GROWTHACES.COM Forex Trading Strategies

Taken Positions

EUR/USD: short at 1.0930, target 1.0750, stop-loss 1.1015, risk factor *

USD/JPY: long at 123.70, target 125.80, stop-loss 122.90, risk factor *

USD/CHF: long at 0.9560, target 0.9750, stop-loss 0.9490, risk factor *

EUR/GBP: short at 0.7025, target 0.6905, stop-loss 0.7070, risk factor **

EUR/CHF: long at 1.0380, target 1.0580, stop-loss moved to 1.0460, risk factor **

Pending Orders

USD/CAD: buy at 1.2900, target 1.3095, stop-loss 1.2820, risk factor *

AUD/USD: sell at 0.7450, target 0.7250, stop-loss 0.7530, risk factor *

NZD/USD: sell at 0.6765, target 0.6405, stop-loss 0.6870, risk factor *

GBP/JPY: buy at 192.45, target 195.00, stop-loss 191.30, risk factor **

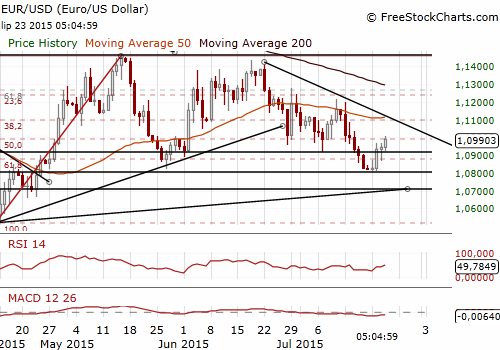

EUR/USD: Strong US Housing Data Suggest September’s Fed Hike Is Likely

(short for 1.0750)

- Greek Prime Minister Alexis Tsipras won parliamentary approval for a second package of reforms required to start talks on a financial rescue deal. The bill that lawmakers voted on early Thursday covered rules for dealing with failed banks and speeding up the justice system - two more conditions set by the eurozone and IMF to open negotiations on an EUR 86 billion loan. The legislation easily passed with the backing of 230 votes in the 300-seat chamber, once again due to opposition support. The government has said it hopes negotiations on the bailout deal can start this week and be wrapped up by August 20.

- The ECB's banking supervision arm will conduct a comprehensive assessment of the state of Greece's banks after the summer to determine their capital needs. Up to EUR 25 billion of the proposed bailout are earmarked for bank recapitalisation and possible resolution. If a deal is ratified in September, a first quarterly review of Greece's progress and economy would be conducted in December.

Key dates for Greece:

July 22 - detailed negotiations on third Greek bailout due to open in Athens, with experts from the European Commisison, European Central Bank and International Monetary Fund

August 20 - Greece due to redeem five-year bond held by European Central Bank, with principal and interest of EUR 3.4 billion.

September - potential signing and ratification of third bailout programme under European Stability Mechanism

October 11 - expiry of 3-month bridge loan from European Financial Stability Mechanism

December - potential first quarterly review of Greek progress in third bailout

- Despite the solid EUR/USD recovery moves, the wide cloud that spans 1.0994-1.1202 will likely impede EUR/USD bulls in the days ahead. The support for the USD may come from hawkish comment from the Fed policymakers, as recent US data suggest a hike in September is likely.

- The National Association of Realtors said yesterday US existing home sales increased 3.2% to an annual rate of 5.49 million units, the highest level since February 2007 and above the market consensus of 5.40 million. June's solid home sales report came right after last week's strong housing starts and building permits data. A tightening labor market is starting to push up wages, helping to boost demand for housing, especially among young adults. But supply remains a constraint.

