In Wonderland what is, it wouldn’t be.

The subject of this post has been made anonymous, as I’ve decided to release it to a wider audience. Said subject anonymized those he was critical of and so, turnabout is fair play.

Elliott Wave technical analyst Mr. Anonymous (Mr. A) has an article explaining his view of why gold is misunderstood by analysts that claim it is a hedge against inflation and a hedge against stock market weakness. On the surface, he is correct. You cannot argue with facts and the facts are that gold has been a less than stellar inflation hedge (under certain inflationary circumstances) and it did go down significantly during Armageddon ’08 and the 2020 pandemic crash.

As noted more times than I care to remember, there are far better hedges against inflation than gold when the inflation manufactured by policymakers is working, albeit temporarily, in support of the economy. Mr. A is also correct in noting that gold went down in the market crash of 2008 and the lesser crash in 2020. So what is my beef here?

Well, we have yet another analyst discussing gold as if it were simply an asset among other assets, focusing on its nominal performance rather than its long-term value and importantly, its relative value when marked up or marked down, as the anti-bubble to most other asset markets, which have been sustained for decades now by a bubble in aggressive and inflationary policy-making.

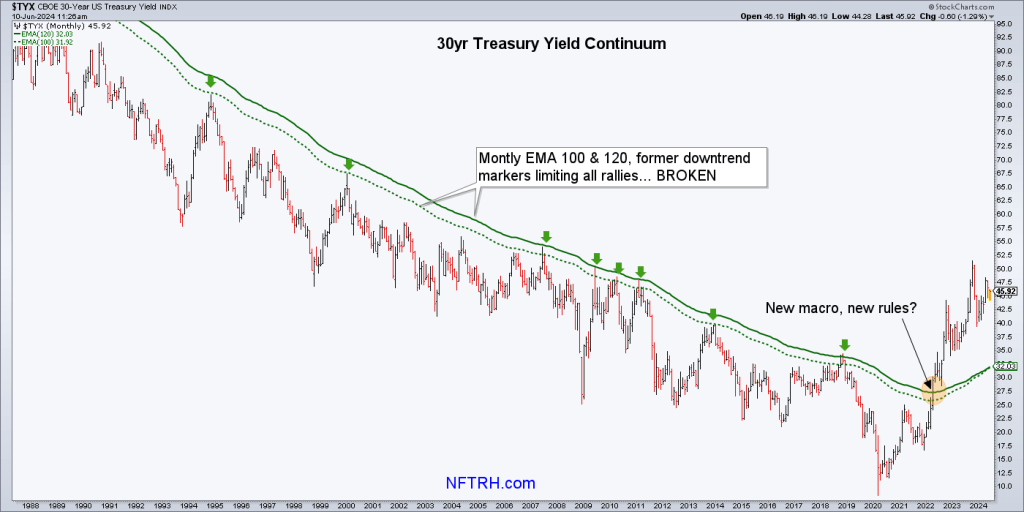

It is a bubble that I believe has ended, although it doesn’t consciously know it yet, with policy-propped asset markets now little more dead men walking. That assertion is based on several macro indicators I use, but none are more visually striking than the decades long trend break in the 30 Year Treasury Yield Continuum.

Among other things, that trend break implies that the ease with which policymakers were able to inflate the system at every crisis or even hint of crisis is a thing of the past. The sedate bond market signaling gentle disinflation gave license to inflationary policy at every sharp downward turn of the Continuum. That ease and simplicity is history now, and hence the odds have increased that the bubble is done (although still stumbling forward trying to make its way to or through the US presidential election with several fiscal initiatives beyond the scope of this article in play).

But here is the key point: Gold is the anti-bubble. Its positive correlation with bubble beneficiary markets since it ended its post-2020 corrective phase in Q4, 2022 is one of two things: cause for concern about the nominal gold price when stock markets take the next bear, or the beginning of the new macro as gold looks ahead to the obvious end of the policy-induced bubble. When stock markets take the bear, I would not bet on gold merrily going up. So there again, on the surface Mr. A is correct. However, it sure as shootin’ will outperform.

Let’s take a few quotes and rebut, shall we?

I do not have to go back terribly far in history to prove this premise as being an outright falsehood. First, let’s start with early 2020. As the SPX proceeded to crash during the Covid outbreak, did gold rally? Nope. Did gold at least remain stagnant? Nope. In fact, gold proceeded to drop by 15% during that time. Silver was even worse as it lost almost 40% of its value during that same timeframe.

