The US 10-year Treasury yield continues to defy The Capital Spectator’s ‘fair-value’ estimate by trading at a premium to this model, but the relatively wide gap still appears to be a constraint to the upside for this key market rate.

As discussed in recent months, it’s the view on these pages that without a material upside change in the fair value estimate, the 10-year yield will likely face headwinds to rising further. Recent market activity for the 10-year rate is starting to fall in line with this view.

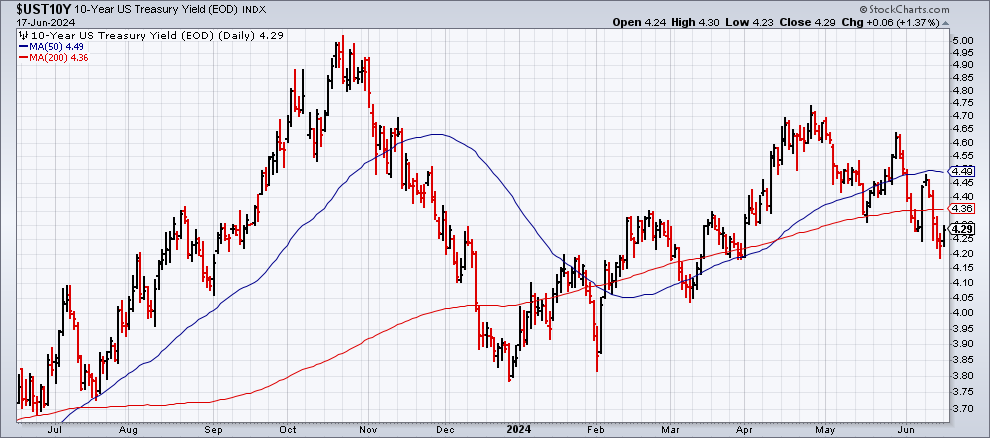

Consider that the 10-year yield has been trending down for much of the past two months, closing at 4.29% on Monday (June 17) – near the lowest level since late March.

Earlier this year the market premium for the 10-year yield increased to an unusually high but not unprecedented level. That’s been a sign that the degree of market premium is near a peak–a forecast that’s starting to resonate via market data.

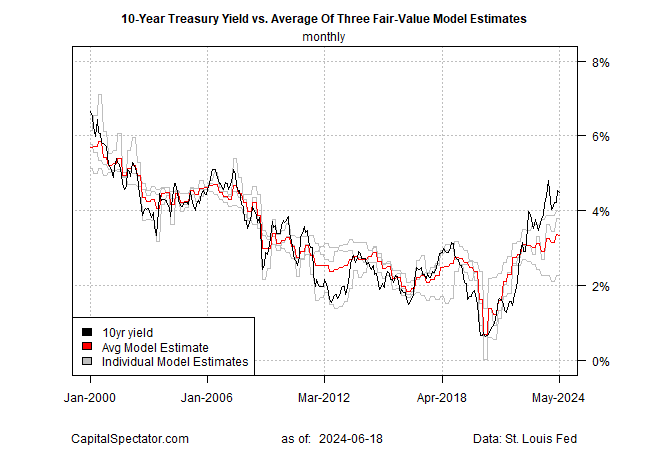

For some perspective, start with the history of the average fair-value estimate (based on three models) vs. the market yield. Using monthly data, the current average fair-value estimate is 3.34% for May, the first dip this year. Meanwhile, the market yield remains more than 100 basis points higher at 4.48% as of last month, although here too the market rate ticked lower for the first time in 2024.

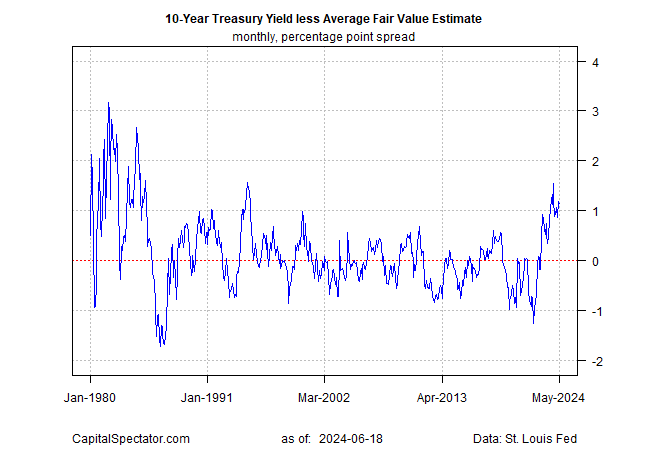

For a clearer view of the relationship, the next chart tracks the market rate less the average fair-value estimate. This spread has fallen modestly from its recent peak. If history is a guide, the market premium will ease further in the months ahead.

A lesser spread implies the market rate will fall, the average model estimate will rise, or some combination of both. Short of a relatively dramatic run of reflation in the US economy and/or a strong acceleration in economic growth relative to recent history (neither of which looks likely at this point), the path ahead seems to favor a lower spread.