- Rising oil prices driven by geopolitical tensions heighten investment interest in the energy sector

- The potential for disruptions in oil exports from the Middle East raises concerns about global supply stability

- Below, we will discuss 3 energy companies with strong fundamentals and promising investment opportunities

- Looking for actionable trade ideas to navigate the current market volatility? Unlock access to InvestingPro’s AI-selected stock winners for under $9 a month!

With escalating tensions in the Middle East causing oil prices to soar, now may be the perfect time for investors to evaluate the energy sector for potential growth opportunities.

Several energy companies are well-positioned to capitalize on rising demand and improve their market standings. This article delves into key players in the oil market that are well-positioned to benefit from the current landscape and may provide attractive investment options.

Investors are increasingly cautious about a potential offensive against energy infrastructure in the world’s largest crude-exporting region, which could disrupt exports in an area that produces a third of the world's oil.

Why the Strait of Hormuz Matters

One scenario that could push oil prices even higher—potentially to $100 per barrel—is the possibility of Iran blocking the Strait of Hormuz. This vital sea channel is one of the most important in the world for global energy logistics.

Approximately 20% of the world's daily oil consumption and 30% of the oil transported by sea passes through the Strait, amounting to 14.6 million barrels of oil and 60 million tons of liquefied natural gas every day. A blockade here would cause significant disruptions, halting the transport of one-fifth of global oil consumption.

For those interested in the oil sector, a noteworthy exchange-traded fund (ETF) is the Wisdom Tree Brent Crude Oil. Launched on January 9, 2012, this fund is based in Jersey and has approximately 655 million euros in assets under management. It tracks the Bloomberg Brent oil index, with a total fee of 0.49%. Over the past five years, it has yielded a 96.51% return and a 58.11% return over the last three years.

Let's take a look at 3 notable energy stocks currently trading below their fundamental values show promising market support:

1. Ovintiv

Ovintiv (NYSE:OVV), formerly Encana, is a Canadian company listed in the United States, focused on natural gas and oil production, with a market capitalization of nearly $11 billion.

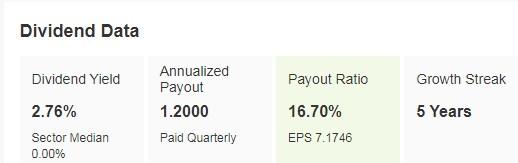

Its dividend yield is 2.76%, and it has consistently increased its dividend over the last five fiscal years.

Source: InvestingPro

Ovintiv reports its next quarterly results on November 5, with expectations for a 6.9% increase in earnings per share (EPS) by 2025. The company generated free cash flow of $403 million in the previous quarter, with a full-year forecast of $1.9 billion.

Source: InvestingPro

The company has maintained a strategic focus on reducing debt and improving shareholder returns. In addition, its diversified portfolio of assets allows it operational flexibility and efficiency, which is expected to contribute to its financial and operational objectives.

Ovintiv’s strategic focus on reducing debt, improving shareholder returns, and maintaining a diversified portfolio of assets allows its operational flexibility and efficiency.

With a price-to-earnings (P/E) ratio of 5.73, it appears undervalued relative to its earnings potential.

Out of 20 analysts' ratings, 13 recommend buying the stock, while seven suggest holding.

Additionally, Coterra Energy (NYSE:CTRA) is rumored to have approached Ovintiv with a takeover proposal, although neither company has confirmed this.

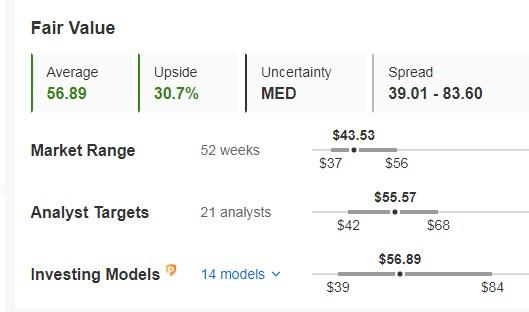

Ovintiv is trading 30% below its fair value estimate of $56.89, with the market giving it a potential upside to $55.57.

Source: InvestingPro

2. Permian Resources

Permian Resources (NYSE:PR) is an oil and gas production company, headquartered in the United States, with a market capitalization of $10.7 billion.

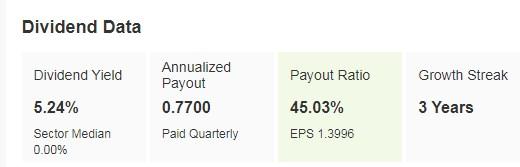

It offers a dividend yield of 5.24%, with remarkable dividend growth of 105% over the last 12 months.

Source: InvestingPro

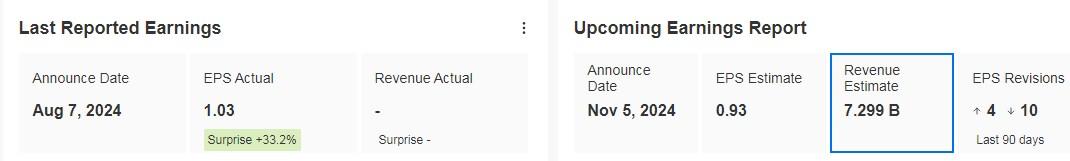

The company announces its next quarterly results on November 5, with expectations for EPS to increase by 4.2% this year and 5.8% in 2025. In the previous quarter, Permian Resources outperformed estimates, with revenue nearly doubling year-over-year to $1.2 billion, and EPS improving by 71.4% to $0.39.

Source: InvestingPro

Permian’s strong fundamentals are supported by its focus on high-quality assets in the Permian Basin, particularly the Delaware Basin, known for its rich resources. The company has been profitable over the last 12 months, with an impressive operating income margin of 37.77%.

The company’s strategic acquisition of the Barilla Draw assets is expected to enhance future growth by adding high-yielding inventory.

With 19 analysts' ratings (17 buy, two hold), the stock is considered a strong buy, with an average price target of $18.95.

Source: InvestingPro

3. Occidental Petroleum

Occidental Petroleum (NYSE:OXY) is a major player in oil and gas exploration, with operations across the United States, the Middle East, Africa, and Latin America.

The company has a market capitalization of $46.2 billion and offers a dividend yield of 1.58%, paying $0.88 per share annually.

Source: InvestingPro

Occidental will announce its next quarterly results on November 5, following a second quarter where it recorded its highest production in four years, generating $1.3 billion in free cash flow. The company expects EPS to increase by 28.8% in 2025, with revenue growth of 5.8%.

Source: InvestingPro

Occidental is a key holding in Warren Buffett's Berkshire Hathaway (NYSE:BRKa) portfolio, with Berkshire recently increasing its stake in the company and now owns nearly a third of Occidental’s shares. It acquired more shares in June and is now the sixth-largest holding in the portfolio.

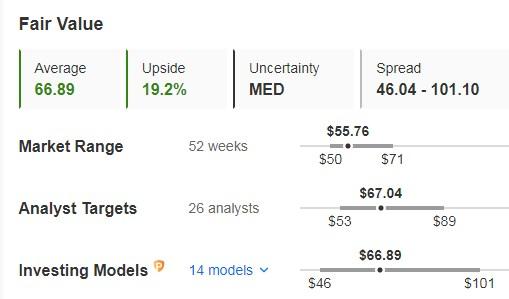

Currently, Occidental is trading 19% below its fair value target of $66.89, with market estimates projecting potential upside to $67.04.

Out of 21 analyst ratings, seven are buy, 13 are hold, and one is sell.

Source: InvestingPro

***

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk is at the investor's own risk. We also do not provide any investment advisory services.