Every energy market got crushed during this week’s Black Monday, but not natural gas.

Futures of crude oil on the New York Mercantile Exchange lost 7% while that of gasoline fell 6%. NYMEX gas futures on the Henry Hub alone rose almost 3% that day.

And gas has continued to outperform its energy peers since, accumulating almost 7% on the week for what could be its best week in five.

On Wednesday, Henry Hub’s front-month August contract on NYMEX hit a more than 2-½ year high of $3.965 per mmBtu, or million metric British thermal units, nearing the much-awaited $4 level.

In fact, the winter gas months of December through February all settled above $4 per mmBtu in NYMEX’s Wednesday session, leaving market punters who had bet that gas prices will consolidate this week due to earlier readings for benign temperatures in disbelief.

So, what’s happening with “natty”—as it’s popularly known in the trade?

Unexpected Temperature Turn

Well as they say, blame it on the weather.

Yes, an unexpected turn in temperature could again cause a heat spike across the United States in the near term, say analysts who’ve parsed latest weather forecasts and worked out what that may mean for the market.

As always, the change will decide how much of the gas that’s produced each week gets burned for cooling and power generation and how much that’s left over gets injected into underground storage.

Dan Myers, analyst at Houston-based gas markets risk consultancy Gelber & Associates said:

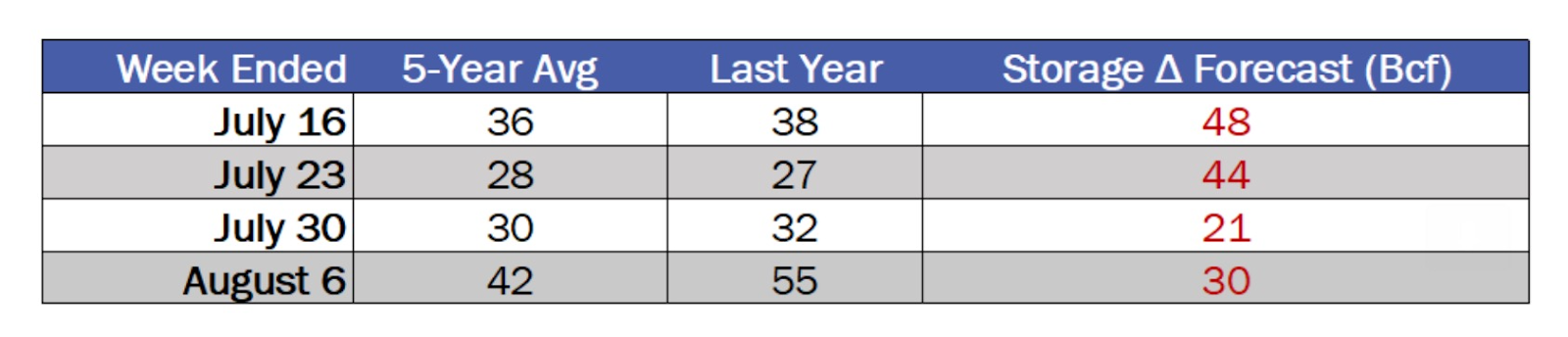

“A turn to widespread above-average temperatures in coming days suggest that additional bullish, smaller than average injections are on tap in the weeks ahead.”

“For the seven days ending July 30th alone, our injection expectations have come down about 13 bcf since last Wednesday due to stronger cooling demand forecasts for next week.”

Source: Gelber & Associates

Source: Gelber & Associates

The debate over gas injections comes as the Energy Information Administration prepares to release its latest weekly update of the US natural gas storage situation at 10:30 AM ET (14:30 GMT) today.

According to forecasts from analysts tracked by Investing.com, US storage levels for natural gas had probably risen by 44 bcf, or billion cubic feet, during the week ended July 16.

If true, that would be 20% lower than the 55 bcf injected into storage in the previous week to July 9, ostensibly due to higher burning of the fuel for cooling.

On an annual basis, the injection for the July 16 week is slightly higher than the 38 bcf seen during the same week a year ago. It is also higher than the five-year (2016-2020) average of 36 bcf.

But more importantly, the injection for the July 16 week would take total gas stockpiles in storage to 2.673 tcf, or trillion cubic feet. That would be 6.3% below the five-year average and 16.7% below the same week a year ago.

While utilities burned more gas last week compared with the week before, temperatures were fairly unchanged to year-ago levels. Data provider Refinitiv said there were 87 CDDs, or cooling degree days last week, compared with the 30-year average of 88 CDDs.

CDDs, which are used to estimate demand to cool homes and businesses, measure the number of degrees a day's average temperature is above 65 degrees Fahrenheit or 18 degrees Celsius.

Even Hotter Days Coming

Bespoke Weather Services, in a forecast carried by industry portal naturalgasintel.com, said forecasts tilted even hotter over the next two weeks. Adding:

“All of the changes lie in the forecast for next week, as we continue to see models shift hotter in locations from the lower Midwest into the South, especially Texas. This is tied into the addition of some blocking in the North Atlantic, which in summer is a hotter signal in the southern US.”

“We see at least a few days in the medium range landing in the 100-105-degree range for highs in cities such as Dallas, marking quite the change from the pattern month-to-date,” the firm added. “Relative to normal, the strongest heat remains in the north-central US, where 90s will be widespread from Minneapolis to Des Moines, and even over to Chicago at times. Some 90s will be seen over in the Mid-Atlantic as well late month.”

According to naturalgasintel.com, production this week has averaged around 91 bcf, or roughly 2 bcf below 2021 highs reached in June.

The combination of relatively light output with accelerating demand has industry observers concerned that utilities may not inject enough gas into underground storage this summer to satisfy looming winter needs for the fuel to power furnaces, the portal reported.

Winter Gas Storage Levels Do Not Look Comfortable

Forecaster Bespoke said: “Until we can at least match the year-to-date highs” in production, “the rally could easily continue.”

The firm said that reaching $4 pricing “looks like a given” for Henry Hub’s prompt August month, as the market continues to digest the reality that, at least right now, there is simply not enough production to get US gas storage to comfortable enough levels heading into the winter.

Unlike in years past, “there has been little material loosening in supply/demand balances despite the strong surge higher in prices,” Bespoke added.

Analysts at Tudor, Pickering, Holt & Co meanwhile said that beyond the move lower in supply, pricing dynamics in recent days had largely come down to power generation as well.

The rally in natural gas prices has “done little” to dampen demand for power generation, the analysts at TPH said.

The TPH team said wind and solar generation have underperformed in recent days, down to just 5% of total generation at the start of this week after averaging 9% over the first half of July.

But gas’ share of thermal generation rose to 61% early this week, following a steady average of 60% last week which suggested that substitute coal, despite its cheaper price, was “struggling to meet the call as renewables lag."

EBW Analytics Group concurred with that view, saying:

“With opportunities for coal displacement largely exhausted, there is no clear stopping point for how high gas prices might need to rise to adequately refill storage before the injection season ends.”

Disclaimer: Barani Krishnan uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables. He does not hold a position in the commodities and securities he writes about.