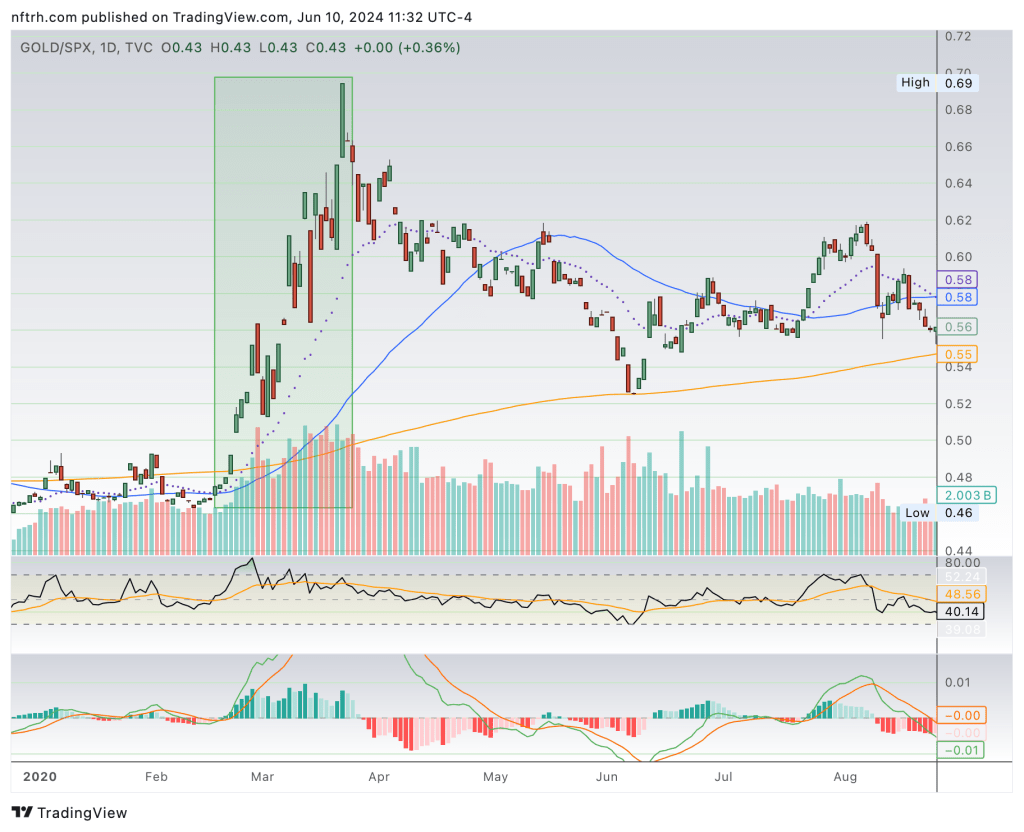

Gold is not supposed to rally in nominal terms during crises. It is supposed to retain relative value. Here is what gold did in relative terms to SPX during that crisis. After its relatively moderate nominal decline, gold led most markets out of the abyss before the inflationary bailout operations of central banks and governments set it up for a long correction as cyclical markets regained footing. That was as it should be for the anti-bubble.

As for silver, it is not gold. I don’t know why it is even included in this conversation. Silver is even further from an effective nominal disaster hedge than gold as it has more cyclical industrial qualities than gold (although it can be a better inflation hedge).

Now, if you are still not convinced, well, let’s go back a bit further to the Great Financial Crisis of 2008. Again, did gold rally during this financial upheaval during which the perceived “safety” of gold was sorely needed? Nope. Did gold at least remain stagnant? Nope. Gold lost 30% of its value, which clearly outlined that you cannot rely upon gold as a hedge against stock market upheaval. And, again, silver was much worse as it lost 60% of its value during this time.

