This week, we are anticipating the crucial release of the US jobs market status through the Non-Farm Payrolls (NFP) report. The NFP report is meticulously compiled by the Bureau of Labor Statistics (BLS) by surveying both government and private enterprises. It aims to assess the number of workers in the US, excluding those engaged in farming, private enterprise, household business, not-for-profits, and the military.

The NFP data is commonly presented as a measure of the increase or decrease in the number of jobs created. Additionally, alongside each month's NFP report, investors receive updates on the official US unemployment rate and the changes in Average Hourly Earnings. Together, these indicators offer valuable insights into the overall health of the US economy. A robust NFP report signals a strong economy and increased spending capacity, fostering economic growth, while the opposite holds true as well.

For forex traders, a vigorous economy typically corresponds to higher interest rates, and higher interest rates tend to bolster the domestic currency. Conversely, a weak economy may lead to lower interest rates and a depreciation of the domestic currency. As a result, forex traders are advised to closely monitor the NFP data, which is released on the first Friday of each month, starting with this Friday's release.

Fedwatch

In its most recent meeting, the Federal Reserve raised interest rates for the eleventh time out of twelve meetings, resulting in the official cash rate being set at 5.25%-5.50%. This represents the tightest monetary policy in over two decades, as the Fed continues its battle against the persistent high inflation observed over the past 12-18 months.During the post-meeting press conference, Fed Chairman Jerome Powell stated that the elevated interest rates are likely to persist for a considerable period, emphasizing the need for sustained restrictive policy measures. He acknowledged that these policy changes might cause some adverse effects on the US economy, leading to a potential period of below-trend growth and softening labor market conditions.

Despite the firm stance on inflation and the possibility of another interest rate hike in September when the Federal Open Market Committee (FOMC) convenes again, Powell hinted at the option of a potential pause. He emphasized that the Fed would carefully assess the economic situation on a meeting-by-meeting basis before making any further decisions.

In June, after the Fed's meeting pause, Powell specifically mentioned the likelihood of "at least" one more rate hike. With one rate increase already implemented in July, the current question prevailing in the market is whether the Fed will proceed with another rate hike or opt for a pause. Market pricing currently suggests that investors are skeptical about the Fed having additional room for rate increases, with futures pricing indicating an 81.5% probability of "No Change" at the Fed's September meeting.

What to watch out for in Friday's NFP

This week, economists anticipate the NFP report to reveal a total of 203,000 jobs created in the US economy during July. This figure shows a slight decrease compared to June's increase of 209,000 jobs and falls significantly below the 12-month rolling average of 316,000 jobs per month. As a result, the market expects further evidence of the US jobs market cooling, indicating a potential reduction in inflationary pressures.An NFP number surpassing expectations, say around 250,000 or higher, is likely to trigger a positive and strong response in the US dollar's value, while stocks and bonds may experience a negative reaction due to increased expectations of the Fed's implementation of its "one more hike to come" scenario. Conversely, if the reading falls below expectations, such as below 180,000 jobs, the US dollar is expected to weaken, and stocks and bonds may rally, as this would suggest a diminished need for additional Fed rate hikes.

