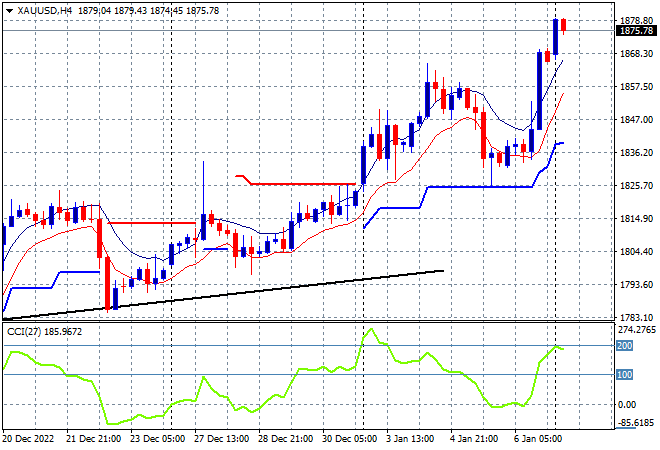

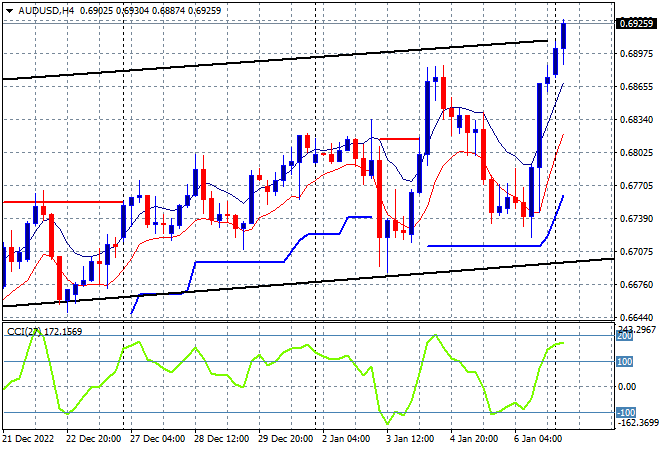

A solid start to the new trading week after the Friday night US jobs report which was headline good but showed underlying lower wage growth which the market thinks means less rate rises from the Fed. As a result everything undollar is rising while stocks are also being lifted across the board. The Australian dollar is pushing higher above the 69 handle as a result while oil prices are trying to recover after falling sharply last week with Brent crude just above the $79USD per barrel level. Gold is building on to its great start to the year, now pushing above the $1870USD per ounce level for a new monthly high:

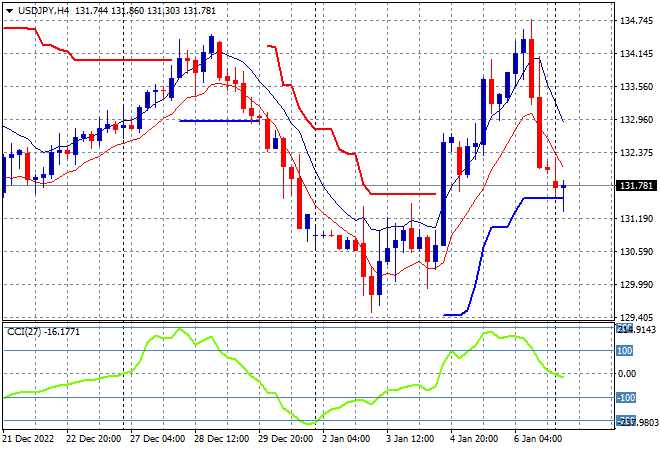

Mainland Chinese share markets are lifting higher going into the close with the Shanghai Composite up more than 0.5% to remain above the 3100 point level, currently at 3175 points while the Hang Seng Index has lifted nearly 1.6% to extend above the 21000 point level. Japanese stock markets were closed with trade in the USDJPY pair also thinly moving around after the big slapdown on Friday night, hovering just above trailing ATR support on the four hourly chart:

Australian stocks have started the week fairly well, but not at the same magnitude as Wall Street with the ASX200 eventually lifting over 0.6% to extend further above the 7000 point level at 7153 points. The Australian dollar is now extending above the 69 cent level to be above the weekly trend channel and looking somewhat overextended:

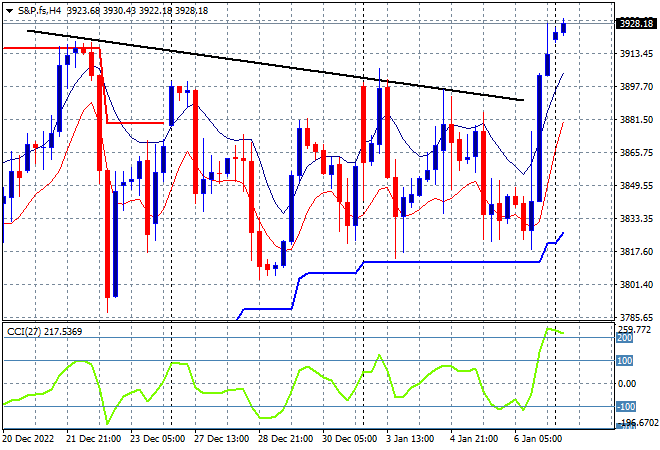

Eurostoxx and US futures are drifting higher, with both wanting to make further gains from the Friday night zooms higher with the S&P500 four hourly chart showing price action still well above the 3900 points level. The upper downtrend line has been broken here but the 4000 point level is the one to beat:

The economic calendar is nominally quiet following the Friday night fun, with Euro wide unemployment the only release of note.