down trend but failing at the first level of short term resistance. Price has also failed to breach its 200 day moving average but I’ll leave you to draw those up on your charts if that’s your thing.

The level marked on the chart above shows price poking its head through resistance and clearing any stops and the weak longs with it, before being smacked back down.

Look for the reactivation of the trend line as resistance and then a possible new leg lower.

On the Calendar Tuesday:

AUD RBA Deputy Gov Lowe Speaks

AUD NAB Business Confidence

CNY Trade Balance

GBP CPI y/y

EUR German ZEW Economic Sentiment

Chart of the Day:

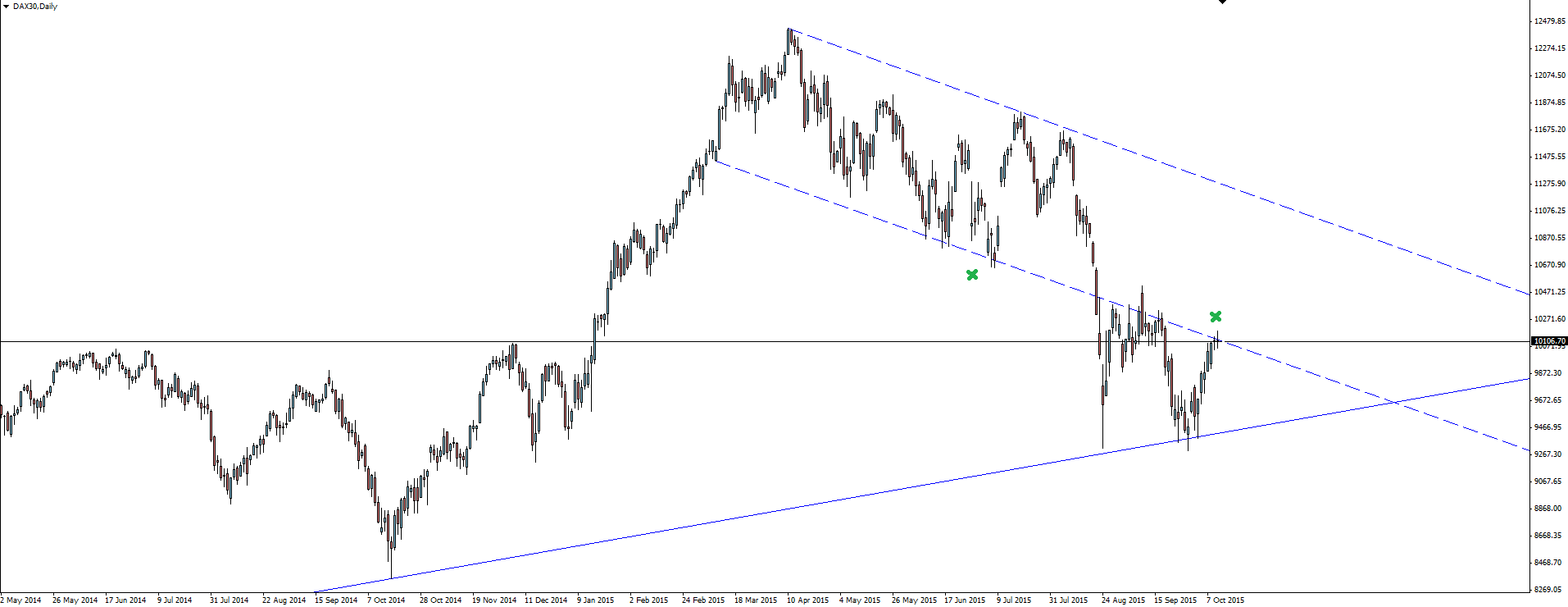

With Vantage FX changing from Futures based Indices trading to the more streamlined Cash Indices Trading markets, we today take a look at the continuing narrative developing in the German DAX.

DAX Daily:

With our last Technical Analysis post taking a look at DAX sitting on major trend line support following the Volkswagen (DE:VOWG) debacle, price has now bounced up again to re-test the underside of the broken short term channel/flag.

If you look at the hourly chart, you could argue that this is the 6th touch of the trend line. With the vertical move up to the level and major trend line support holding, I am now watching for price to reactivate the line as support again and continue its move higher.

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd, does not contain a record of our prices, or an offer of, or solicitation for, a transaction in any financial instrument. The research contained in this report should not be construed as a solicitation to trade Forex. All opinions, news, research, Forex analysis, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently any person opening a Forex trading account and acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the actions of the reader. We always aim for maximum accuracy and timeliness and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on the service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.