Donald Trump nominated seasoned hedge fund manager Scott Bessent as the next Treasury Secretary. While the Treasury Secretary has many responsibilities, debt management is one of the most important. Therefore, given the recent scrutiny the bond market has been paying to high deficits and associated debt, Scott Bessent appears to be a timely appointment. Bessent appears to appreciate the bond market’s concern, which helps explain why he immediately released his 3-3-3 rule. As the name suggests, the 3-3-3 rule has three components as follows:

- Cut the budget deficit to 3% of GDP by 2028

- Push GDP growth to 3%

- Pump out an extra 3 million barrels of oil per day

The bond market is cheering Bessent’s selection and his 3-3-3 rule. Given the recent spate of excessive debt issuance, his hawkish views on government spending and managing budget deficits to 3% is welcome news. Moreover, boosting GDP growth to a steady 3% will raise taxes and reduce deficits.

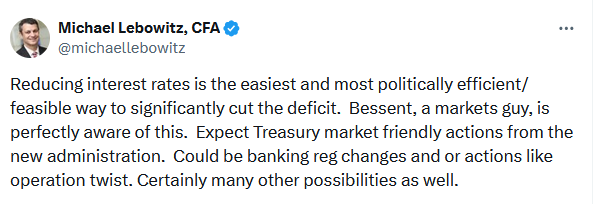

Lastly, his oil production goal will lower oil prices. The strong relationship between oil prices and inflation will help reduce yields, thus funding costs, on the margin. Our Tweet of the Day below highlights that the easiest way for Bissent to achieve the first bullet point of his 3-3-3 rule is to reduce Federal interest expense via lower interest rates. This is the lowest-hanging fruit and one he is likely to pursue early in his tenure.

