Wall Street’s third quarter earnings season has kicked into high gear this week, with investors anticipating one of the best reporting seasons in years as the impact of the COVID-19 pandemic fades for several industries.

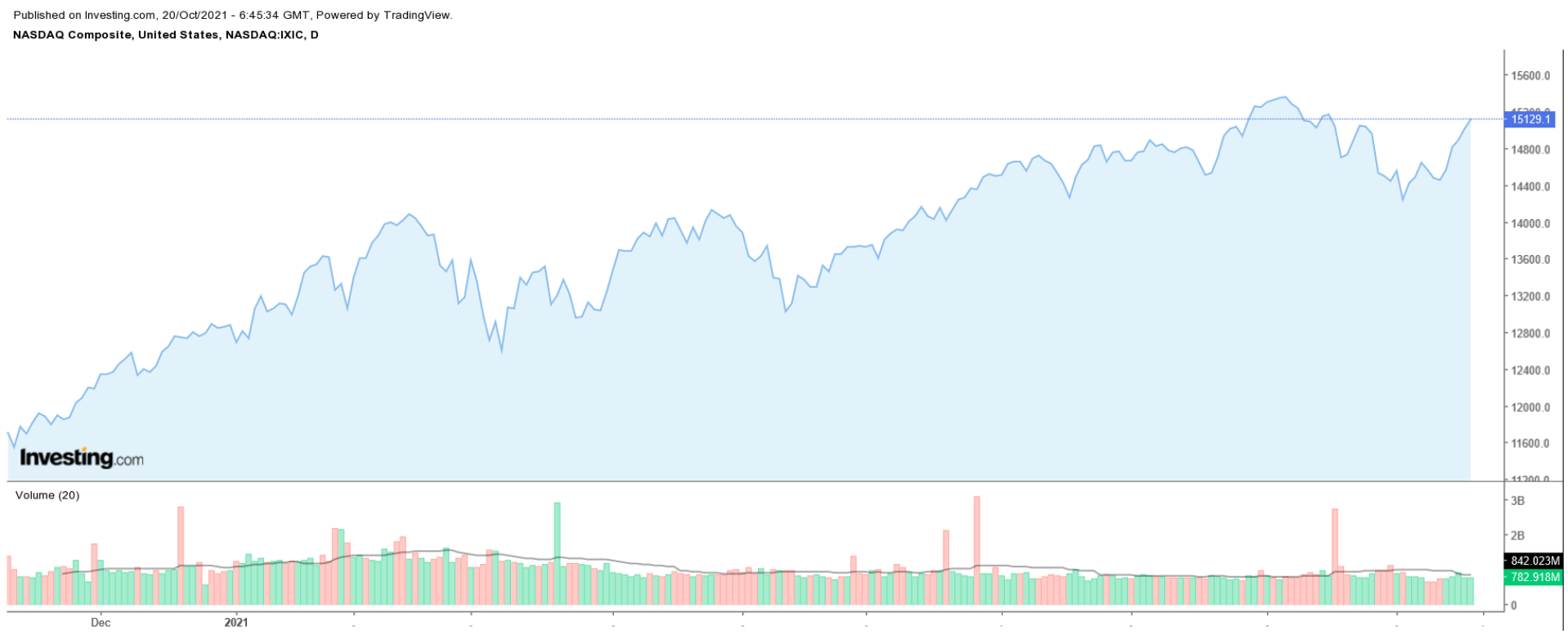

With the NASDAQ Composite trading near its highest level on record, most of the focus going forward will once again be on the five marquee mega-cap tech companies—collectively referred to as the FAAMGs—all due to report results later this month.

Each of the five is set to enjoy another quarter of blockbuster earnings and all are well worth considering given their ongoing dominance in the still-booming tech space.

1. Facebook

- Earnings Date: Monday, Oct. 25, after the close

- EPS Growth Estimate: +17.3% YoY

- Revenue Growth Estimate: +37.4% YoY

- Year-To-Date Performance: +24.5%

- Market Cap: $969.7 Billion

Facebook (NASDAQ:FB)—which reported its strongest revenue growth since 2016 in the previous quarter, but warned of a significant slowdown ahead—is projected to post third quarter results on Oct. 25.

