Defensive shares serve as a safeguard for your investment portfolio against sudden declines in value. These stocks come from companies that have demonstrated resilience and reliability over time, even during crises. As a result, their share prices often remain stable, making them particularly appealing for investors seeking consistent dividends.

While defensive shares may not offer the high returns associated with growth stocks or speculative investments, they carry significantly lower risk levels. This makes them an ideal choice for shielding your portfolio from market volatility and downturns by providing steady returns.

Investing in defensive shares can add stability to your portfolio amid market fluctuations. Not only does this help maintain peace of mind when reviewing your investments' performance but also implies potentially missing out on significant growth opportunities during economic booms.

With this strategy in mind, here are 2 local companies that hold strong defensive potential according to InvestingPro.

Wesfarmers Ltd (ASX:WES)

What Does the Company Do?

Wesfarmers Ltd is a diversified Australian company involved in retail and industrial activities. Its retail operations span supermarkets, convenience stores, department stores, home improvement, office supplies, and apparel. The company also manages properties, engages in investment banking, supplies maintenance and repair products, and manufactures chemicals, fertilizers, safety products, LPG, and LNG. Serving industries such as construction, food and beverage, government, mining, manufacturing, retail, transport, and utilities, Wesfarmers also holds non-controlling interests in forest products, property, investment banking, and private equity. With its headquarters in Perth, Western Australia, Wesfarmers operates various segments including Bunnings, Kmart Group, Officeworks, WesCEF, Industrial and Safety, Health, Catch, and Others. Its retail operations encompass home improvement, outdoor living, apparel, general merchandise, office supplies, and health and beauty products, while its industrial and safety segment supplies industrial, safety, and workwear products and services.

One example of a strong candidate for a defensive portfolio is Wesfarmers, with daily price action data revealing the stock trading in an ascending channel since mid 2022:

Source: Investing.com

Morgans recommends buying Wesfarmers due to its robust management team and affordable price points.

They expect fully franked dividends per share at $1.79 in FY 2023 and $1.92 in FY 2023 based on the current share price, yielding returns of 3.7% and 4%, respectively:

Source: InvestingPro

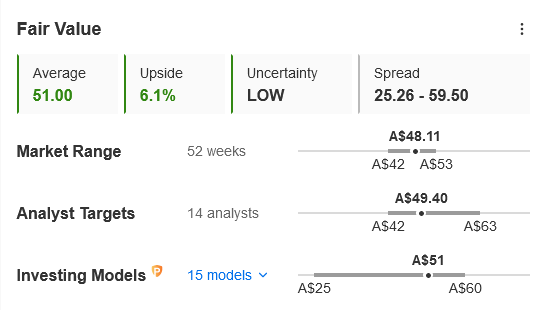

Fair Value Estimate

Currently, the stock is trading at A$48.07, while the average of 15 Fair Value Investing Models revealed a price target of $51, indicating an upside of 6.1%.

Source: InvestingPro

Super Retail Group Ltd (ASX:SUL)

What Does the Company Do?

Super Retail Group Limited is an Australia-based retail company that owns and operates several brands including Supercheap Auto, rebel, BCF, and Macpac. It is involved in the distribution and retail of sporting equipment and apparel, automotive parts and accessories, tools and equipment, camping and outdoor equipment, and apparel. The company operates in Australia, New Zealand, and China, and employs around 14,800 people. Super Retail Group Limited is headquartered in Lawnton, Queensland and is publicly listed.

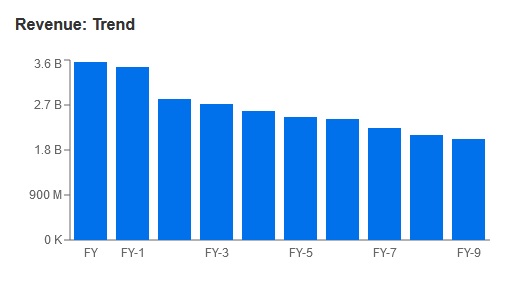

Despite challenges faced by the retail sector, Goldman Sachs Group Inc (NYSE:GS) remains optimistic about Super Retail Group due to its businesses' resilience and extensive loyalty program. The latter is considered a significant competitive advantage for the company.

Strengthening revenues also bolster confidence in the retailer:

Source: InvestingPro

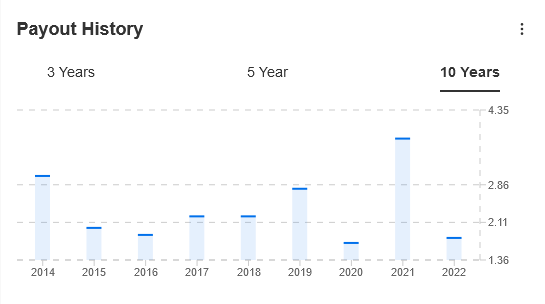

As well as a strong dividend history and post-covid recovery:

Source: InvestingPro

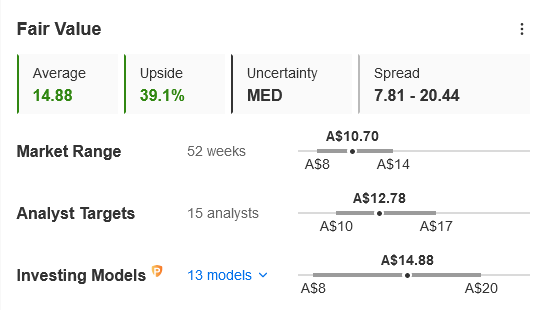

Fair Value Estimate

Currently, the stock is trading at A$10.7, while the average of 13 Fair Value Investing Models revealed a price target of $14.88 indicating an upside of 39.1%.

In order to determine if defensive shares suit you best, consider factors such as personal risk tolerance, income requirements, and investment timeline. If you prefer low-risk options or seek additional income sources approaching retirement age, incorporating more defensive stocks into your portfolio might be appropriate.

This analysis was done using InvestingPro, access the tool by clicking on the image.

Find All the Info you Need on InvestingPro!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky, and therefore, any investment decision and the associated risk remains with the investor.