What To Watch Today

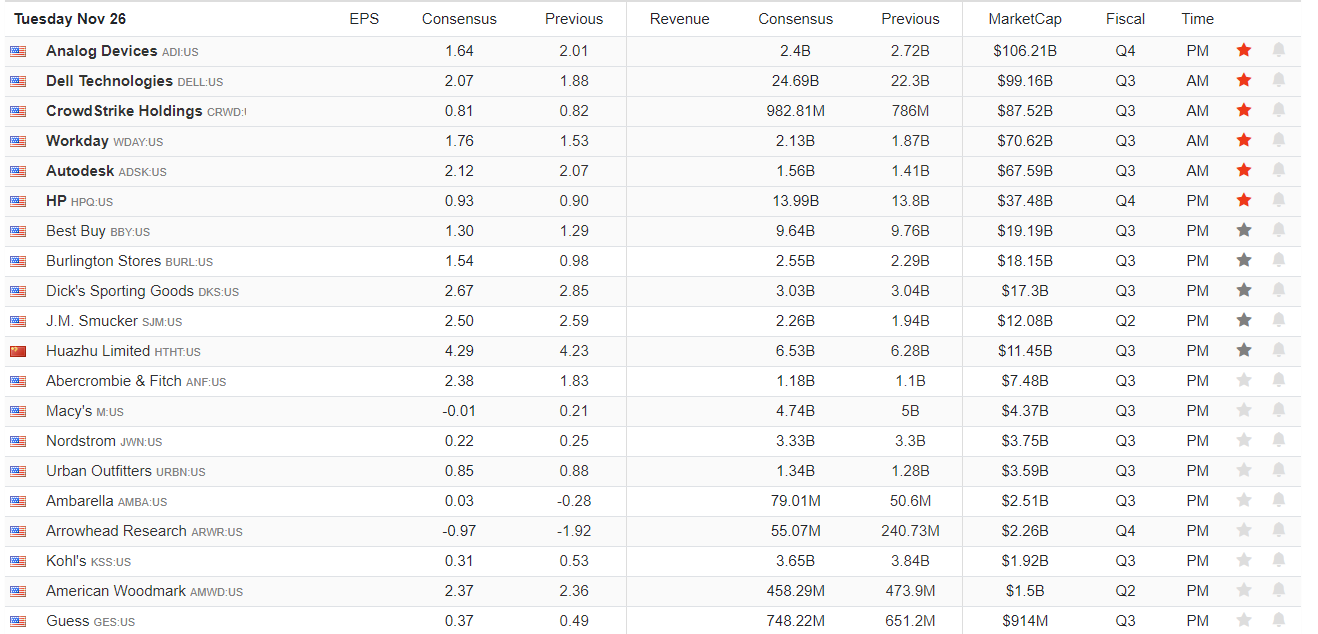

Earnings

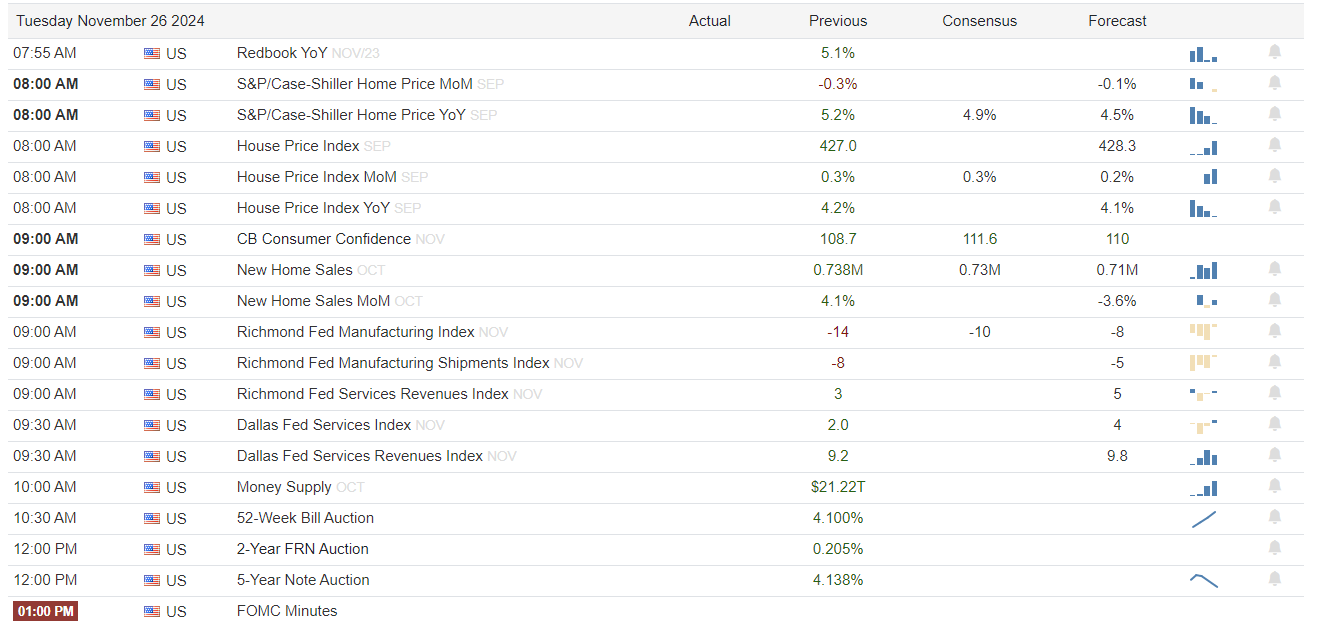

Economy

Market Trading Update

Yesterday, we noted that after holding support at the 20-DMA for several days, the market gained some traction late in the week. That buying pressure is reversing the short-term MACD sell signal, which should allow the market to rally further this week. The market did rally yesterday on news of Scott Bessent’s appointment as Treasury Secretary, which both the stock and bond markets liked. Regulatory reform, deficit reduction, and tax cuts are all economically friendly in the long term.

The election of Donald Trump and the various appointments pointing toward more deregulation fuel the rise in small and mid-cap stocks. As you know, we recently added a position to both our equity and ETF models. Currently, that trade is a bit ahead of itself is significantly deviated from long-term moving averages, and is overbought on a relative strength basis. While we think that small and mid-cap companies may continue to get bids, there are a lot of losses in those markets that could be harvested during the first couple of weeks of December. We will look to add to our current position on a pullback as mutual funds harvest losses and make their annual distributions.

The weekly chart below of the iShares Russell 2000 ETF (NYSE:IWM) remains bullish-biased after breaking out to new highs from the 2022 peak. While small and mid-cap stocks have underperformed their large-cap brethren, we should expect some flows to continue into early 2025. There is risk in this sector due to the lack of profitability in about 40% of companies, but the bullish setup remains for now.

China Backs The U.S. Dollar

The same media pundits arguing for the dollar’s death now claim that China’s new dollar-denominated debt issuance will introduce a new world financial order. China issued $2 billion of a US dollar-dollar bond in Saudi Arabia. The bond was well subscribed to and at interest rates similar to those in the U.S.