Analysts are unified in their call for earnings per share (EPS) of $3.18, up roughly 17% from EPS of $2.71 in the year-ago period. Revenue is forecast to increase about 37% YoY to a record high $29.5 billion, boosted by strong advertiser demand and higher ad prices.

As usual, the market will pay close attention to Facebook’s update regarding its active user accounts as well as average revenue per user (ARPU); two important metrics for the social network company.

Facebook said daily active users (DAUs) as of the second quarter climbed 7% from a year earlier to 1.91 billion, while monthly active users (MAUs) also increased 7% to 2.90 billion. Meanwhile, ARPU clocked in with a double-digit percentage gain, surging 43.5% YoY to $10.12.

In addition, investors will focus on comments from CEO Mark Zuckerberg regarding the negative impact of potential regulatory actions, as well as recent changes in Apple’s iOS, which limits Facebook's ability to track users' activity across third-party sites.

FB stock, which is up 24.5% year-to-date, ended at $339.99 on Tuesday, not far from a record high of $384.33 touched on Sept. 1. At current levels, the social network giant is valued at $969.7 billion, making it the fifth most valuable company traded on the U.S. stock market.

The Menlo Park, California-based company, which has benefitted from an acceleration in ad spending, now counts roughly 3.51 billion monthly users across its entire family of apps, including Instagram, Messenger, and WhatsApp.

2. Google

- Earnings Date: Tuesday, Oct. 26, after the close

- EPS Growth Estimate: +44.6% YoY

- Revenue Growth Estimate: +37.4% YoY

- Year-To-Date Performance: +63.5%

- Market Cap: $1.91 Trillion

Google-parent Alphabet (NASDAQ:GOOGL)—whose earnings and revenue crushed expectations in the second quarter—next reports financial results on Oct. 26.

Analyst consensus calls for third quarter earnings per share of $23.72, improving by nearly 45% from EPS of $16.40 in the same quarter a year earlier. Revenue is forecast to clock in at an all-time high of $63.4 billion, increasing about 37% from sales of $46.1 billion in the year-ago period, driven by an ongoing surge in digital ad spending.

Investors will stay laser-focused on growth rates at Google’s core ad revenue business, which saw a YoY gain of 69% to $50.4 billion in the previous quarter. YouTube ad revenue growth, which soared 83% from a year-ago to $7.00 billion in the last quarter, will also be eyed.

In addition, one segment that should be primed for another quarter of blockbuster growth is Alphabet's Google Cloud Platform, which saw sales surge 54% to $4.63 billion in Q2.

Market players will be eager to hear fresh details on the U.S. government’s ongoing antitrust suit against Google. Part of the litigation focuses on allegations the tech giant monopolizes its internet search tool to suppress competition.

GOOGL stock closed at $2,864.70 last night, within sight of its recent record of $2,925.10 reached on Sept. 1. The Mountain View, California-based tech behemoth has a market cap of $1.91 trillion, making it the fourth most valuable company trading on the U.S. stock exchange.

Google has been the best-performing ‘FAAMG’ stock of 2021, rallying 63.5% year-to-date, as it benefits from broad strength in the online advertising market.

3. Microsoft

- Earnings Date: Tuesday, Oct. 26, after the close

- EPS Growth Estimate: +13.8% YoY

- Revenue Growth Estimate: +18.3% YoY

- Year-To-Date Performance: +38.6%

- Market Cap: $2.31 Trillion

Microsoft (NASDAQ:MSFT), which easily topped expectations for earnings and revenue in the last quarter and provided upbeat guidance, is scheduled to next report financial results on Oct. 26.

The consensus calls for the software giant to post earnings per share of $2.07 for its fiscal first quarter, improving almost 14% from EPS of $1.82 in the year-ago period. Revenue is expected to rise nearly 18% YoY to $44 billion, benefitting from strong demand for its cloud-computing services.

As such, investors will focus on growth in Microsoft’s booming Intelligent Cloud business, which includes Azure, Windows Server, SQL Server, GitHub, and other enterprise services. Microsoft’s commercial cloud revenue rose 30% YoY to $17.3 billion in its most recent quarter, while revenue from its Azure cloud services grew 51%.

Another key metric in focus will be how well Microsoft’s Productivity and Business Processes segment performed. The key unit—which includes Office 365 cloud productivity software, Teams communications app, LinkedIn, as well as Dynamics products and cloud services—saw revenue grow 25% in the last quarter to $14.6 billion.

