While I was looking for zig-zag measured moves lower for the S&P 500, Nasdaq and Russell 2000 (IWM). All of these indexes did a good job of pushing out of bearish patterns and setting up for challenges of highs.

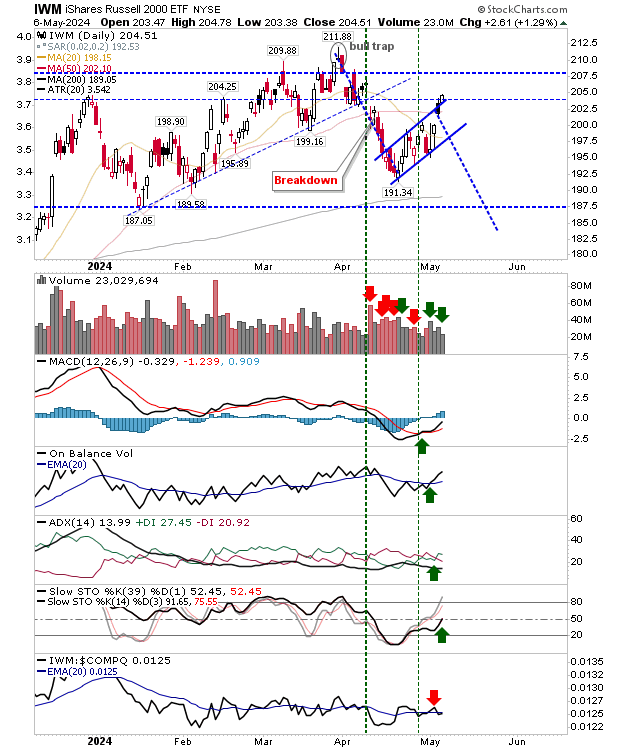

It was impressive, as the easier option was probably to move lower, particularly for the Russell 2000 ($IWM) that had finished the day before yesterday on a bearish 'black' candlestick.

The Russell 2000 ($IWM) easily negated the 'black' candlestick, not just gapping higher, but pushing itself outside of resistance of the 'bear flag' and above a minor horizontal resistance level (now support).

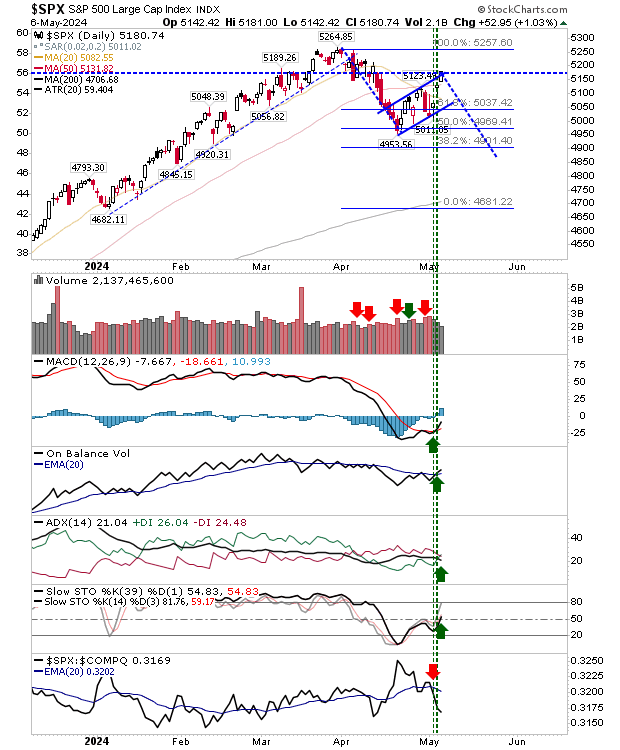

The S&P 500 rallied to the upper level of 'bear flag' resistance that corresponded to horizontal resistance, but there was no end-of-day reversal to suggest we have reached resistance-in-practice. Technicals are net bullish.

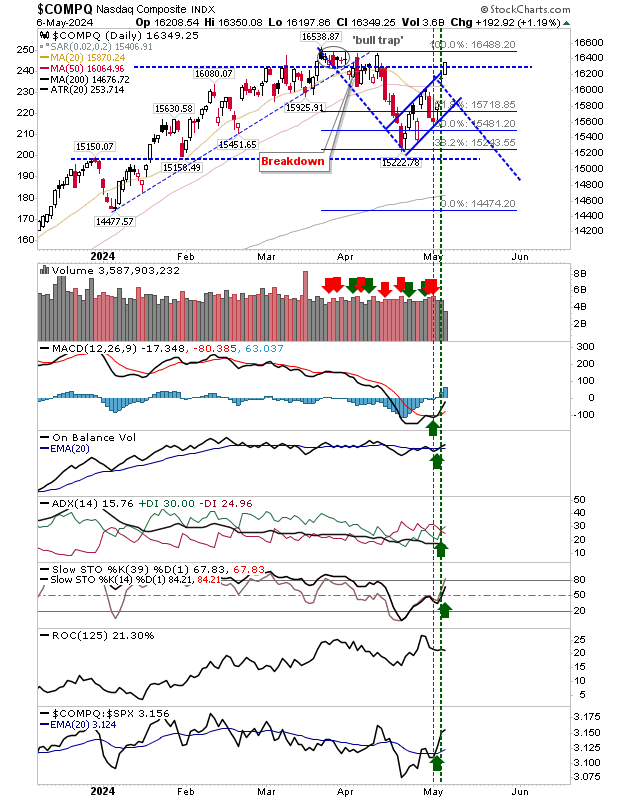

The Nasdaq moved into the 'bull trap' zone, effectively negating the bearish implications of the pattern. It's not entirely undone, but the strong end-of-day close to move technicals into a net bullish setup suggests new highs are coming.

I will be watching the Nasdaq closely for leads, it's the index most likely to post new all-time highs. Doing so will bring the S&P 500 and Russell 2000 with it. I was bearish on the outlook for the Nasdaq, I'm not so sure now.