The bonds were 20x oversubscribed, meaning there was $40 billion of interest. We don’t know at what rate the interest was and from whom. We suspect China directly or indirectly provided many bids to give the appearance of a robust auction. Yes, the interest rate is in line with U.S. rates. However, the bond was “only” $2 billion. The U.S. issues about $2.5 trillion of securities a month. Assessing rates based on a tiny bond is insane. If China were to approximate U.S. issuance, the rate would be much higher than Treasury rates, and they would struggle to find buyers to fulfill such a need.

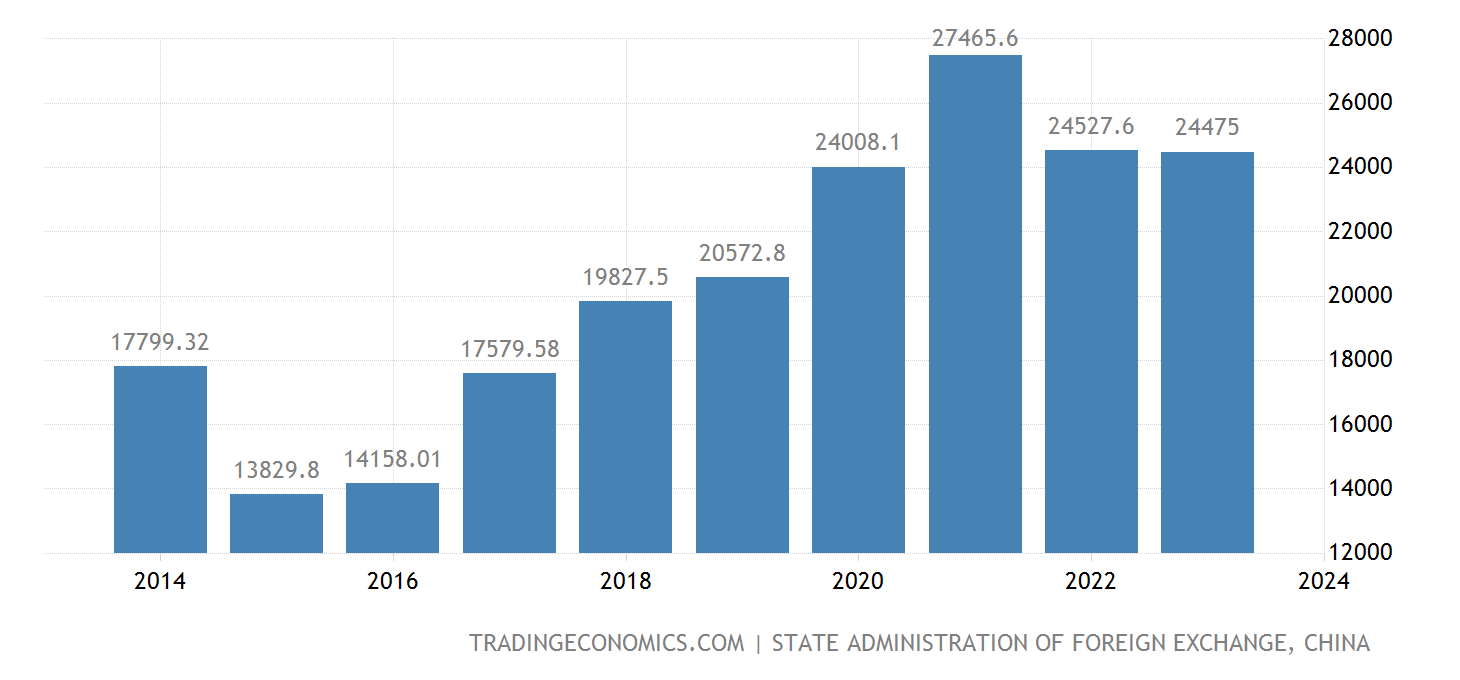

It is also critical to mention that this debt issuance is not a new strategy and only represents about 1% of the total debt in foreign currencies. Per Wikipedia:

As of March 2024, China’s total external debt stood at approximately $2.51 trillion, with U.S. dollar-denominated debt comprising a significant portion. Specifically, 80% of China’s foreign debt was denominated in U.S. dollars, 6% in euros, and 4% in Japanese yen.

Lastly, many countries issue debt in dollars rather than their home currency because they need dollars for global trade. While the fearmongers claim the end of the dollar is approaching, China’s debt issuance only strengthens the dollar.

The Banks Are the Hottest Sector Since the Election

Since Donald Trump was elected President on November 5th, the financial sector has been on fire. The first table below, courtesy of SimpleVisor, shows that the financial sector (XLF) has outperformed the S&P 500 by over 5% since the election. During the same period, healthcare stocks (XLV) underperformed by a similar amount.

