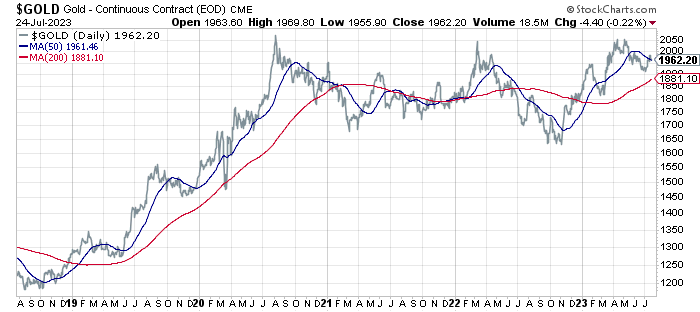

The price of the world’s favorite precious metal remains near its upper range of the past three years, but this is disappointing for gold bulls. The surge of inflation in the wake of the pandemic should have by now pushed the price much higher than the current $1962 per ounce, its more zealous supporters complain.

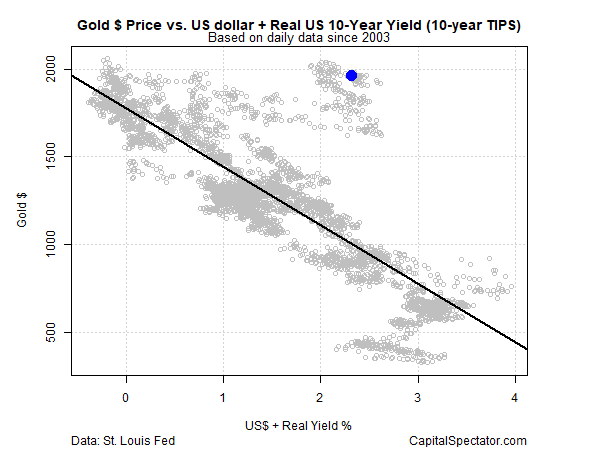

But while inflation is, or at least can be, a factor in gold’s price, real (inflation-adjusted) interest rates and the US dollar tend to dominate pricing. By that reasoning, the spike in real rates in recent years explains a lot. No wonder CapitalSpectator.com’s “fair value” gold model, which uses the greenback and real rates, still advises that the precious metal’s valuation is lofty.

Gold bugs may be inclined to disagree. After all, the metal’s price has been range-bound in recent years and recently made another (failed) attempt at breaking decisively above the $2000-plus ceiling.

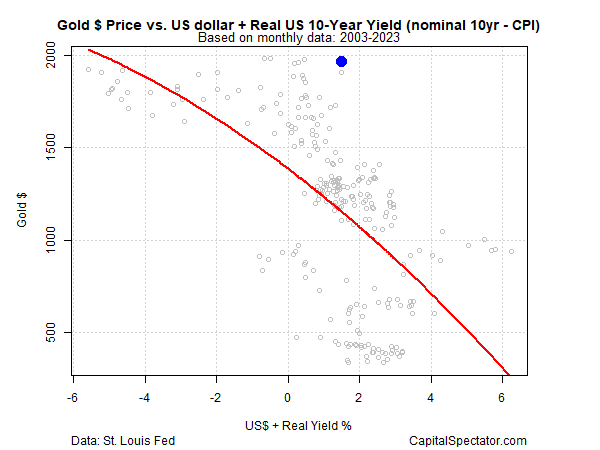

It's disappointing if you bought into the narrative that last year’s inflation surge would drive gold to $3,000-$5,000, as some of the metal’s most enthusiastic supporters predicted. But our fair value model throws cold water on that idea. Echoing the analysis published in May, today’s update continues to suggest that gold’s current price remains well above the estimate implied by current levels of the US dollar and real rates.

Using the United States 10-Year TIPS inflation-indexed Treasury as a proxy for the real yield with a measure of the US dollar suggests that the near-$2000-an-ounce price for gold is significantly overvalued… still.

Running the numbers using monthly data (as opposed to daily in the chart above) and replacing the TIPS yield with the nominal 10-year Treasury rate less the year-over-year change in the Consumer Price Index (CPI) tells a similar story. (Current data is shown by the blue dot in the chart below.)

Why should real rates and the dollar be such dominant forces for estimating gold’s fair value? The empirical record for one. Gold tends to trade inversely against those two factors with a fair amount of regularity. Why? Competition for scarce investor resources is probably the best answer.

Gold yields no payout, so there’s an opportunity cost to holding it vs. cash, bonds, stocks, and real estate. When real rates are low or negative, the opportunity cost fades or disappears entirely. But real rates (based on TIPS) are relatively high, near the highest in over a decade.

Ergo, a “safe” inflation hedge is available. That’s tough competition for gold. An added headwind for gold: the Federal Reserve, although it was slow out of the gate, appears to be getting ahead of the curve in taming inflation.