The market seemed dead yesterday, with trading volumes down and price action stalled out since the CPI report last week. Things should start to loosen up today because the pinning in the VIX will pass, and the Fed minutes at 2 PM ET should help give the markets something to think about.

Chris Waller gave the market plenty to think about when he discussed delaying rate cuts to later this year or the start of next year. He then gave a preview of Friday’s speech, mentioning that the neutral rate may be higher than previously thought.

When you listen to all of these Fed speakers, they seem to be pointing to a June preview of the dot plot, which will probably see the median move to only one cut in 2024 and the longer-run rate move higher. It will also probably mean fewer cuts in 2025.

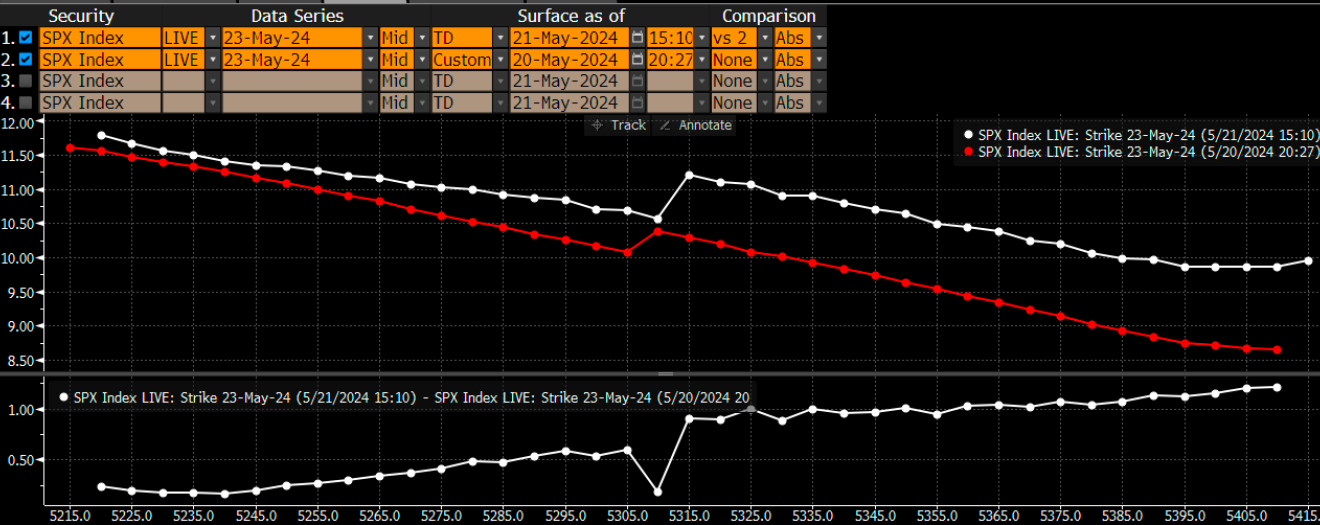

Meanwhile, the VIX1D and the VIX 30-day were down yesterday, but I’d imagine if there was a VIX 2-Day, it would show that implied volatility was higher. Fixed strike volatility for the S&P 500 for expiration on May 23 showed that IV was up across the curve and was skewed toward rising S&P 500 prices. This means that the IV rose more from the previous day for prices going higher than prices going lower.

(BLOOMBERG)

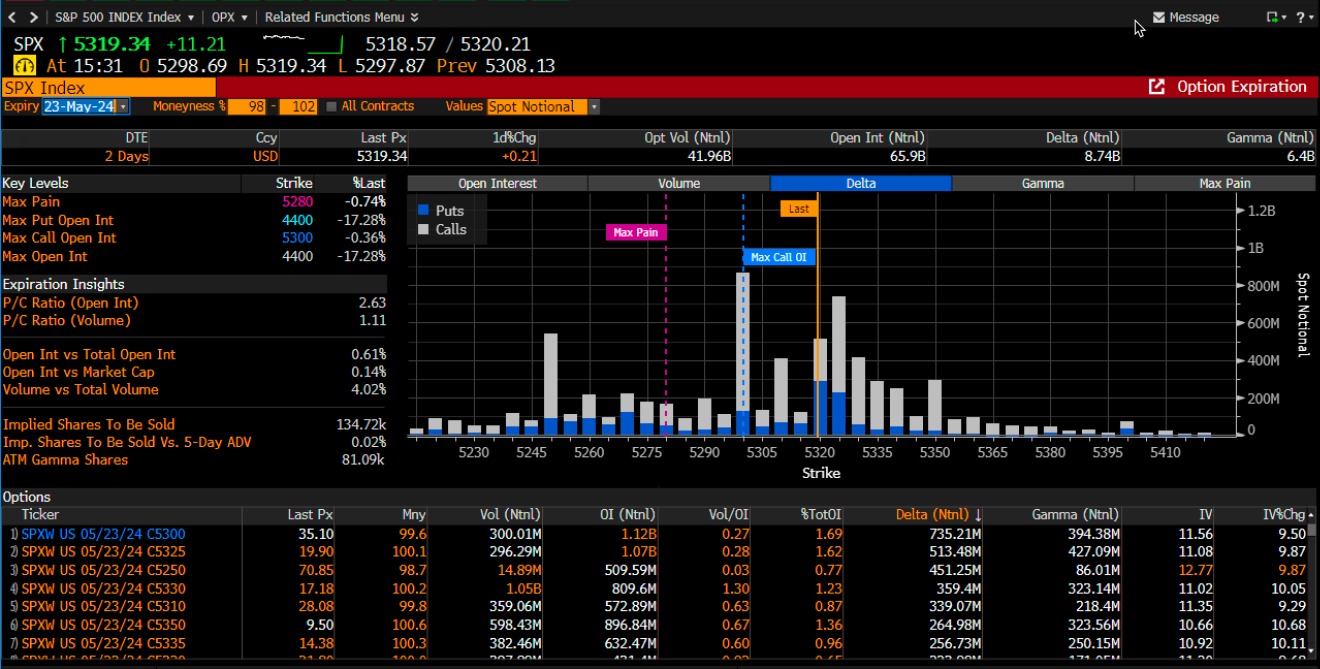

The buildup in the S&P 500’s call delta for Thursday easily outweighs the put delta, so the market is not surprisingly positioned bullishly ahead of Nvidia's (NASDAQ:NVDA) earnings report. So I would expect that as IV comes down, instead of the puts being crushed, pushing the market higher, the calls will be crushed, pushing the market lower.

Now, of course, if Nvidia reports amazing results and beats by a huge amount, pushes guidance even higher than expectations, and maybe announces a 10-for-1 stock split, the market bets on more upside will probably pay off. But there is no way to handicap what Nvidia’s results or guidance will be.

(BLOOMBERG)

Overall, this seems to suggest that the market stalemate will break sometime today late in the day, with very high odds of it breaking on Thursday, with a big move likely, either up or down. Given how low implied volatility is overall across the curve, a big move in the broader markets could be a big surprise, especially if it is to the downside.