The case for raising equity allocations when interest rates were close to zero was easy. After a year of interest rate hikes by the Federal Reserve, the calculus is more complicated.

By some accounts, a favorable tailwind is now blowing for bonds, particularly for a buy-and-hold strategy with Treasuries. Jim Bianco of Bianco Research highlighted the idea this week by noting that buying Treasuries of late, and tapping into sharply higher current yields, offers an opportunity unseen in recent years until now.

“You are going to get two-thirds of the long-term appreciation of the stock market with no risk at all,” said Bianco.

Fair point, but deciding how or if to raise weights in bonds – Treasuries in particular – requires thoughtful analysis. Granted, a 10-year Treasury yield at 3.88% (as of Feb. 23) is close to the highest level in more than a decade and a world above the 2020 low of roughly 0.5%. What’s not to like?

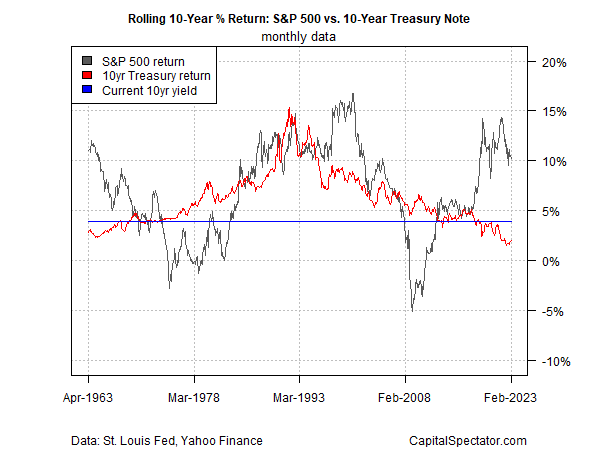

But deciding how much to hold in Treasuries requires thinking about more than yields. It’s also a task of factoring in your time horizon, risk tolerance, and other variables that are specific to you. It’s important to also make some assumptions about how equity returns will unfold over a relevant time horizon vs. the bond maturity you favor. A good place to start is considering how the US stock market (S&P 500 index) compares on a rolling 10-year basis vs. buying and holding a 10-year Treasury note, which is summarized in the chart below for results since the early 1960s.

As an approximation of what you would have earned in a 10-year note, I’m using the current yield for a 10-year Treasury as a return estimate. For example, assume you bought a 10-year note a decade ago when the current yield was just below 2%. Buying and holding that note implies a 2% return over the subsequent decade, as shown by the last point in the red line in the chart above. By comparison, the S&P 500 earned an annualized 10.2% over the trailing decade (black line). The blue line marks the current 10-year Treasury yield: 3.88% (Feb. 23), which serves as a reliable forecast of expected return for a 10-year note for the decade ahead.

The key takeaway: the S&P’s 10-year return varies widely relative to the implied return for buying and holding a 10-year note. No surprise, but it’s a reminder that when you buy a Treasury, and how long you hold it, will cast a long shadow on how the investment fares.

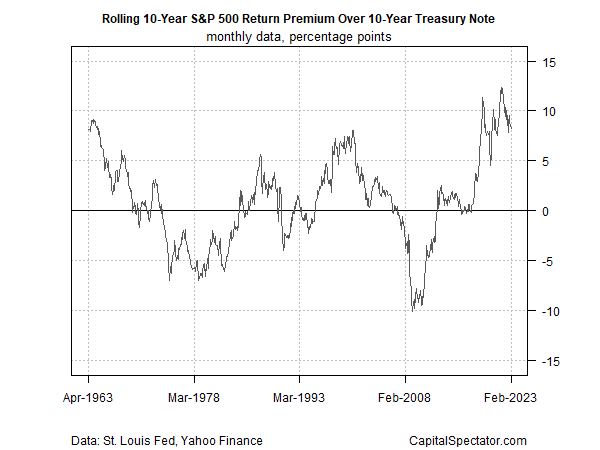

For a clearer comparison of how the S&P’s performance stacks up against a buy-and-hold 10-year note position, the next chart tracks the stock market’s premium over this Treasury security. Clearly, recent history has been unusually kind to a heavy allocation in equities.

Is it timely to switch to a heavy bond (Treasury) allocation? Maybe, but the answer requires more than simply comparing current yields in the bond market, although that’s a good place to start the analysis.