Significant technical analysis' levels:

Resistance: 1.1035 (high Jul 15), 1.1090 (high Jul 14), 1.1100 (psychological level)

Support: 1.0922 (session low Jul 23), 1.0869 (low Jul 22), 1.0812 (low Jul 21)

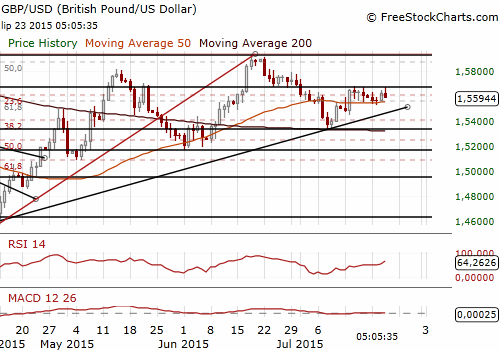

GBP/USD: UK Retail Sales Data Disappoints

(stay sideways)

- British retail sales volumes dropped by 0.2% mom in June to show 4.0% growth yoy. The market expected a 0.3% mom rise.

- For the second quarter as a whole, the volume of goods bought was up 0.7% from the previous quarter, compared with a rise of 0.9% in the three months to March. We should notice, however, that this result was influenced by falling prices.

- The GBP/USD eased against the USD and the EUR after British retail sales fell unexpectedly in June. We stay sideways on the GBP/USD, but EUR/GBP perspective remains bearish. The outlook on British consumer spending in the coming months should be rosy, despite today’s weaker sales reading, as disposable income is rising with falling prices for many goods. Moreover, last-week's data showed the fastest wage growth in more than five years. That is why weaker retail sales data for June should not reduce the likelihood of Bank of England delivering an interest rate hike in December. EUR/GBP upticks could be a good opportunity to get short on this pair.

Significant technical analysis' levels:

Resistance: 1.5671 (session high Jul 23), 1.5673 (high Jul 17), 1.5676 (high Jul 15)

Support: 1.5551 (low Jul 22), 1.5529 (low Jul 21), 1.5503 (50% fibo 1.5330-1.5676)

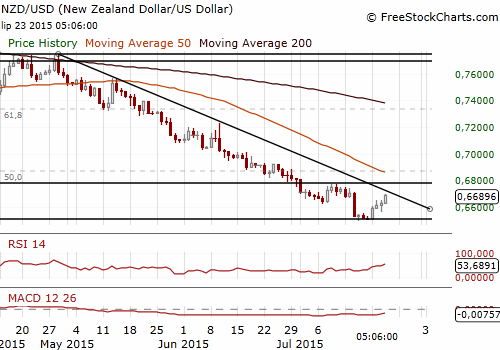

NZD/USD: 25 Bps Now And Further Rate Cuts Soon

(sell at 0.6765)

- The Reserve Bank of New Zealand cut its official cash rate by 25 basis points to 3.0%. RBNZ Governor Graeme Wheeler said in a statement: “A reduction in the OCR is warranted by the softening in the economic outlook and low inflation (…) At this point, some further easing seems likely. (…) While the currency depreciation will provide support to the export and import competing sectors, further depreciation is necessary given the weakness in export commodity prices.”

- We wrote yesterday: “… there are two scenarios for today: a 25 bps cut and flagging more rate cuts soon, or a 50 bps cut but with wait-and-see guidance and softening the language on the NZD.” The RBNZ decided for this first option.

- The NZD went up yesterday, as the bank had not decided for a more aggressive 50-bps reduction, but in our opinion, this rally was only a short-term reaction, and should be short-lived. The NZD/USD has even stronger potential to fall in the medium-term now than in the case when the RBNZ cuts by 50 bps with a wait-and-see guidance and softens its language on the NZD. We expect another rate cut by 25 bps in September, so the NZD/USD will be under pressure of monetary easing in New Zealand and rate hikes in the USA in the coming weeks. We do not change our bearish NZD/USD outlook. We are looking to sell the NZD/USD at 0.6765.

Significant technical analysis' levels:

Resistance: 0.6700 (psychological level), 0.6724 (high Jul 15), 0.6743 (high Jul 14)

Support: 0.6565 (session low Jul 23), 0.6560 (low Jul 22), 0.6505 (low Jul 20)