Inflation concerns continue to lurk, but the US bond market is holding on to its rally so far this year, based on a set of ETFs through Wednesday’s close (Feb. 19).

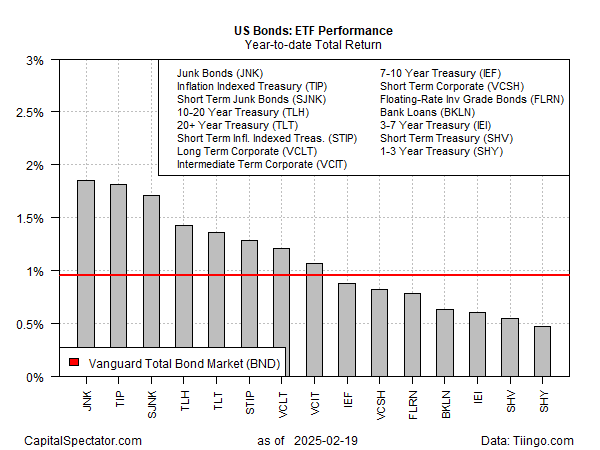

The investment-grade benchmark for US fixed-income securities (BND) is up 1.0% in 2025, which is close to its high-water mark for the year to date. Several slices of the bond market are posting even stronger results.

High-yield bonds (JNK) continue to lead the field, rallying 1.9% year to date. The advance extends the fund’s rally in each of the past two calendar years. In 2024, JNK rose 7.7% on a total-return basis.

Inflation-indexed Treasuries are a close second-place performer in 2025, based on the iShares TIPS Bond ETF (NYSE:TIP), which is trailing junk bonds only fractionally year to date.

Inflation, in fact, remains in focus for markets and the Federal Reserve this year, following news last week that consumer prices continue to show signs of accelerating. The central bank’s 2% inflation target, in other words, remains elusive. As a result, the central bank’s inflation fight continues and so the odds for extending rate cuts diminishes. In turn, the prospects appear weak for bond prices to rally from current levels.

The so-called sticky inflation data of late has persuaded the crowd to price in high odds that the central bank will Fed funds unchanged at the next policy meeting on Mar. 19, based on CME data for Fed funds futures.

The Federal Reserve appears concerned about inflation risk as well, based on yesterday’s minutes of its Jan. 28-29 meeting. Officials highlighted risks that inflation could accelerate, which in turn persuaded the central bank to leave its benchmark rate unchanged last month following rate cuts in late-2024.

The minutes also suggest that the odds are low for additional rate cuts in the near-term future as long as the labor market remains robust: “Participants indicated that, provided the economy remained near maximum employment, they would want to see further progress on inflation before making additional adjustments to the target range for the federal funds rate.”

Another variable that the Fed is watching is the rapidly evolving state of President Trump’s tariff plans. There’s a general view that if import duties rise, the change would lift inflation, if only temporarily.

For the moment, monetary policy appears to be in a holding pattern until further clarity about tariffs emerges. The bond market is also watching and waiting.