MSFT ended at an all-time high of $308.23 yesterday. With a market cap of $2.31 trillion, Microsoft is the second most valuable company listed on the U.S. stock exchange. The Redmond, Washington-based tech titan has seen its stock gain almost 39% since the start of the year, thanks to robust demand for its cloud-based offerings.

4. Apple

- Earnings Date: Thursday, Oct. 28, after the close

- EPS Growth Estimate: +68.5% YoY

- Revenue Growth Estimate: +31.3% YoY

- Year-To-Date Performance: +12.1%

- Market Cap: $2.46 Trillion

Apple (NASDAQ:AAPL)—which posted blowout earnings and revenue in the previous quarter—next reports financial results on Oct. 28.

Analysts concur on earnings per share of $1.23 for its fiscal fourth quarter, climbing nearly 69% from EPS of $0.73 in the year-ago period. Revenue is forecast to increase more than 31% YoY to $84.9 billion, benefitting from robust demand for its lineup of 5G-enabled iPhone models.

As such, Wall Street will pay close attention to growth in Apple’s iPhone revenue, which jumped nearly 50% to $39.5 billion in the previous quarter. Any updates on growth in the tech giant’s iPad and Mac business, which posted YoY revenue growth rates of 16% and 12%, respectively, in the last quarter, will also be eyed as it copes with supply constraints linked to the global chip shortage.

In addition, Apple’s services business—which includes the App Store, AppleCare, iCloud, Apple Pay, Apple Music, Apple TV+, and Apple Fitness+ —will be honed in on after posting YoY sales growth of 33% in the preceding quarter.

More importantly, investors are hoping Apple will provide guidance for its lucrative fiscal Q1 holiday quarter. The company has not offered a forecast since the beginning of the COVID-19 pandemic, citing uncertainty surrounding the impact of the virus on its business.

AAPL hit an all-time high of $157.26 on Sept. 7. It settled at $148.76 on Tuesday. At current levels, the consumer electronics conglomerate has a market cap of $2.46 trillion, making it the most valuable company trading on the U.S. stock exchange.

The Cupertino, California-based iPhone maker has seen its shares rise about 12% since the start of 2021, underperforming the broader market, amid concern over regulatory and legal challenges it faces in the U.S. and Europe.

5. Amazon

- Earnings Date: Thursday, Oct. 28, after the close

- EPS Growth Estimate: -28.1% YoY

- Revenue Growth Estimate: +16.1% YoY

- Year-To-Date Performance: +5.7%

- Market Cap: $1.74 Trillion

Last quarter, Amazon.com (NASDAQ:AMZN), reported its first revenue miss in three years and gave weak guidance going forward. The mammoth e-tailer is slated to report its third quarter financial results on Oct. 28.

Analysts are calling for earnings per share of $8.90, falling 28% from EPS of $12.37 in Q3 2020, due to costs related to COVID-19. Revenue, meanwhile, is expected to climb roughly 16% from the year-ago period to $111.6 billion, reflecting ongoing strength in its e-commerce, cloud-computing and advertising businesses.

As such, investors will zero in on the company’s thriving cloud unit to see if it can maintain its torrid pace of growth. Amazon Web Services’ (AWS) revenue rose 37% to a record $14.8 billion in the second quarter, solidifying its spot as the leader in the cloud-computing space, ahead of the aforementioned Microsoft Azure and Google Cloud.

Outside of its core retail and cloud segments, advertising revenue, which has increasingly become another major growth driver for Amazon, will also be eyed. While Amazon does not disclose advertising sales figures, they are included in the company’s “Other” category, which saw revenue surge 87% in the last quarter.

Perhaps of greater importance, investors will scrutinize Amazon’s operating income and revenue guidance for its key fourth quarter, which covers the holiday shopping season.

AMZN reached a record high of $3,773.00 on July 13, closing on Tuesday at $3,444.15. With a valuation of $1.74 trillion, the Seattle, Washington-based e-commerce and cloud giant makes it into the third spot of the most valuable companies listed on the U.S. stock exchange.

After scoring a gain of 76% in 2020, Amazon shares have struggled this year, rising less than 6%, as pandemic-era lockdown restrictions eased and consumers flocked back to physical retail stores in greater numbers.