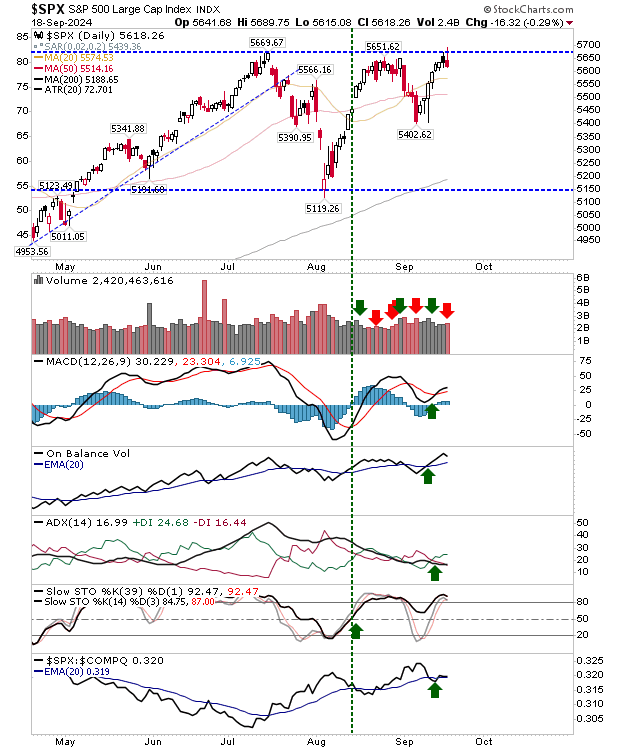

The S&P 500 was the index to watch yesterday - it promised much - but in the end, delivered little. The larger picture (weekly charts) still favors bulls, but daily charts are doing their best to suggest otherwise.

As of the time of writing, index futures are in the green, suggesting a positive start to the session today.

Yesterday, the S&P 500 started to push a breakout, but by the close of business, it had reversed back under resistance. Volume climbed to edge confirmed distribution, although technicals are net bullish.

Today offers another opportunity but the index is moving towards a period of relative underperformance to its peers. Again, not a great sign for those looking for a bull market, but that's the way it is.

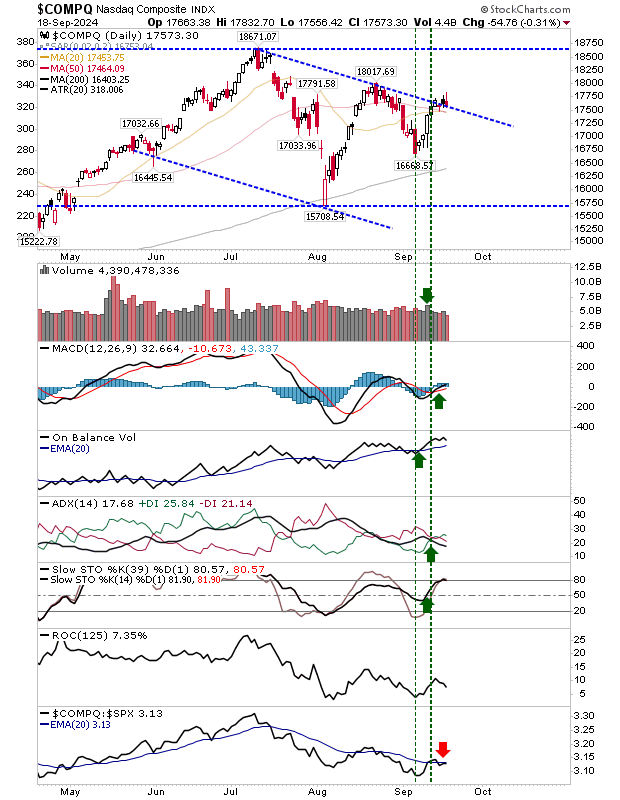

The Nasdaq didn't do much either way and remains tied to downward channel resistance. There was no confirmed distribution, technicals are net bullish, and the index remains above 20-day and 50-day MAs. We twist for today.

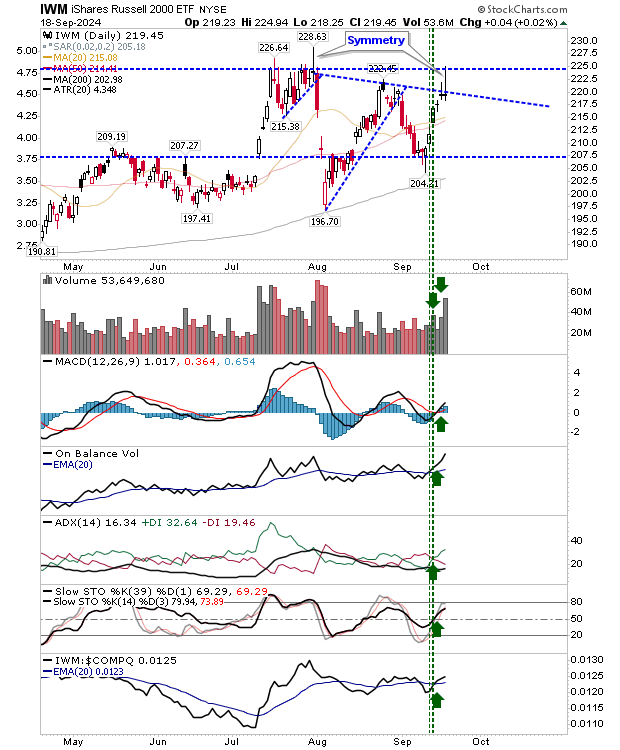

The index that marked the largest peak reversal was the Russell 2000 (IWM). There was a clear symmetry in the peak from July and the one from yesterday. And, should the index follow the same path, then a short, sharp drop can be expected. Technicals are net bullish, as they were back then. The best outlook for bulls is if premarket action can eat into the spike high, but if it stays at or near yesterday's close, then when markets open it could turn into an ugly day.

For today, we will want to see how yesterday's bearish candlesticks pan out. If we see a move into yesterday's spike highs it will go a long way to negating the implicated bearishness of yesterday. But any struggles run the risk of expanding into something worse. I still favor a larger bullish trend, but with the election coming it could be a scrappy few months ahead.