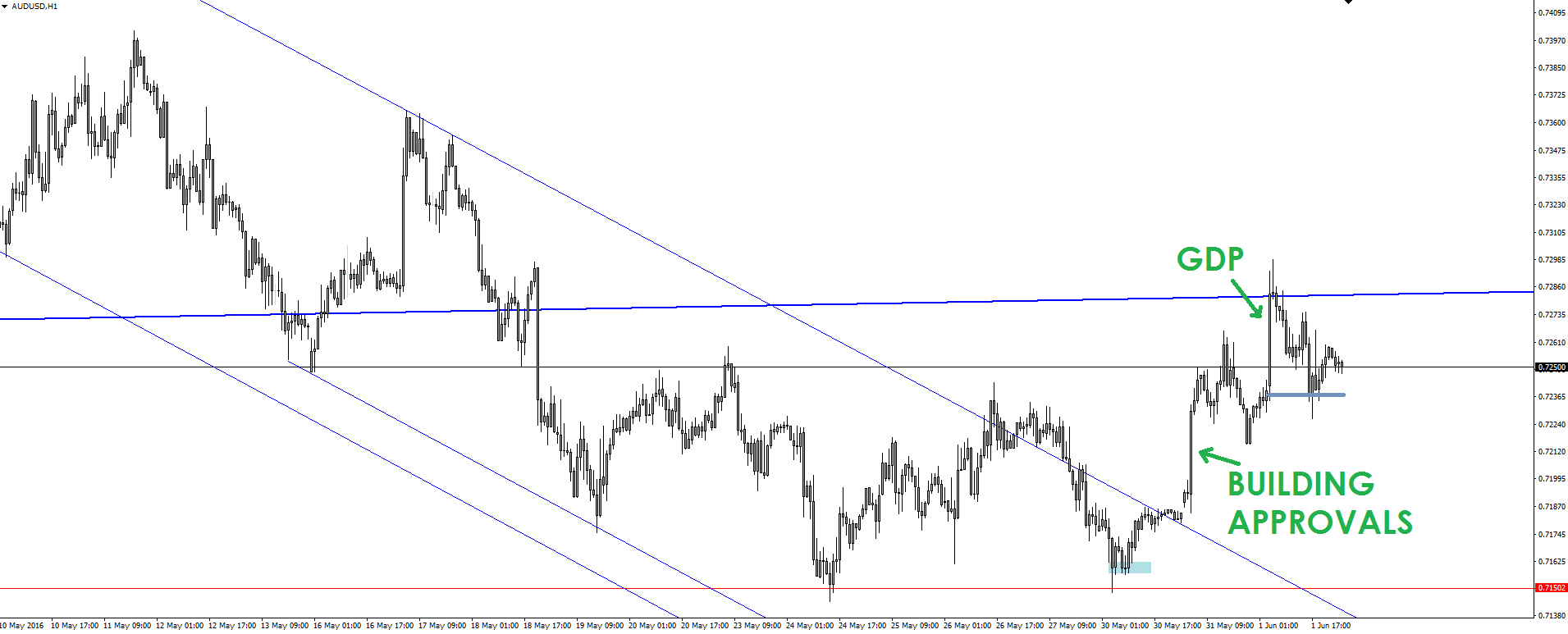

Riding the Aussie:

After highlighting the opportunity of a possible AUD/USD contrarian trade at the most recent swing lows, the deluge of Australian economic data that has been dumped this week saw the Aussie get a nice double kick to the upside.

But disappointing for AUD/USD bulls was the fact that after yesterday’s excellent headline GDP beat, the currency pair couldn’t hold onto its gains and the entire rally was wiped out not long into the New York trading session.

US ISM Manufacturing data beat expectations, but the trade-off between a June and July Fed rate hike for me still relies on the Fed’s willingness to move in the middle of a Brexit referendum. Having shown a reluctance to move in the past due to global concerns centred around China, I just can’t help but lean toward July.

There is actually an overwhelming amount of charts sitting at excellent levels which I’m looking forward to feeding out via the @VantageFX Twitter feed. If you’re not involved in the discussion over there, come and get involved today by giving us a mention.

