- Nvidia is scheduled to report fiscal fourth-quarter earnings after the bell on Wednesday.

- Excitement over the business potential of AI has boosted its shares by 40% this year.

- NVDA stock could see a post-earnings selloff if results fail to blow past estimates.

- Looking for more actionable trade ideas? Join InvestingPro for under $9 a month for a limited time only and never miss another bull market by not knowing which stocks to buy!

Nvidia's (NASDAQ:NVDA) earnings report on Wednesday afternoon is set to pose a critical test for the AI-led market rally.

Some analysts are even going as far as to suggest that the print could be the most important one for the entire stock market in years.

Given Nvidia's stature and its leading role in the artificial intelligence hype train that has been propelling recent gains in U.S. stocks, the company's upcoming results have the potential to significantly impact market sentiment.

The Santa Clara, California-based tech giant briefly overtook Alphabet (NASDAQ:GOOGL) and Amazon (NASDAQ:AMZN) to become the third most valuable company trading on the U.S. stock exchange last week, trailing only Microsoft (NASDAQ:MSFT) and Apple (NASDAQ:AAPL).

With excitement around AI innovation reaching a fever pitch, investors are closely watching to see if Nvidia's results will validate the optimism surrounding the tech sector.

Should the chipmaker fail to meet expectations, it could have swift repercussions on investor sentiment, potentially dampening enthusiasm for AI-related investments.

With so much riding on the outcome, all eyes will be on Nvidia as the market awaits the verdict on the company's performance and its implications for the future trajectory of AI-driven innovation.

What To Expect

Nvidia is scheduled to release its highly anticipated fiscal Q4 update after the U.S. market close on Wednesday at 4:20 PM ET, and it is expected to shatter its sales record once again amid robust demand for its AI chips.

A call with CEO Jensen Huang and finance chief Colette Kress is set for 5:00 PM ET.

An InvestingPro survey of analyst earnings revisions points to mounting optimism ahead of the print. Profit estimates have been revised upward 33 times in the last three months, compared to zero downward revisions.

Source: InvestingPro

Consensus expectations call for Nvidia to post earnings per share of $4.64, jumping 426% from EPS of $0.88 in the year-ago period.

Meanwhile, revenue is forecast to skyrocket 239% year-over-year to $20.5 billion, as the tech leader benefits from a surge in demand for its A100 and H100 AI chips, which have become the gold standard in AI development.

If confirmed, that would mark Nvidia’s third consecutive quarter of triple-digit percentage growth in both earnings and sales.

The Key Metric to Watch

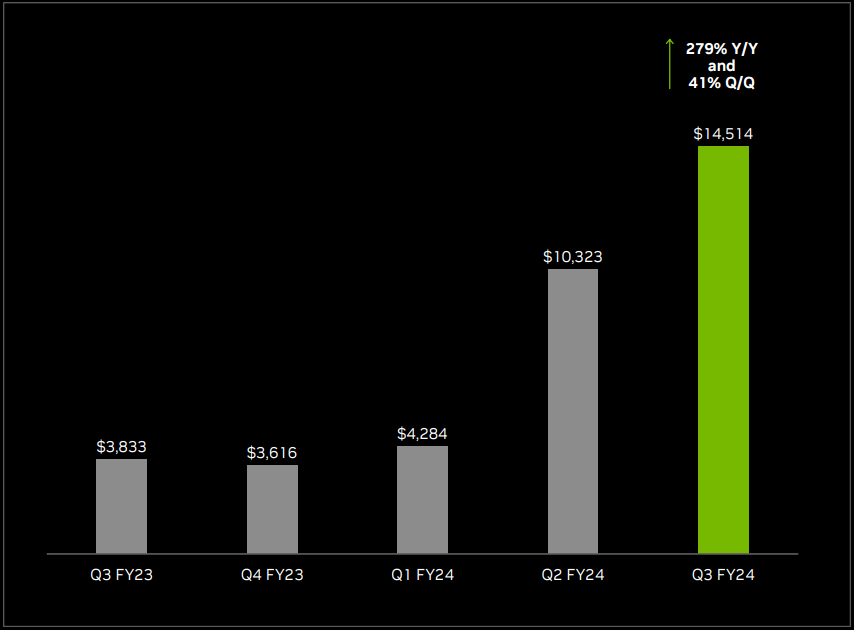

The market will stay focused on growth rates at Nvidia’s data center business, which provides cloud and AI services. The key unit saw sales surge 279% annually to a record $14.51 billion in the third quarter.

Source: Nvidia Investors Presentation

Nvidia said that nearly half of the data center revenue during the period came from cloud infrastructure providers such as Amazon, and the other from consumer internet entities and large companies.

Cloud service providers have been actively acquiring Nvidia’s graphics processing units (GPUs) to power various AI applications amid the current environment.

Guidance

As Nvidia continues to solidify its position as a key player in the AI ecosystem, its forward-looking guidance could be of greater importance to investors seeking clues about the longevity of the current surge in spending on data center-based AI.

Positive updates to Nvidia's corporate outlook for the months ahead could fuel more AI optimism and extend the current market rally. On the other hand, investors may use a less-than-stellar outlook as an opportunity to take profits.