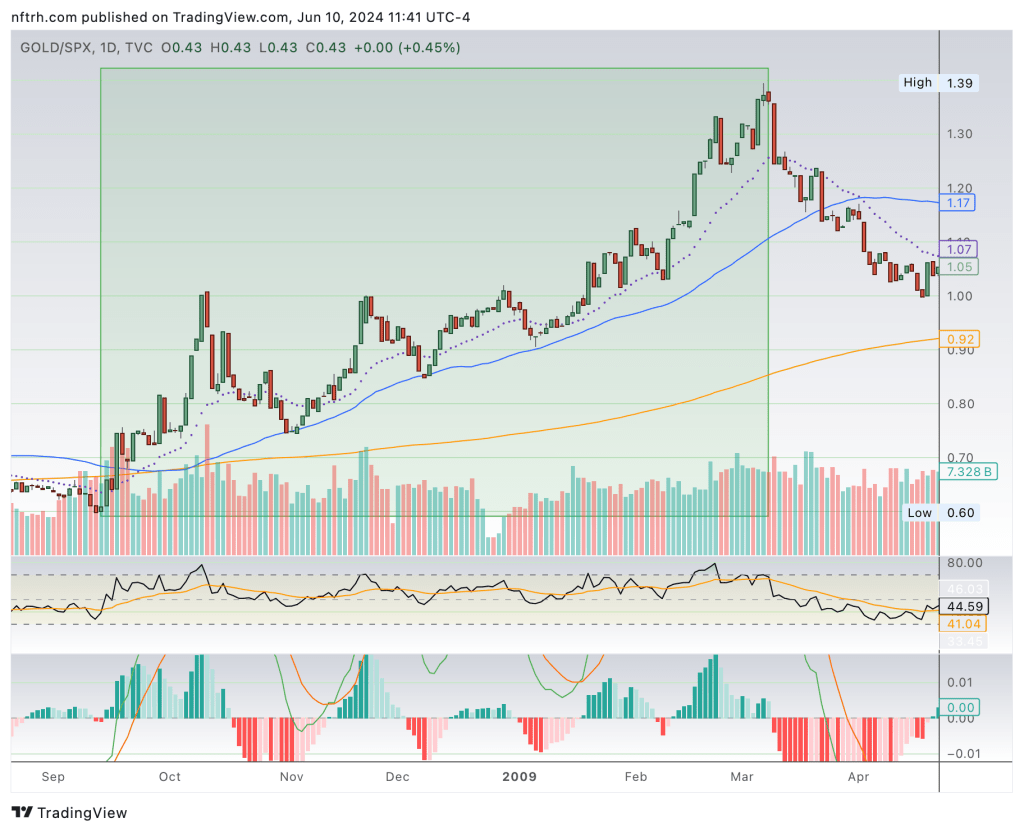

Gold got hammered during Armageddon ’08 (which for stocks, actually extended to Q1, 2009), but in relative terms it rose strongly vs. SPX and rocketed higher vs. cyclical commodities like oil and base metals. It then went on to out and under perform periodically as cyclical inflation manifested out of the 2008 policy panic and subsequent years of Zero Interest Rate Policy (the financial blight known as ZIRP).

But, clearly, history did not teach this lesson to everyone, as many completely ignored what occurred during this timeframe, and again expected gold to save them during the Covid crisis. And, the many that have still not learned this lesson now come back to prognosticate that gold will provide safety in the event the stock market turns down.

What is most interesting is that most of these same folks also maintain a world view that gold will not rally alongside the equity market. In fact, I just read another article which outlined this erroneous commonly held view, and claim surprise when it does rally alongside the equity market.

The point with gold is its relative performance. Nominally, it is going to go up or down as the prevailing winds and varied macro inputs (economic, policy both monetary and fiscal, inflation/deflation, disinflation, psychological/sentiment, etc.) dictate. But the big picture macro is what is important. Where has it been? Where is it going? What is it indicating? As for the “surprise” of gold being correlated with asset markets lately, it is already noted above that gold is either being set up for price pressure when a broad bear market ensues or it is diverging to indicate the new macro.

Mr. A goes on to discuss what I have harped upon for many years, that gold is not usually an effective inflation hedge, at least during the pro-cyclical previous several decades. Let’s not dig that up again. Anyone who bothered to look beyond the standard gold bug dogma already knows that. Let’s however, rebut one final point.

My friends, at some point, one has to open their eyes and look at markets objectively. Gold is not driven by inflation. Nor is it driven by deflation. Nor is it driven by the dollar. Nor does it fall when the equity market rallies or vice versa. Gold is driven by market sentiment. And, it is the only constant in the gold market which allows one to maintain an objective perspective on the price trend in gold, and be able to prognosticate that trend in any reliable and consistent manner.

Gold’s case should not be simplified to only sentiment unless we are discussing the very big macro picture. While sentiment is an important tool in managing an inherently emotional sector like the precious metals, it is far from the only consideration. Mr. A is writing in linear fashion, as if the decades of the Continuum’s downtrend were still intact. The gold market going forward will respond to policy initiatives and constraints, economic acceleration or more likely in the few years ahead, deceleration. Gold market sentiment is a knock on effect of what is already happening. That is what sentiment is, a tail chasing the dog. The dog being macro fundamentals and technicals.

Notice I did not mention war, pestilence (the hard post-pandemic correction for gold was in the bag by mid-2020 due to damaging hype), China/India buying or any of the other common themes put forth as fundamentals for gold? Boiling it down, gold is about policy and sentiment. Aside from being a very long-term holder of real monetary value gold is a barometer to mass confidence or lack thereof in policymakers in government and finance trying to regulate the economy and associated markets to desired and by definition, manipulated ends.

So yes, gold is about sentiment. But it is about big picture sentiment on a societal level. That is why a significant change in the long-term macro is so important. It is going to feed sentiment on a mass scale in the years ahead. My rebuttal seeks to add layers and detail to another analyst’s opinion, rather than express outright criticism.