Oracle knocks stocks as Fed’s message drags on dollar

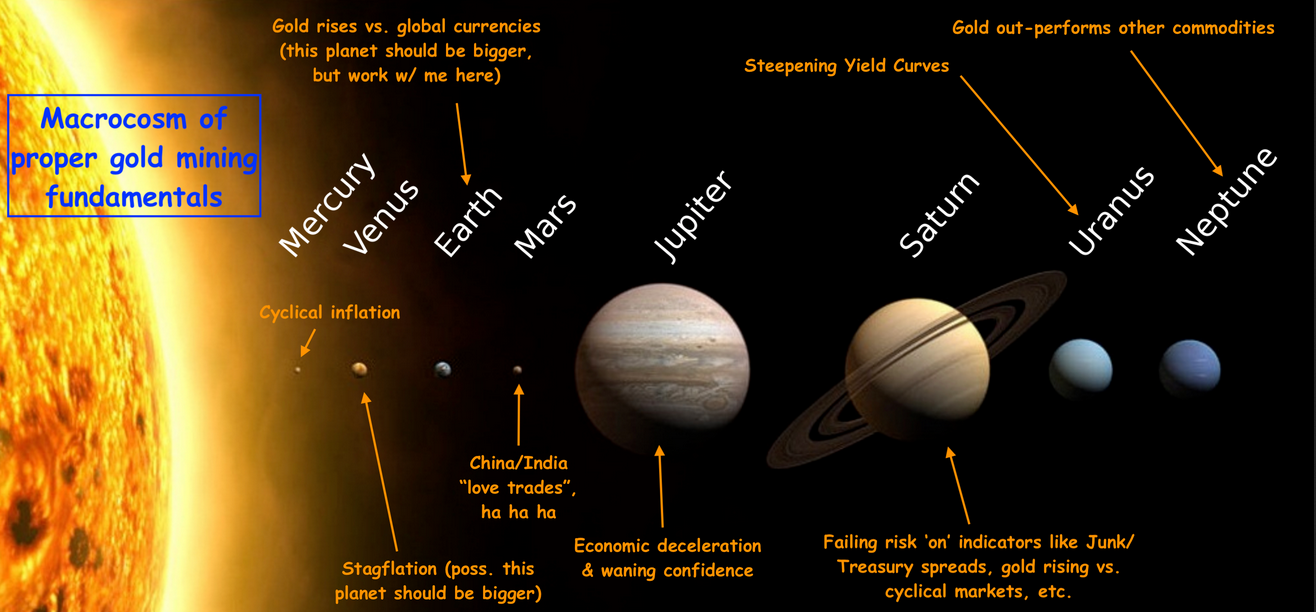

Real gold mining macro fundamentals matter. A lot. Here is a list of things that don’t matter, or at least shouldn’t matter when considering a bullish view of the gold stock sector (GDX, ARCA Gold Miners):

- Cyclical Inflation: Inflation is often touted by gold stock perma-bulls as a reason to buy. When inflation is working to the benefit of the economy it most certainly is not the time to buy. It is the time to be wary of such promos and to mostly avoid gold mining stocks (gold royalty companies have a different set of fundamentals). For example, when mining cost input prices of crude oil/energy are out pacing the mining product gold, well, do the math. It was not surprising in the least how badly gold stocks performed from mid-2020 until Q4, 2022 as the inflation hysteria took hold. Logically, as we began planning for the end of the inflation phase the miners bottomed and turned up in late 2022. It’s so simple as to be confusing for many. Over time, you can spot promotional entities by their habit of creating reasons to be bullish no matter the macro backdrop.

- War, terror, pestilence and end of the world prophecies: Sure, gold can get a knee-jerk rally at any time that fear overruns its bounds, but that is always corrected and reversed in the absence of real fundamentals. It is the stuff of day traders and fear mongers. I personally don’t think gold should have anything to do with this sordid stuff. All the poor old rock does is hold value over decades and centuries as I pointed out in this recent article.

- Indian wedding season or the China love trade: Pure promo from some of the more imaginative gold salesmen/women. Sure, there are supply/demand dynamics in play here but a casual review of recent decades proves that Indian and China love do not stand up to the proper macro fundamentals.

- Central Bank buying: Well sure, if you ignore the fact that for every buyer there is a seller. It’s a net wash and central banks have proven to be no smarter than any other entity.

What matters is our Macrocosm, which I have not presented in a long time but which is proven once again in the current environment to be a good way to view the macro fundamentals not only for gold, but especially for gold stocks, which leverage gold’s standing within the macro. Generally speaking, the larger the planet the more important the fundamental consideration.