Meanwhile, key topics likely to come up on the earnings call will be further details on the outlook for AI services revenue and an update on the data center supply chain.

Nvidia could also provide additional commentary on reported plans to launch a new custom chip unit as well as the impact of tighter China export controls.

China accounted for more than a fifth of Nvidia's revenue in the third quarter.

NVDA Stock Performance

Nvidia's upcoming earnings report could spur a massive move in the shares of the world's most dominant AI chipmaker.

Market participants are bracing for a big move following the print, as per the options market, with a possible implied swing of about 11% in either direction.

With Nvidia's market capitalization at roughly $1.70 trillion, a move of that size would make for a potential swing in market value of about $200 billion.

That's the largest expected move traders have priced ahead of Nvidia’s earnings in the last three years and well above the stock's average earnings move of 6.7% over that period.

Source: InvestingPro

Nvidia’s stock has experienced a meteoric rise, increasing by 40% this year alone thanks to ongoing AI-related buzz. In 2023, Nvidia’s shares soared by a whopping 239%, cementing its status as a leader in the AI industry.

Source: InvestingPro

It should be noted that NVDA stock appears to be trading at a hefty premium heading into the earnings update, as per the quantitative models in InvestingPro, which point to a potential downside of 13.7% from last night’s closing price of $694.52.

That would bring shares closer to their ‘Fair Value’ of $599.60.

Nvidia ProTips

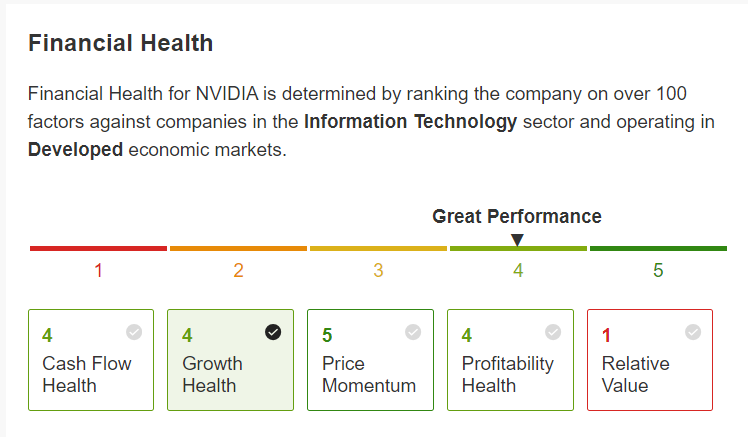

As ProTips points out, Nvidia is in a Great financial health condition, thanks to robust earnings and sales growth prospects, and a healthy profitability outlook.

ProTips also underscores Nvidia's anticipated substantial surge in free cash flow due to its high operating margins.

Source: InvestingPro

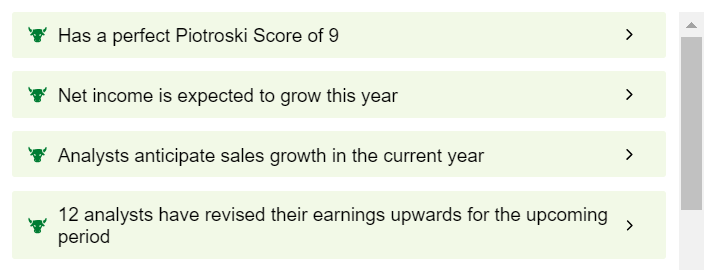

Additionally, it should be noted that the company has a perfect Piotroski score of 9, which can be seen as a bullish, or positive, signal for investors.

Source: InvestingPro

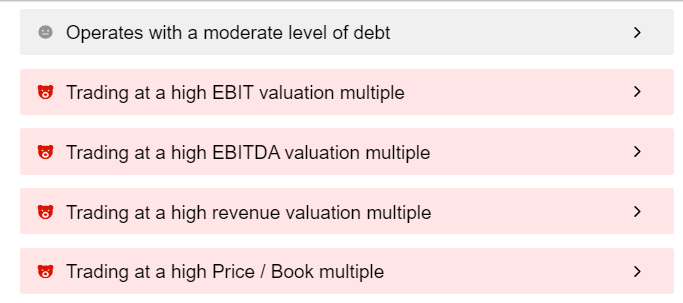

Nevertheless, concerns loom as ProTips points out Nvidia’s high earnings and revenue multiples and a lofty price-to-book ratio, raising questions about its current valuation.

Source: InvestingPro

The mammoth AI-inspired rally has left shares extremely overstretched and overvalued, making them vulnerable to a post-earnings plunge.

In my opinion, expectations for Nvidia are so high that its shares could fall by at least 10% if the company fails to blow past analyst estimates and investors are disappointed by its guidance.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading.

InvestingPro empowers investors to make informed decisions by providing a comprehensive analysis of undervalued stocks with the potential for significant upside in the market.

Readers of this article enjoy an extra 10% discount on the yearly and bi-yearly plans with the coupon codes PROTIPS2024 (yearly) and PROTIPS20242 (bi-yearly).

Subscribe here and never miss a bull market again!

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR S&P 500 ETF (SPY (NYSE:SPY)), and the Invesco QQQ Trust ETF (NASDAQ:QQQ). I am also long on the Technology Select Sector SPDR ETF (NYSE:XLK).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.