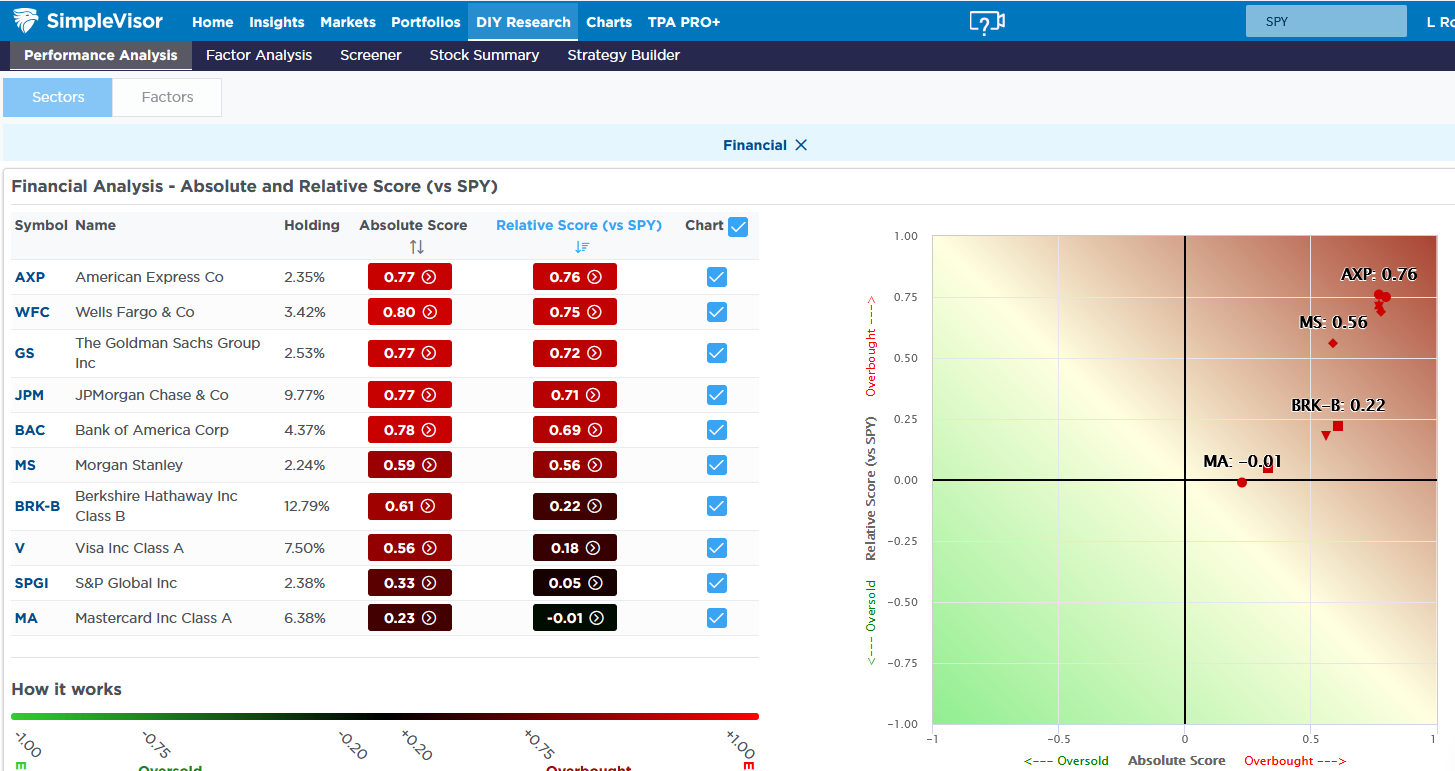

The over and underperformance shows up clearly in the SimpleVisor Absolute and Relative sector analysis in the second graphic. XLF is now grossly overbought from a relative and absolute perspective, while the opposite holds for healthcare. The third table highlights that the banks are largely responsible for the great performance of the financial sector. Non-banks like Visa (NYSE:V), Mastercard (NYSE:MA), Berkshire (NYSE:BRKb), and S&P Global (NYSE:SPGI) have near-zero absolute and relative scores compared to the market.

The relationship between financials and healthcare is approaching three standard deviations. Therefore, a change in the relative performance between the two is becoming likely. To appreciate which stocks are most vulnerable to a rotation, SimpleVisor allows users to run the relative and absolute scores for the top 10 holdings, as we do in the third graphic. Not shown, Thermo Fisher (NYSE:TMO) and Eli Lilly (NYSE:LLY) are the two most oversold healthcare stocks.

Tweet of the Day