Let’s take a checkup on some market based gold ratio indicators of the proper gold mining macro fundamentals (using daily charts), considering that gold miners leverage these indicators to the downside (all too often) and upside (as we’ve been projecting for 2023).

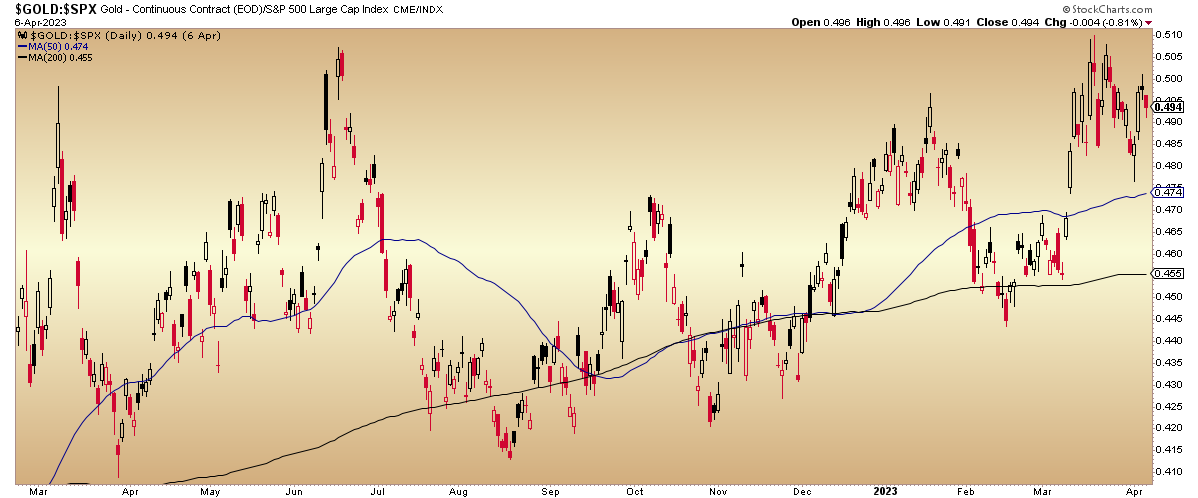

Gold/SPX

Steady gold uptrend vs. US stocks (S&P 500). A macro/psych/sentiment positive for gold mining.

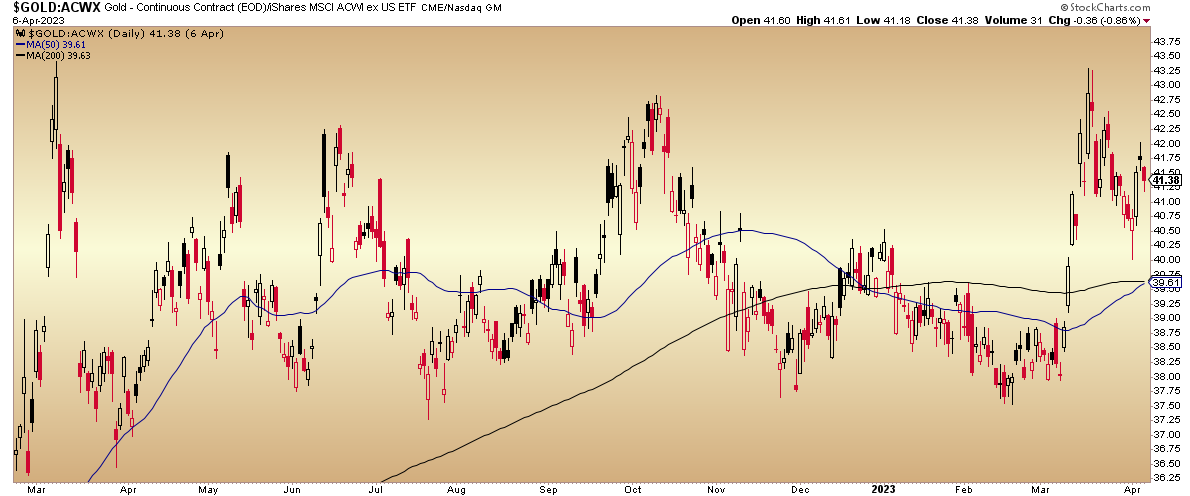

Gold/ACWX

A spike upward and flag as measured in global stocks ex U.S. (ACWX). This is a potential trend change to up.

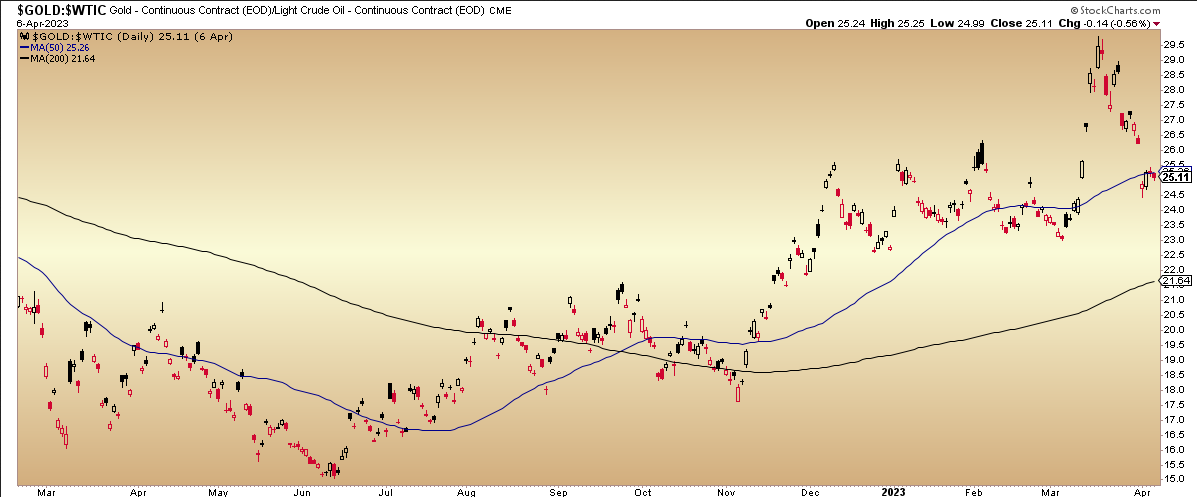

Gold/WTI Oil

In a daily uptrend, recently hammered by the OPEC price manipulation of the oil market. A positive for gold mining sector fundamentals if/as the trend holds.

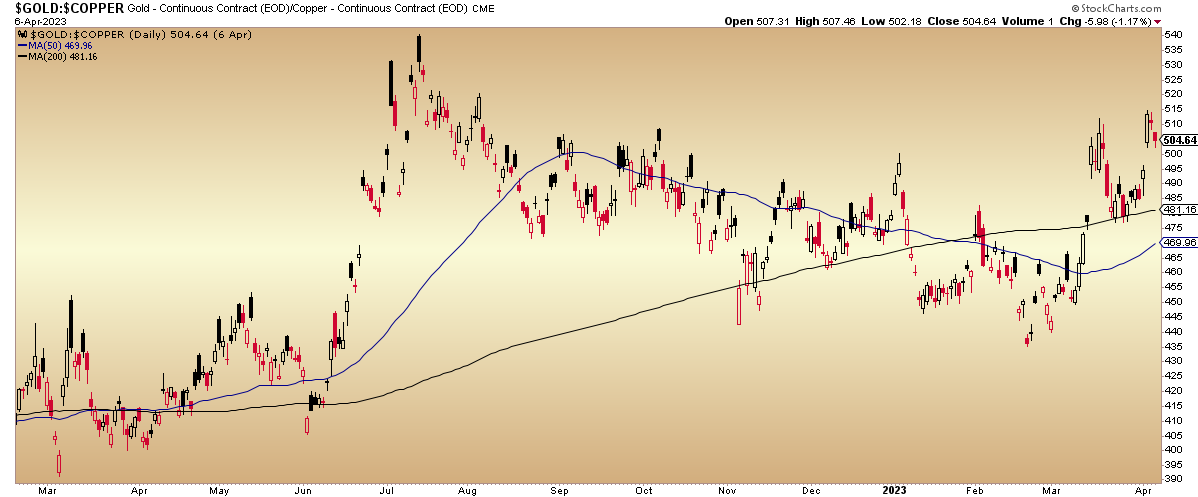

Gold/Copper

Gold is reasserting its long-term uptrend in copper terms and is likely to turn the intermediate (SMA 50) daily trend back up. China reopening and surging economy? I don’t think so. At least not as will pertain to the global economy and gold miner fundamentals. This is the picture of a counter-cyclical metal reasserting vs. a cyclical one.

Gold/CRB Index

Gold is firmly trending upward in broad commodity terms and with the recent oil manipulation is flying a bull flag to test the trend. Bullish for the counter-cyclical view and gold mining fundamentals.

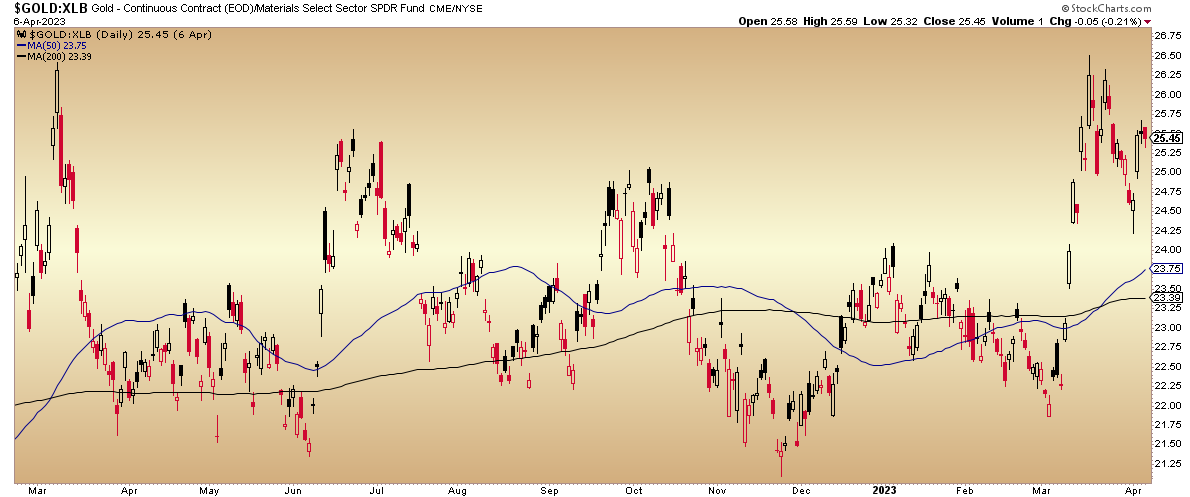

Gold/XLB

Gold/US Materials sector (XLB) spiked and flagged. It is a potential trend change from neutral to up. Hence, a change from a counter-cyclical metal in relation to a very cyclical stock sector.

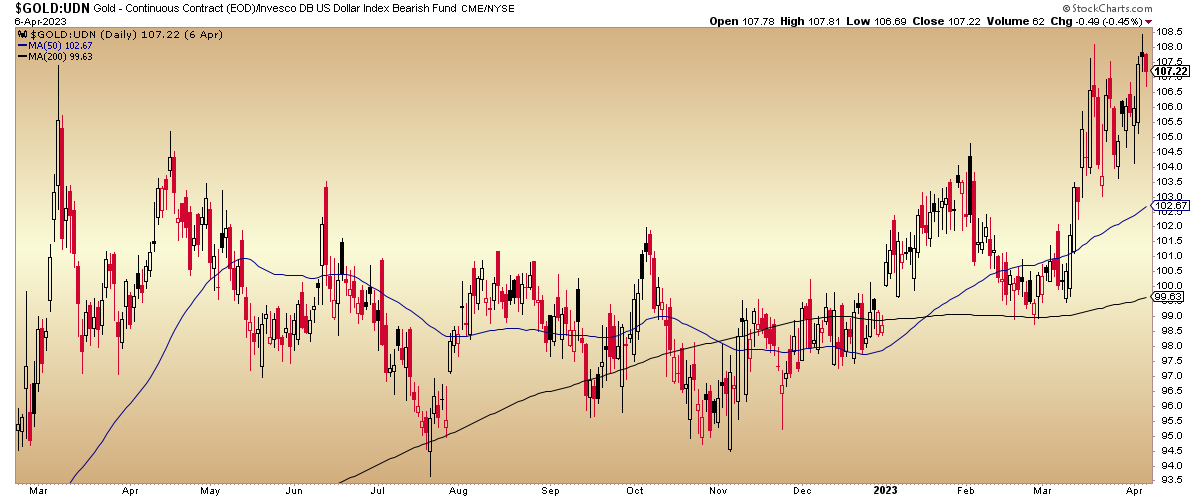

Gold/UDN

Gold vs. a measure of global currencies (an anti-USD fund) (UDN) is reasserting its uptrend. The old saying is that it’s not a real gold bull market unless it is rising in all currencies, and that has validity.

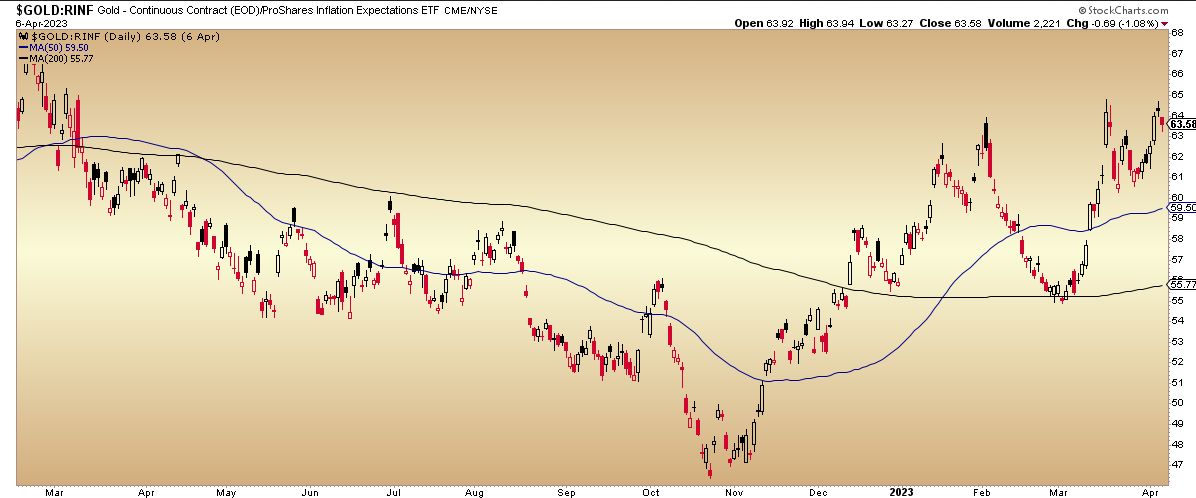

Gold/RINF

Gold vs. the very thing many people falsely believe is the main reason they should buy gold, inflation or in this case inflation expectations (RINF). It is likely a new uptrend and one we’ve been anticipating since Q4, 2022.

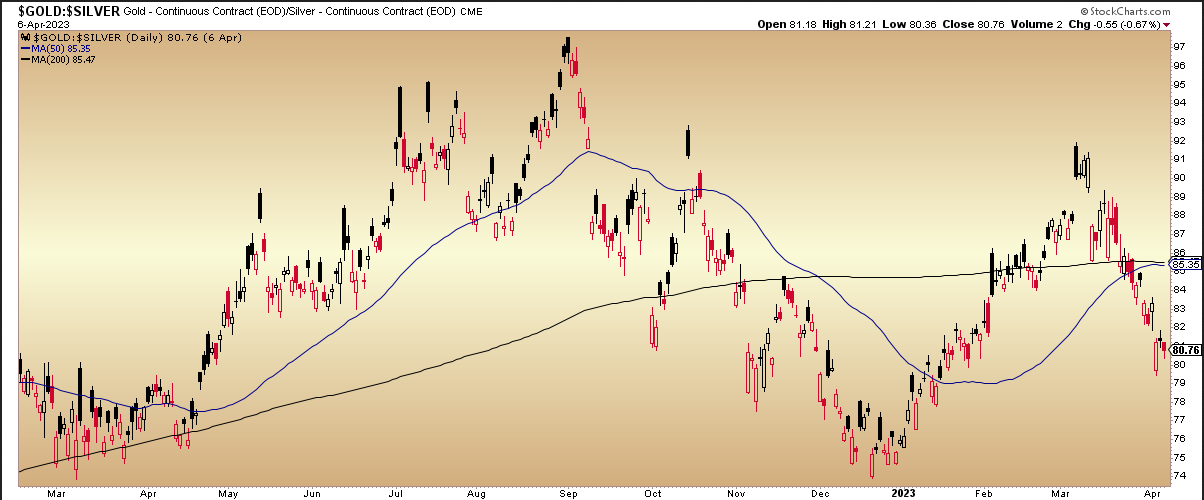

Gold/Silver (GSR)

Finally, what would any gold ratios article be without a view of the old monetary man vs. his impetuous little brother, who is more cyclically inclined and thus, inflation sensitive? The gold/silver ratio is neutral, at best. That is just fine for the gold miners at this time because silver often leads bullish phases in the precious metals complex. When the GSR turns up, however, it will be wise to prepare for a volatility phase in the precious metals and a resumed bear phase elsewhere.