How to trade Friday's NFP

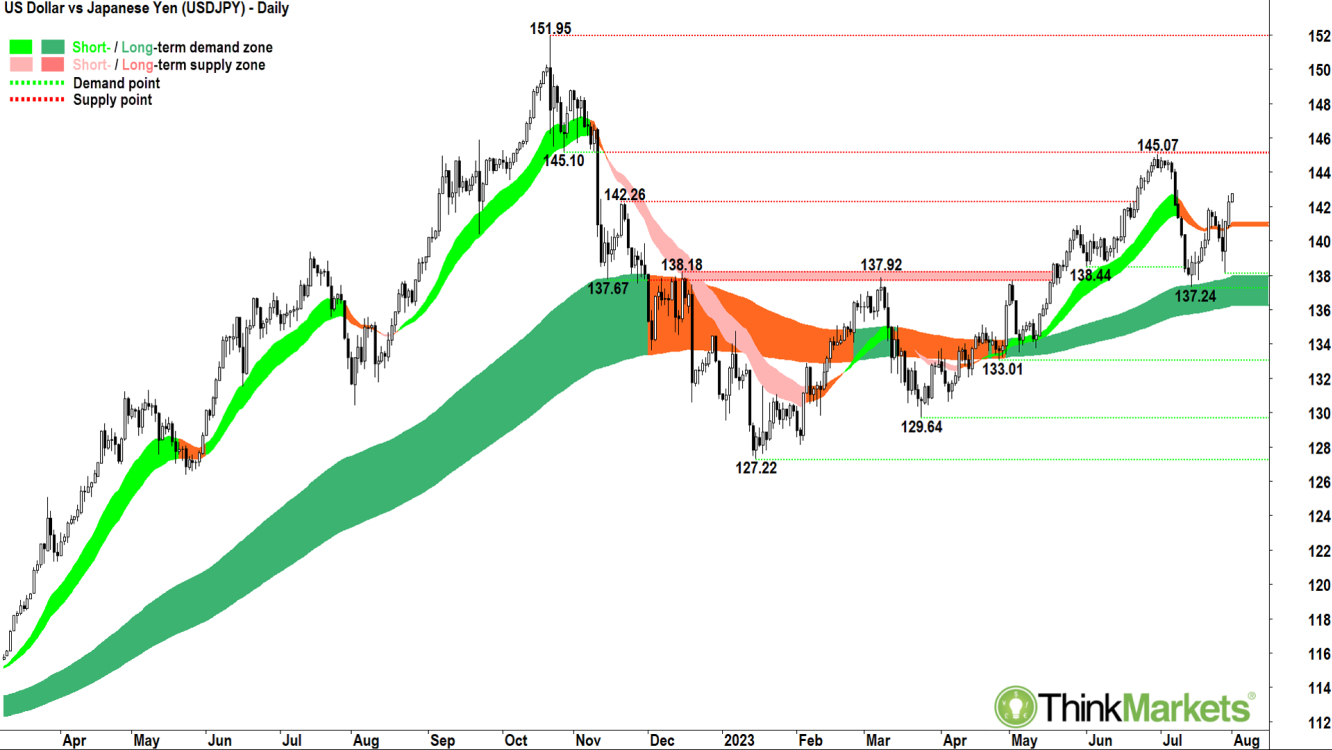

Stronger than expected NFP: Long USDJPY

The US dollar (USD) has maintained an uptrend against the Japanese Yen (JPY) on and off for the past two years. More recently, this long-term uptrend has reasserted itself (dark green ribbon). After a correction back to the long-term trend in July, the price action has rebounded with higher peaks and higher troughs, as well as a clear majority of demand-side candles (i.e., candles with white bodies and/or lower shadows). Each of these factors suggests a market which is in a state of excess demand for USD versus JPY.

Analyst view: I am comfortable adding long-side risk exposure to USDJPY around the current price and while the short-term trend remains up. A stronger than expected NFP release would likely see the price target 145.07, but potentially 151.95 in the medium term. Stops may be set below the previous excess demand point of 137.24.

Weaker than expected NFP: Short USDCHF

The Swiss Franc (CHF) has maintained an uptrend against the USD since January. A modest rally since a major sell off in early-July has allowed the price to recover to the short-term trend ribbon (light pink zone). We typically find the trend ribbons offer areas of dynamic resistance in a well-established downtrend. Therefore, traders would be well served by watching this area closely for reversal candles. In particular, candles with black bodies and/or upper shadows are excellent signals of excess supply of USD vs CHF.

Analyst view: I am comfortable adding short-side risk exposure to USDCHF in the short-term trend zone after observing one or preferably, two reversal candles. A weaker than expected NFP release would likely see the price target 0.8552, but but there are few major points of potential support in the USDCHF chart until closer to 0.70. Stops may be set above the previous excess supply point of 88.21.