Charts of the Day:

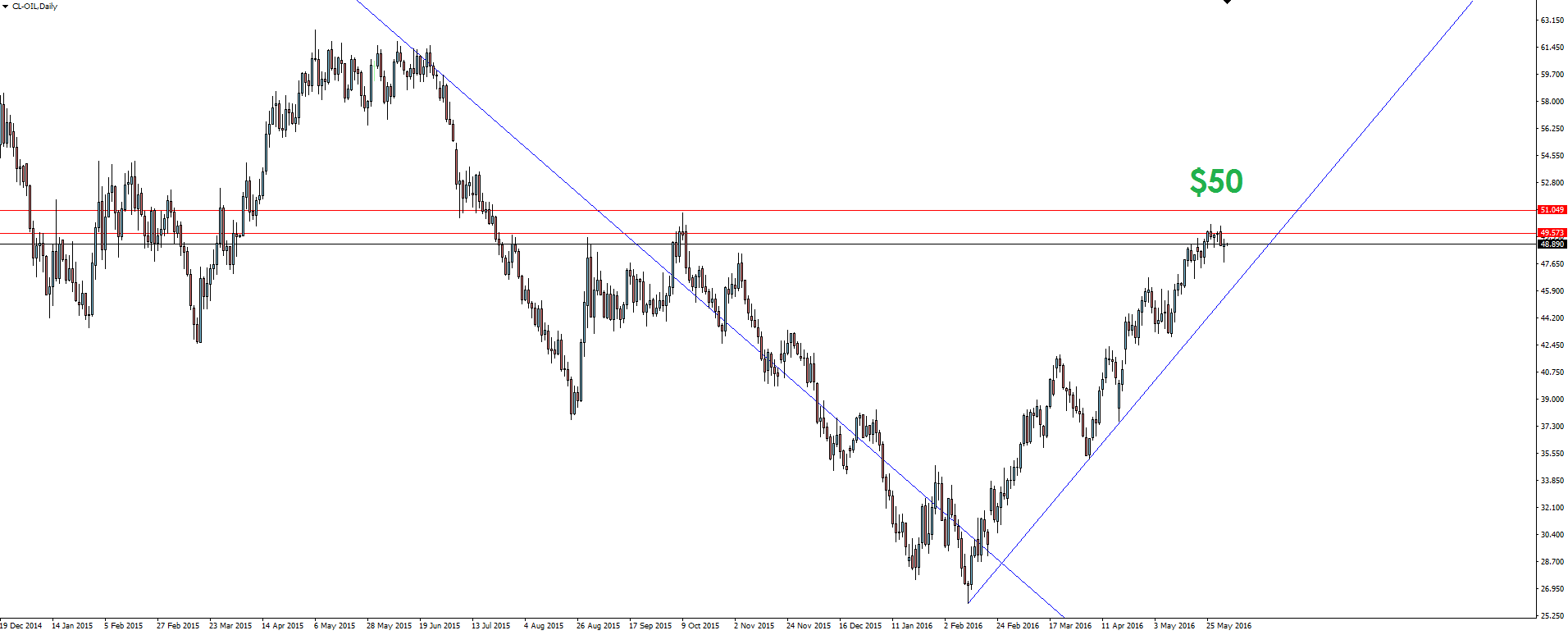

We ended last week with a post on oil’s $50 psychological level and it looks like the round number was enough to spook the bulls into covering some of their long positions into it.

Oil Daily:

With the official OPEC meeting back on the calendar in Vienna tonight, closed door talks in the lead up has revived the possibility of the block backing a production ceiling.

Just keep in mind that this narrative of high expectations and equally high disappointment has played out countless times over the last 12 months alone and there is no reason to expect tonight’s result to be any different. Oil markets just wont learn.

When Saudi Arabia and Iran are involved, it really is hard to feel overly bullish no matter what the WSJ headlines tell you.

On the Calendar Thursday:

AUD Retail Sales m/m

AUD Trade Balance

EUR Italian Bank Holiday

GBP Construction PMI

EUR Minimum Bid Rate

EUR ECB Press Conference

ALL OPEC Meetings

USD ADP Non-Farm Employment Change

USD Unemployment Claims

GBP BOE Gov Carney Speaks

USD Crude Oil Inventories

“Festa della Repubblica: (in English, Republic Day) is the Italian National Day and Republic Day, which is celebrated on 2 June each year. The day commemorates the institutional referendum held by universal suffrage in 1946, in which the Italian people were called to the polls to decide on the form of government, following the Second World War and the fall of Fascism.”

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Vantage FX does not contain a record of our prices, low spreads or solicitation to trade. All opinions, news, research, prices or other information is provided as general news and market commentary – not as investment advice. Consequently any person acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the actions of the reader. We always aim for maximum accuracy and timeliness, Australian Forex Broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.