FX Brief:

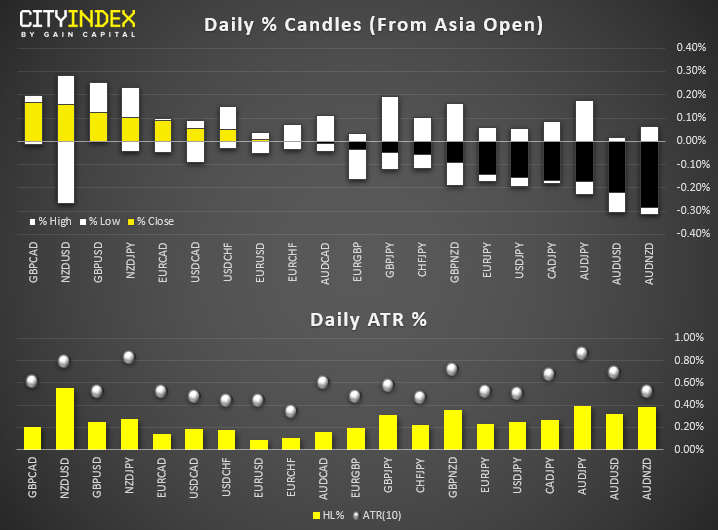

- NZD pairs spiked broadly higher after RBNZ held rates and didn’t deliver the dovish press conference that many expected. It raises the potential that (for now at least) 1% is the floor, although an easing bias remains within the statement.

- All NZD pairs have exceeded their 10-day ATR’s, with AUD/NZD and EUR/NZD’s daily range expanding over of their typical ranges. It’s possible NZD pairs are now prone to a little mean reversion but there’s still potential for NZD strength to extend further out, given how off expectations for a cut were so high ahead of the meeting.

- Trump said he’ll raise tariffs on China if they fail to come to a phase one deal, prompting USD/CNH to touch a 6-day high and Asian currencies follow the Yuan lower.

- Japan’s producer prices fell -0.4% YoY, missing estimates of -0.3%. Whilst monthly prices for October rose 1.2%, it's likely related to the pending sales tax hike – as this is the sharpest monthly spike since 2014 when the sales tax was last hiked.

- Australian wages fell short of expectations at 2.2% YoY versus 2.3% YoY, although monthly hit expectations of 0.5%. Still, weaker wages mean weak inflation and a lower cash rate, at a time RBA would really like to see higher wages to offset the high debt to saving ratio.

Equity Brief:

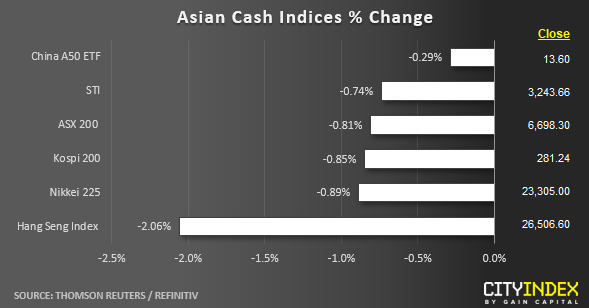

- A sea of red is the theme today for Asian stock markets triggered by a contagion effect from Hong Kong’ Hang Seng Index where it plummeted by close to -2.00% as at today’s Asian mid-session, on track for its worst weekly performance since mid-Aug 2019.

- Tensions continue to flare in Hong Kong where anti-government protestors have changed tactics to disrupt the city’s transportation system on weekdays and turned Hong Kong’s universities into a “war zone” with standoffs against the police. Also, protestors have urged the public to perform another flash mob styled demonstration in Central, the financial hub of Hong Kong for the third day at noon.

- The worst performers in the Hong Kong stock market are property related stocks; New World Development, Sino Land, Wharf Real Estate Investment that have plunged by -5.1%, -3.72% and -3.53% respectively.

- Alibaba (NYSE:BABA), a Chinese based internet giant has been granted regulatory approval for a secondary listing of its shares on the Hong Kong Stock Exchange with the aim of selling up to HKD117 billion worth of new shares. At a valuation of HKD117 billion, Alibaba’s IPO will be the 3rd largest in Hong Kong history since 1986. Alibaba is expected to trade in Hong Kong in the week of 25 Nov.

- Yesterday’s U.S. President Trump’s speech at The Economic Club of New York offers no hints on the progress for the “Phase One” U.S-China trade deal that gave a reason for profit-taking activities on Japan’s Nikkei 225, the best performer in the past 4 weeks. It is downed by around -0.90%.

- S&P 500 E-Mini futures has declined by -0.30% in today’s Asian session and it is breaking below yesterday’s U.S. session low of 3084 seen in the S&P 500 cash index.

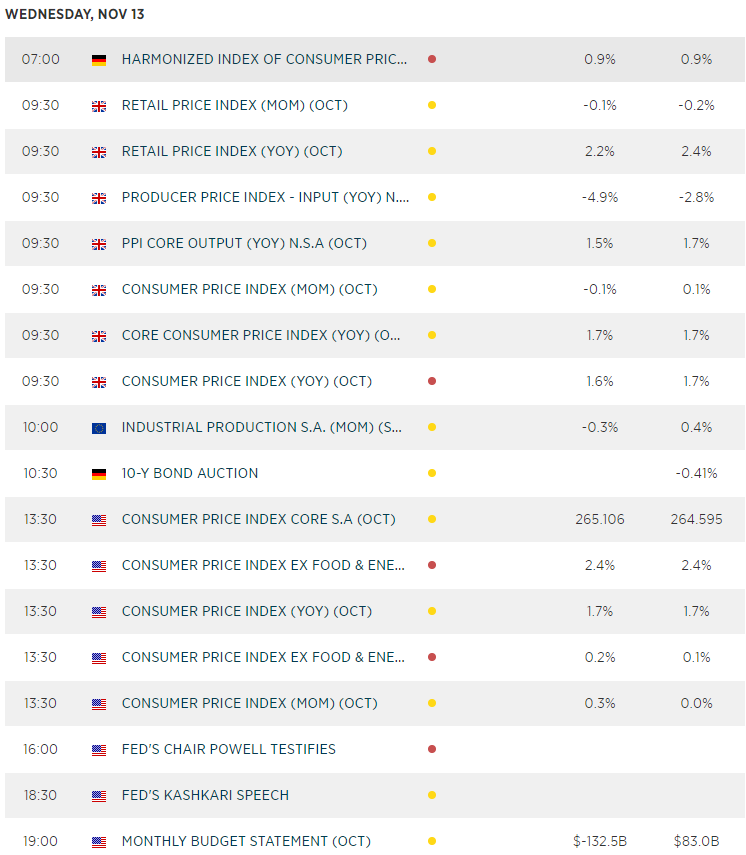

Up Next

- 1st day of Fed Chair Powell testimony to Congress at 1600 GMT where traders should pay attention to any insights given to the current state of the repo market given the recent on-going “not- QE” injection implemented by the Fed. Also, on the current health of the U.S. economy to gauge the possibility of a 4th rate cut.

"Disclaimer: The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient.

Any references to historical price movements or levels is informational based on our analysis and we do not represent or warrant that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, the author does not guarantee its accuracy or completeness, nor does the author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions."