Back in August, I wrote an article called Gold: The Anti-Bubble.

The point being that if you want to consider an asset to be sound value in a world of ongoing plays boosted by inflationary policy, speculating upon it – especially at a time when the cyclical risk ‘on’ trades are in upside momentum mode – is illogical.

As are expectations for it to perform up to par with said bubble beneficiaries (as noted previously, I define the bubble as monetary and fiscal policy and the stock market as a direct beneficiary) as long as It’s a Bubble, and It’s Intact.

Today, six months after the ‘Anti-Bubble’ article I present a short excerpt from this week’s edition of Notes From the Rabbit Hole that continues the theme.

It’s been six more months, but an ancient asset of monetary value will move at the same pace as the intact bubble and its performance will generally be inverse to said bubble. When the risk ‘on’ mania blows out, well, you do the math.

Gold will not be ready until it is ready, that goes double for the miners, and no amount of cheerleading, railing against the ‘system’ or dogmatic thinking about gold and inflation will change that.

Gold is the Anti-Bubble

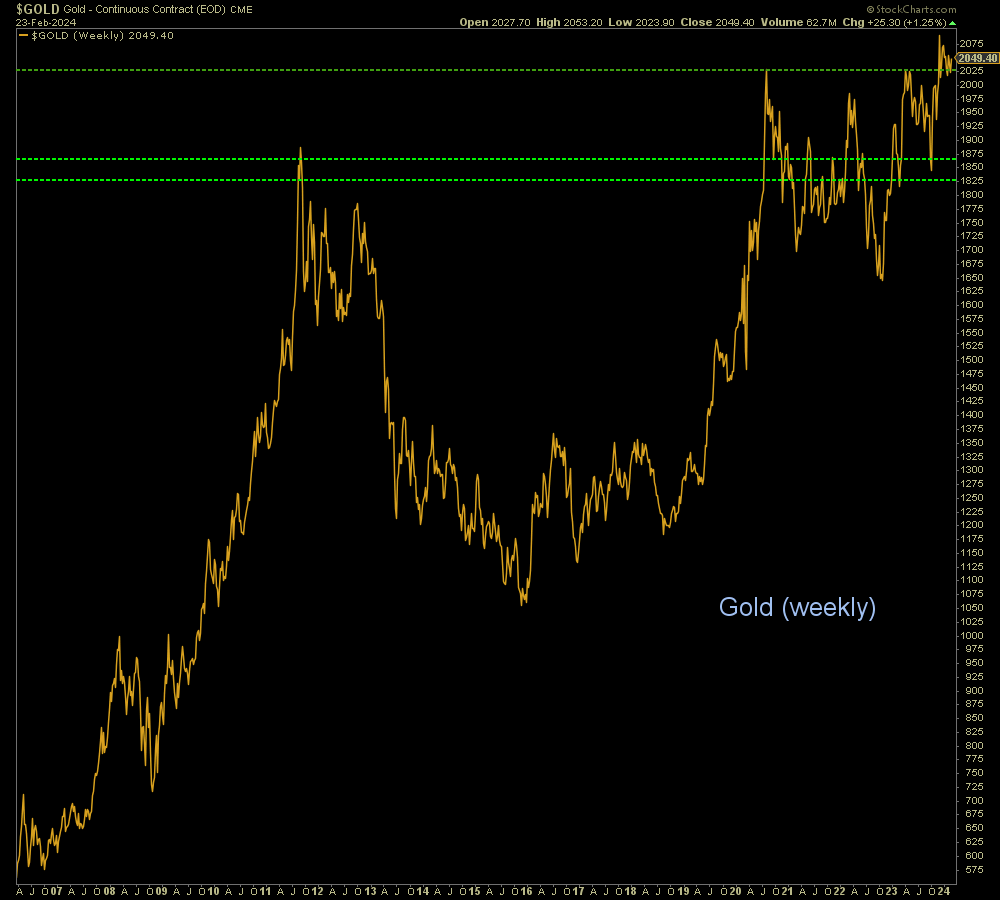

Gold is the anti-bubble, and speaking personally I find that keeping that in mind helps me to not get it mixed up with the speculative macro. Gold, big picture bullish as it is

Is the ANTI-BUBBLE, after all. When you realize that this metal is not a speculative asset * but is instead, monetary insurance and an anchor in the next financial debt/paper/digital storm, you don’t pressure the ancient hunk of value to be what it is not.

It acts as an inflation protector at times, although it is often a relatively poor one, as evidenced by how well stocks have done in the post-2020 inflation phase compared to gold.

That is because the inflation worked to cyclical advantage, post-2020 and because the market has implied and full confidence in the Fed to mop up its mess.

And that dynamic naturally carries over to the companies that dig gold out of the ground. So once again let’s review the clear evidence that gold stocks (HUI) should follow gold’s ratio to stocks (SPX).

HUI blew the correlation away in the 2004-2008 phase and that bubble was summarily blown up for it the Armageddon ’08 crash.

More recently, we noted in 2020 that HUI had far exceeded the Gold/SPX ratio. It has not gotten blown up for it, but it has endured a correction going on 4 years now. A correction to what I believe is a terribly volatile bull market that began in Q1, 2016.

The current excess can be fixed by gold rising in relation to stocks or gold stocks dropping anew to get closer to the ratio. So why again do we make such a big deal about the stock market and its policy bubble fuel?

As long as policymakers hold the pig together the macro is not right for gold mining.

* Sadly, all too many gold bugs believe the promotions about gold and China/India buying, BRICS de-dollarization, inflation benefits, war, terror, pestilence and maybe even Doug Casey’s asteroid crashing to earth as reasons to stay perma interested in gold and worse, gold mining.

I am perma-interested in [real] gold for the very (decades now) long-term, as insurance and value retention. I am interested in gold miners when the macro is right because when that pivot comes they are going to rip, and rip good as today’s negative leverage to indicators like the Gold/SPX ratio flips to positive leverage.

In the meantime, it is advisable to tune down the blatant perma-promoters and also the armies of naive but loud dogmatists. In the face of that, frustration and angst are instigated, and do not need to be.

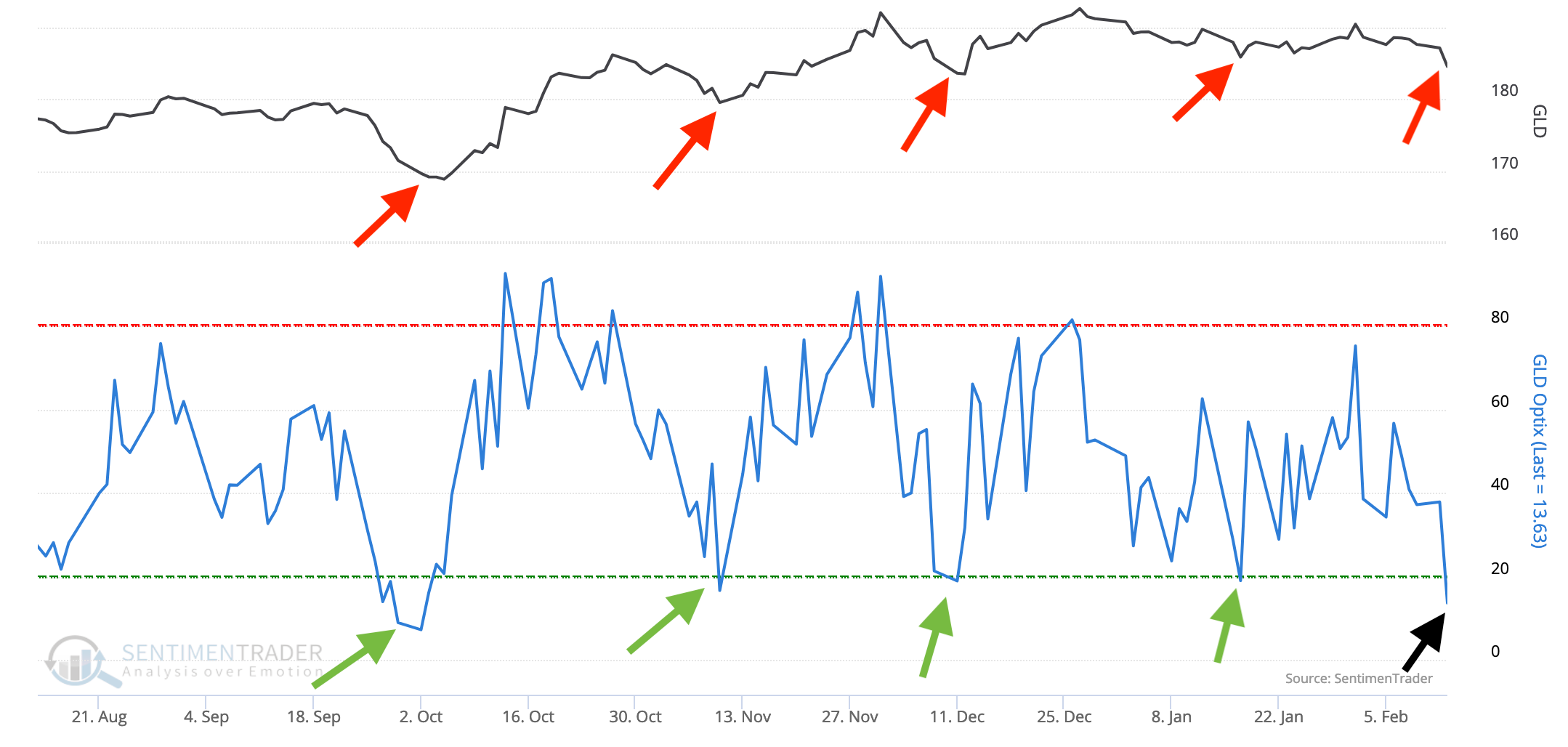

I am keeping in mind the solid contrarian setup developing for gold. Here is a review of the public’s lack of interest in GLD, which is the main tool they would use to buy what they view to be gold.

A chart like this could take a while to play out. Or maybe it will not play out as it has on the previous occasions. But history says it will, for some kind of rally at least.

The above is a big-picture view of the situation. To be ready for the macro pivot that will one day drive a head-spinning reversal of fortune for precious metals investors (including quality gold miners, which will leverage the positive macro as they have leveraged it negatively during the bubble years) NFTRH does more focused work in each weekly report and in-week NFTRH+ updates.

We will be ready, but will not impose impatience upon the situation. You’ve got to manage the market you’re given, not the one you want or think should be. In preparation for coming macro changes, I’ll be combining technical and macro fundamental analysis (my strong suits) with fundamental analysis on individual gold mining stocks, per a few fundamental-focused associates and the excellent fundamental data bank at Simply Wall St.