Inflation is easing, or so recent data shows. The debate is now centered on how fast and how far pricing pressure will slide — or if the recent easing is a head fake. In other words, it’s the perfect time to launch a resource that summarizes and updates several of the key inflation indicators that deserve close attention on a monthly basis: The US Inflation Trend Chartbook.

This report will be published shortly after each monthly release of US consumer price indexes.

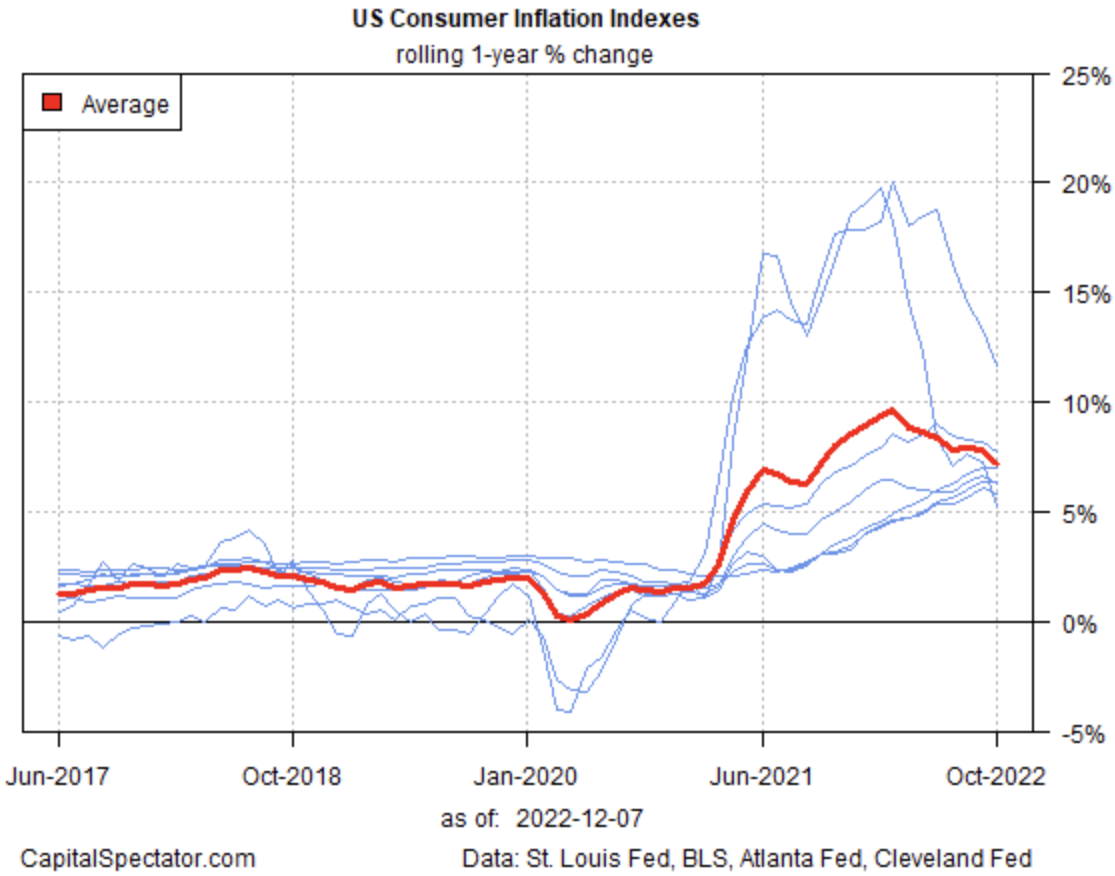

Here’s a selection of charts from the current report. First up is comparison of variations on the standard headline consumer price index (CPI). Looking at the trends on a rolling one-year basis through October clearly shows that pricing pressure has peaked, although the level of inflation remains elevated vs. the pre-surge period.

