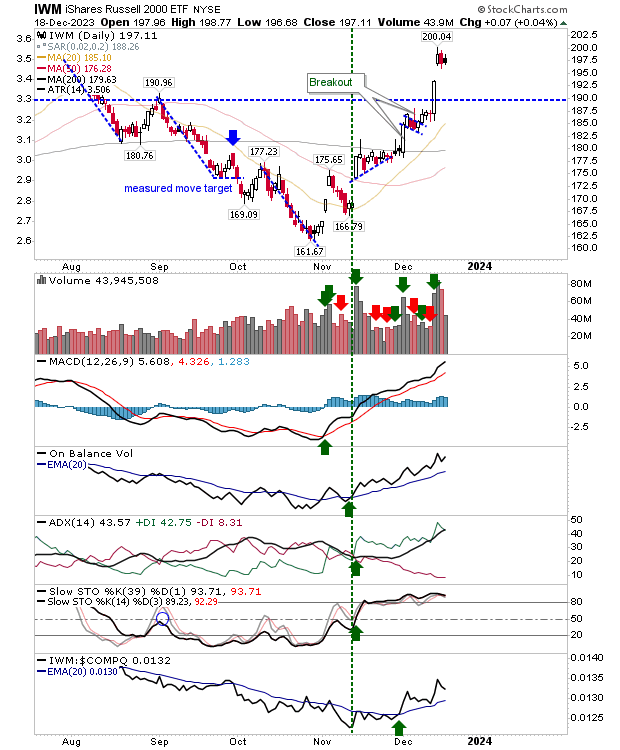

"Black" candlesticks are rarely good and we had one yesterday in the Russell 2000 (IWM). The expectation is for an open below today's close, then a close lower than the open.

As part of this bearish setup I will be looking for a gap closure that may result in a bullish 'hammer', but more likely, I would look for a close inside the gap that keeps bears in control.

Buying volume dropped significantly from Friday, but with the holidays fast approaching I wouldn't worry too much about volumes.

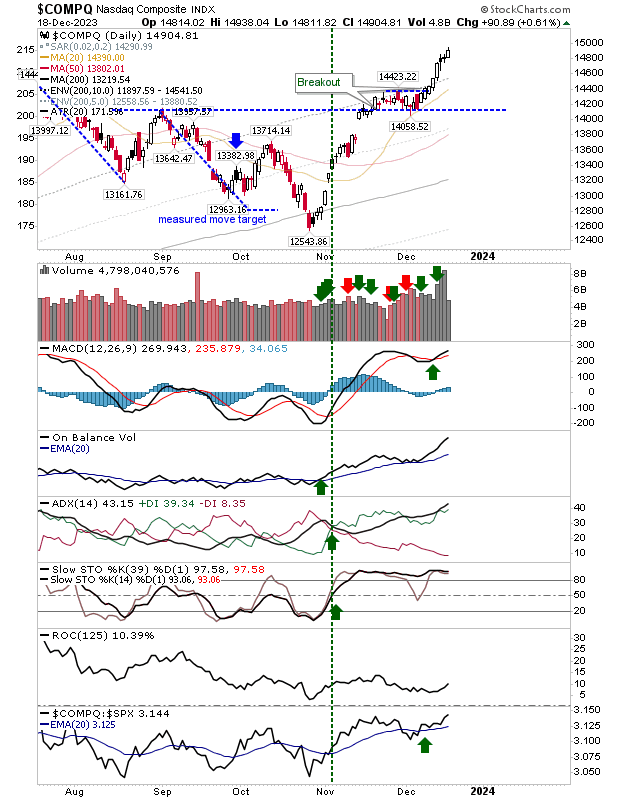

The Nasdaq maintained its momentum, closing with a small 'white' candlestick that continued the rally. Buying volume was down, but it has proven hard to bet against the bull. Technicals remain strongly bullish with little hint of divergence.

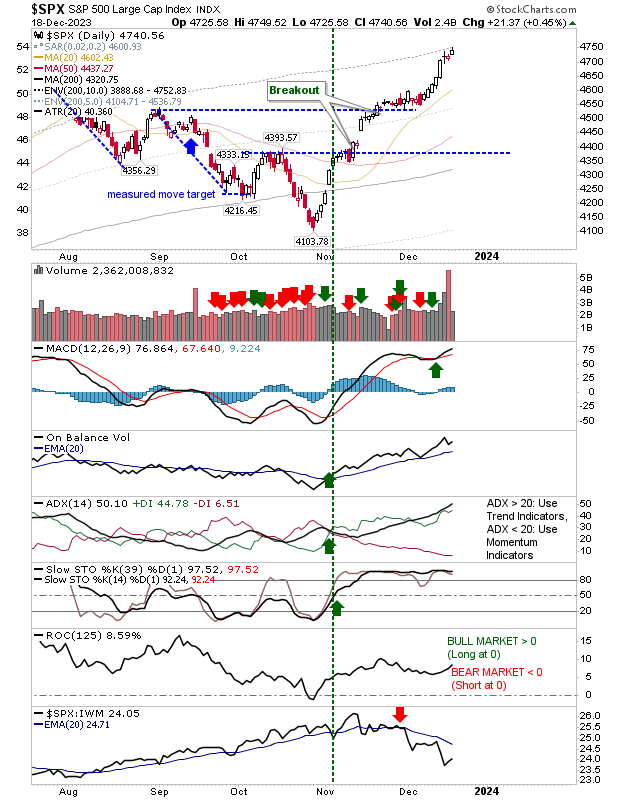

While the S&P 500 enjoyed a day similar to the Nasdaq.

Today, I would be looking for more of the same. My day trading experiment registered a second losing day as I got caught up trying to force a sale in both the Nasdaq and Russell 2000 ($IWM).

The latter index was particularly frustrating given the presence of the large breakout gap on the daily timeframe chart. Today I suspect may be more frutiful, but buyers have proven stubborn and all too willing to defend.