Intel (NASDAQ:INTC) is planning to make significant savings in the future, as the CEO of the ailing semiconductor company announced at the beginning of August. Now another concrete measure has been announced: the marketing department is to cut costs by more than 35 per cent by the end of the year.

This goal was announced by Intel's Chief Commercial Officer Christoph Schell on 5 August during an internal meeting, reports CRN, citing information from a corresponding presentation.

Restructuring and staff cuts in marketing

Intel's Sales and Marketing Group (SMG), which is headed by Schell, must ‘simplify programmes from start to finish’ and reassign responsibilities with regard to costly and revenue-damaging expenses. In future, decisions are to be made more quickly. Ultimately, these measures will also mean a reduction in the number of staff in this area. At the beginning of August, Intel CEO Pat Gelsinger had already announced that up to 15,000 jobs were to be cut. In the wake of the announcement of the deeply negative quarterly figures, the share price lost almost 30 per cent of its value.

Intel expects the measures at SMG to initially save it USD 100 million in the second half of the year. These savings are expected to increase to USD 300 million in the coming year.

Reduced marketing campaigns

In a statement to CRN, an Intel spokesperson said: ‘We are becoming a simpler, leaner and more agile company that partners and customers can work with more easily. At the same time, we are ensuring that our investments are focused on areas where we see the greatest opportunities for innovation and growth.’ Despite the savings, business partners will remain an essential part of Intel's future strategy.

However, the budget for large marketing campaigns and partner programmes will be significantly reduced. The report emphasises how important such programmes with OEMs (original equipment manufacturers) have traditionally been for Intel.

Cost-cutting programme in full swing

The cost-cutting measures announced by CEO Gelsinger, which are ultimately intended to reduce costs by USD 10 billion, are already having an impact. First of all, the annual ‘Intel Innovation’ in-house exhibition was cancelled for this year. Shortly afterwards, it was announced that Intel had sold its entire stake in the British chip developer Arm.

Hopes pinned on Lunar Lake and Arrow Lake

Intel's product side is eagerly awaiting this year's new products. A new series of mobile CPUs, known as ‘Lunar Lake’ or Core Ultra 200V, will be launched at the beginning of September. The ‘Arrow Lake-S’ for desktops is expected to follow on 10 October. In addition, new server CPUs from the Granite Rapids family, known as Xeon 6900P, are expected in the current quarter.

Intel's position in the international arena

Despite the tensions at Intel, we should not be too quick to write off this company. Intel still has a very high market share of around 63% in the microprocessor sector. AMD (NASDAQ:AMD), the only significant competitor in this field, has a market share of 36%. And if we look at the entire market of semiconductor manufacturers, Samsung (KS:005930) leads with a market share of just over 10%, closely followed by Intel with just under 9%.

And even in the rapidly growing market for special-purpose processors (central processing units, CPUs), which are used primarily in the field of AI, Intel can hold its own in a good third place behind AMD and Nvidia.

So it was only a matter of time before we added Intel to our analysis portfolio as another stock from this sector. With Nvidia, AMD, Samsung and Intel, we cover the world's largest and leading companies in all areas of the semiconductor industry. Nvidia and AMD are already in our portfolio, while we are preparing the right time to buy Samsung and Intel.

When is the Intel share ripe for purchase?

Probably soon. The stock has taken a hammering and is now at a very important point where a turnaround should occur. We believe the stock is capable of this. However, a few conditions must be met before we consider buying.

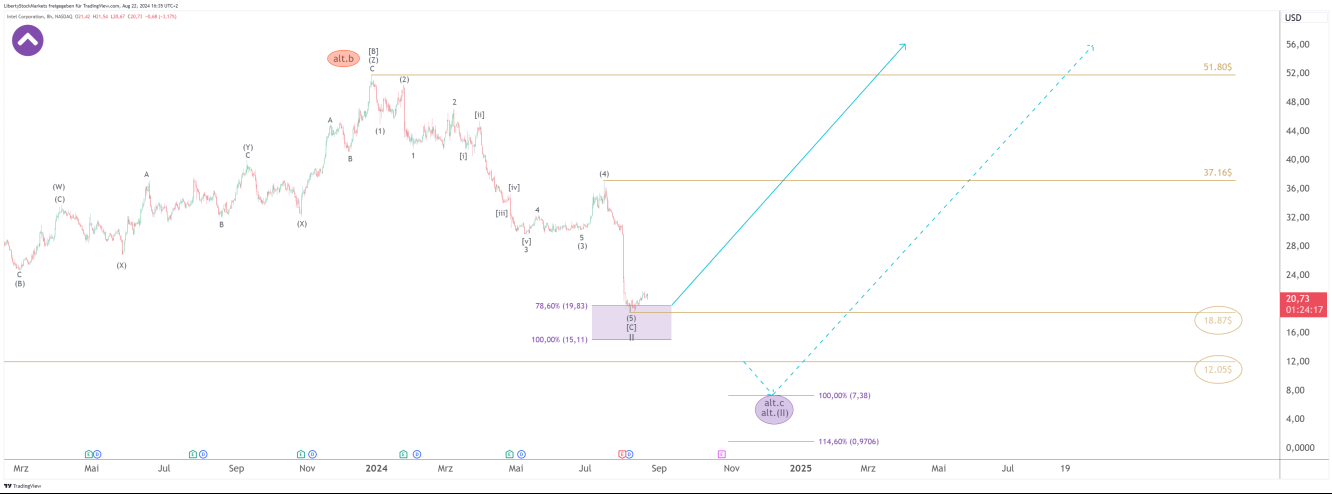

Today we will limit ourselves to the details. The important price range that we have mentioned is between $19.83 and $15.11. And that is exactly where the share should react sustainably upwards.

In our view, two things are important now: the share should no longer fall below the purple box. That would be the first bad sign. If it falls below $12.05, things will get dark. Then the long-term floor will probably only be extended between $7.38 and $0.9706. Intel could still become a penny stock. We have to take that into account. In view of this danger, buying is still much too early for us at the moment.

Nevertheless, we see the chance of a sustainable trend reversal within the purple box (19.83$ to 15.11$) as higher than the total price decline. However, for this to happen, the share should now form a clean impulsive structure upwards that does not show any major overlaps. We will be watching this very closely and providing exclusive analytical support for our clients. We know exactly what to look out for now.

Intel has to deliver. Not only in the form of important strategic decisions within the company and new competitive products, but also in the structure of the chart.

It is especially important not to lose sight of the stock market right now. Hundreds of investors read our analyses every day, follow our recommendations and increase their assets through smart decisions. You can test us for a full 14 days without obligation. You can access our website via the link next to my profile picture above this text.

Disclaimer/Risk warning:

The information provided here is for informational purposes only and does not constitute a recommendation to buy or sell. It should not be understood as an explicit or implicit assurance of a particular price development of the financial instruments mentioned or as a call to action. The purchase of securities involves risks that may lead to the total loss of the capital invested. The information provided does not replace expert investment advice tailored to individual needs. No liability or guarantee is assumed, either explicitly or implicitly, for the timeliness, accuracy, appropriateness or completeness of the information provided, nor for any financial losses. These are expressly not financial analyses, but journalistic texts. Readers who make investment decisions or carry out transactions based on the information provided here do so entirely at their own risk. The authors may hold securities of the companies/securities/shares discussed at the time of publication and therefore a conflict of interest may exist.

- English (USA)

- English (UK)

- English (India)

- English (Canada)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Intel – Will the share price turn around or will it become a penny stock?

Published 23/08/2024, 12:59 am

Intel – Will the share price turn around or will it become a penny stock?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.