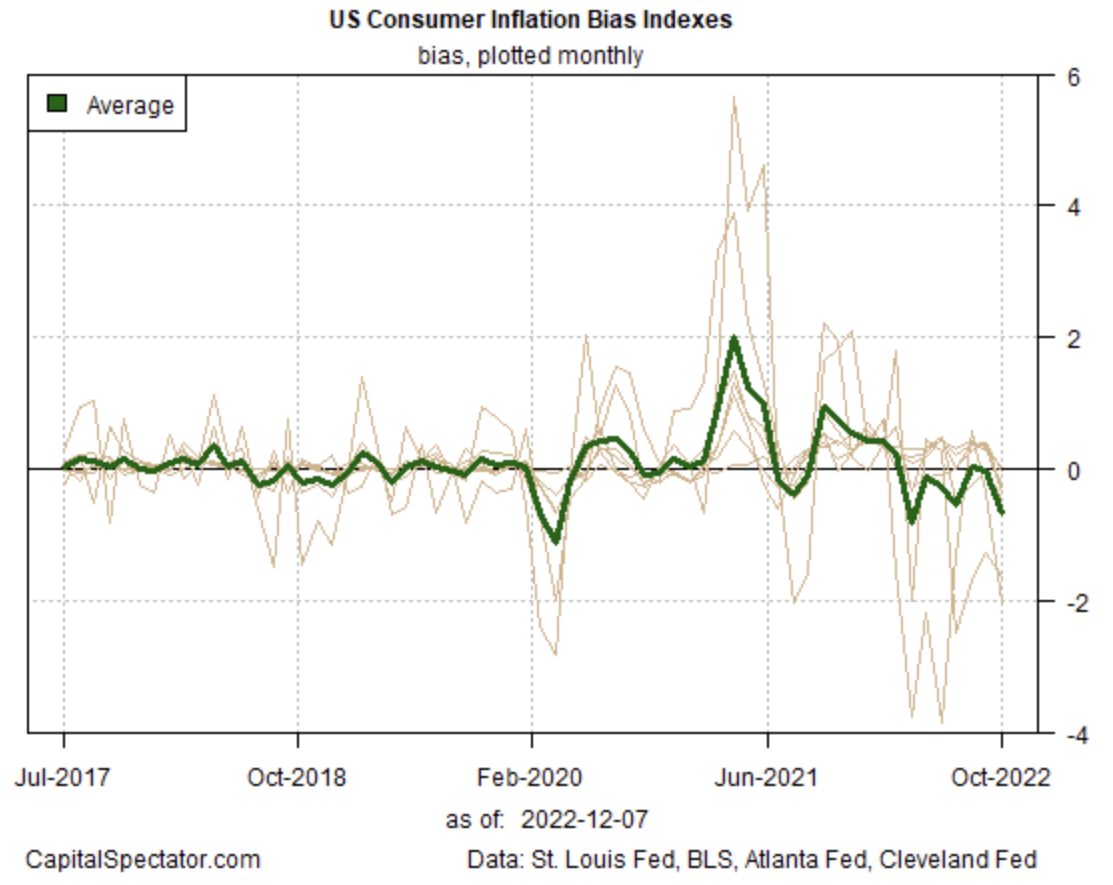

The next chart shows the “bias” of the one-year changes in the chart above. Here, too, there’s a clear indication that the trend has turned lower in recent months. The average for the US Consumer Inflation Bias Indexes was negative for a second month in October. Since May, this measure of bias has been sub-zero for all but one month, a trend that suggests inflationary pressure will continue to ease.

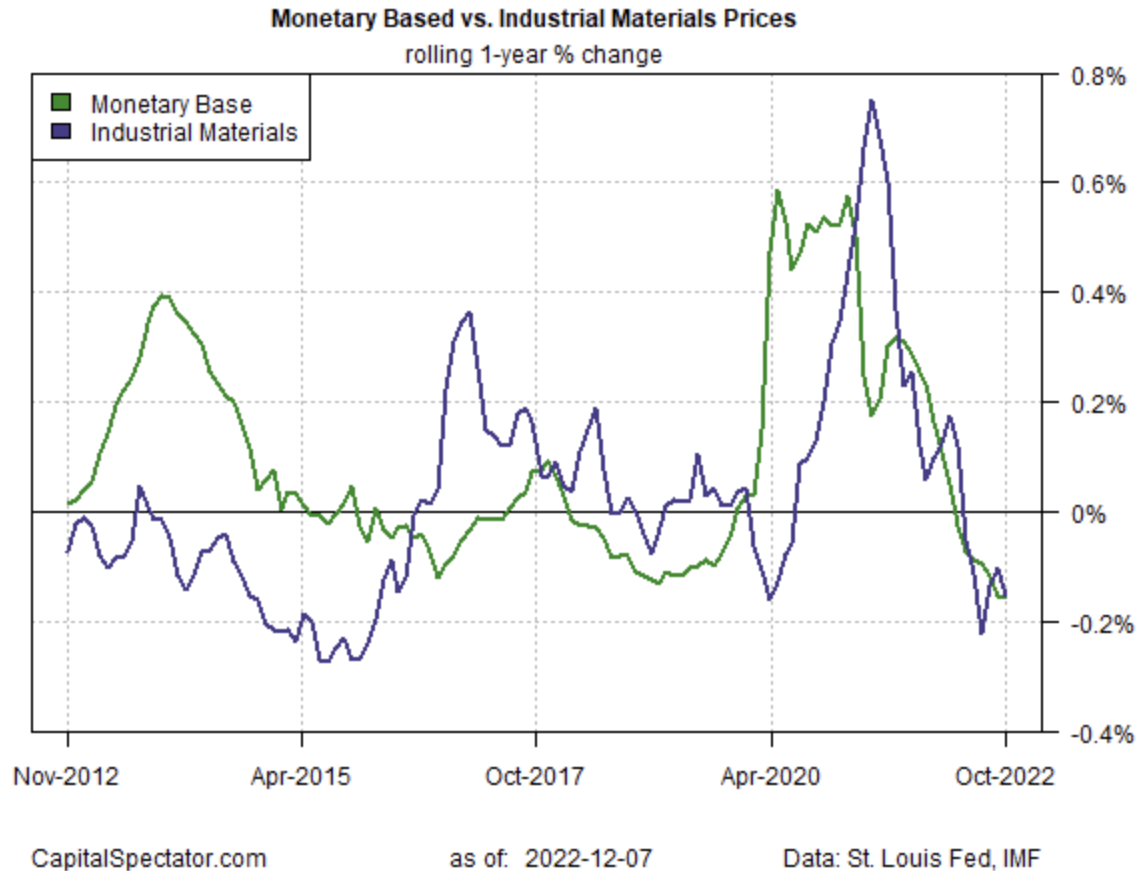

A number of other indicators also show a clear break in the recent inflation surge. For example, the one-year changes in the US monetary base and industrial materials prices have been posting negative one-results recently.

Finally, here’s the current forecast for core CPI, based on CapitalSpectator.com’s ensemble modeling.