This week is a pivotal one for GBP/USD and EUR/USD, with political events in the UK and France coupled with significant US economic data releases. Traders should stay alert to developments and be prepared for potential volatility. By the end of the week, the market may reveal clearer trends, providing better trading opportunities.

In addition to political events, key data on the US economic calendar will influence the USD side of the GBP/USD pair. Notable data includes:

- Nonfarm Payrolls (NFP) Report: Expected on Friday, this report is critical for gauging US economic health. The previous month saw a strong print of 272,000 jobs, but this month's forecast is a more modest 190,000.

- FOMC Meeting Minutes: These minutes will offer clues on future monetary policy directions.

It is all about politics in Europe

This week is all about politics in two of Europe’s large economies. We have already seen a bit of a short-lived relief rally in mainland European shares after the National Rally recorded a smaller margin of victory in French elections on Sunday than expected and as mainstream parties began seeking strategies to prevent the far-right party from obtaining an absolute majority.

This will keep the French politics in focus for the rest of the week until the second round of the votes on Sunday. Ahead of that, we will have the UK general election this Thursday, July 4, making the early hours of Friday a super important period for UK assets.

And with key US data to come on either side of the US Independence Day on July 4, currency pairs like the GBP/USD and EUR/USD may well experience heightened volatility. The GBP/USD will be impacted if there is a surprise outcome such as a hung parliament given that a Labour victory is widely expected.

UK General Elections and its impact on GBP/USD

The polling will take place on Thursday, July 4, when the US is out celebrating Independence Day. So, don’t expect any fireworks in the markets on Thursday. Ruling Conservatives are trailing Labour badly in the polls. If Labour does win, it must maintain investors' trust while tackling unresolved economic issues facing the UK, for example, the public debt-to-GDP being at a 63-year high.

It is difficult to see a dramatic turn in the fortunes of the economy. Labour will need to raise taxes or increase borrowing to avoid spending cuts. It is a lose-lose situation, one that markets have accepted. Given that a labour victory is expected, the pound and FTSE could react sharply if there is a surprise outcome such as a hung parliament. From around 10 pm, there will be exit polls to give us an early indication of how the parties have performed, with actual results not out until the early hours of Friday.

NFP among key US data highlights

After Friday’s core PCE price index, which was bang in line with expectations, more key US economic data is to come over the next couple of weeks. The June non-farm jobs report is due on Friday, followed by the CPI on July 11. This week’s other important data releases include the ISM manufacturing and services PMIs, ADP (NASDAQ:ADP) private payrolls, JOLTs job openings, and FOMC minutes.

Of course, the key data is on Friday, when we will have had the UK election outcome as well. The headline jobs data beat expectations last month with a print of 272,000, while wages also grew more than expected. As a result, the US dollar has been supported on the dips and we have recently seen a fresh multi-decade high in USD/JPY.

This week’s data releases could significantly impact the USD direction, which in turn should impact the GBP/USD forecast. After showing surprising resilience throughout this year so far, we could begin to see more weakness in the US economy moving forward. Indeed, economists expect the US jobs report to shown only a modest 190,000 rise in non-farm payrolls compared to 272,000 the month before.

Here’s the full list of key macro events due for release this week, relevant to the GBP/USD forecast.

|

Date |

Time (BST) |

Currency |

Data |

Forecast |

Previous |

|

|

|

|

|

|

|

|

Tue Jul 2 |

2:30pm |

USD |

Fed Chair Powell Speaks |

|

|

|

3:00pm |

USD |

JOLTS Job Openings |

7.86M |

8.06M |

|

|

Wed Jul 3 |

1:15pm |

USD |

ADP Non-Farm Employment Change |

156K |

152K |

|

1:30pm |

USD |

Unemployment Claims |

235K |

233K |

|

|

2:45pm |

USD |

Final Services PMI |

55.0 |

55.1 |

|

|

3:00pm |

USD |

ISM Services PMI |

52.5 |

53.8 |

|

|

7:00pm |

USD |

FOMC Meeting Minutes |

|

|

|

|

Thu Jul 4 |

All Day |

GBP |

Parliamentary Elections |

|

|

|

9:30am |

GBP |

Construction PMI |

54.0 |

54.7 |

|

|

Fri Jul 5 |

1:30pm |

USD |

Average Hourly Earnings m/m |

0.3% |

0.4% |

|

|

USD |

Non-Farm Employment Change |

189K |

272K |

|

|

|

USD |

Unemployment Rate |

4.0% |

4.0% |

GBP/USD technical analysis and trade ideas

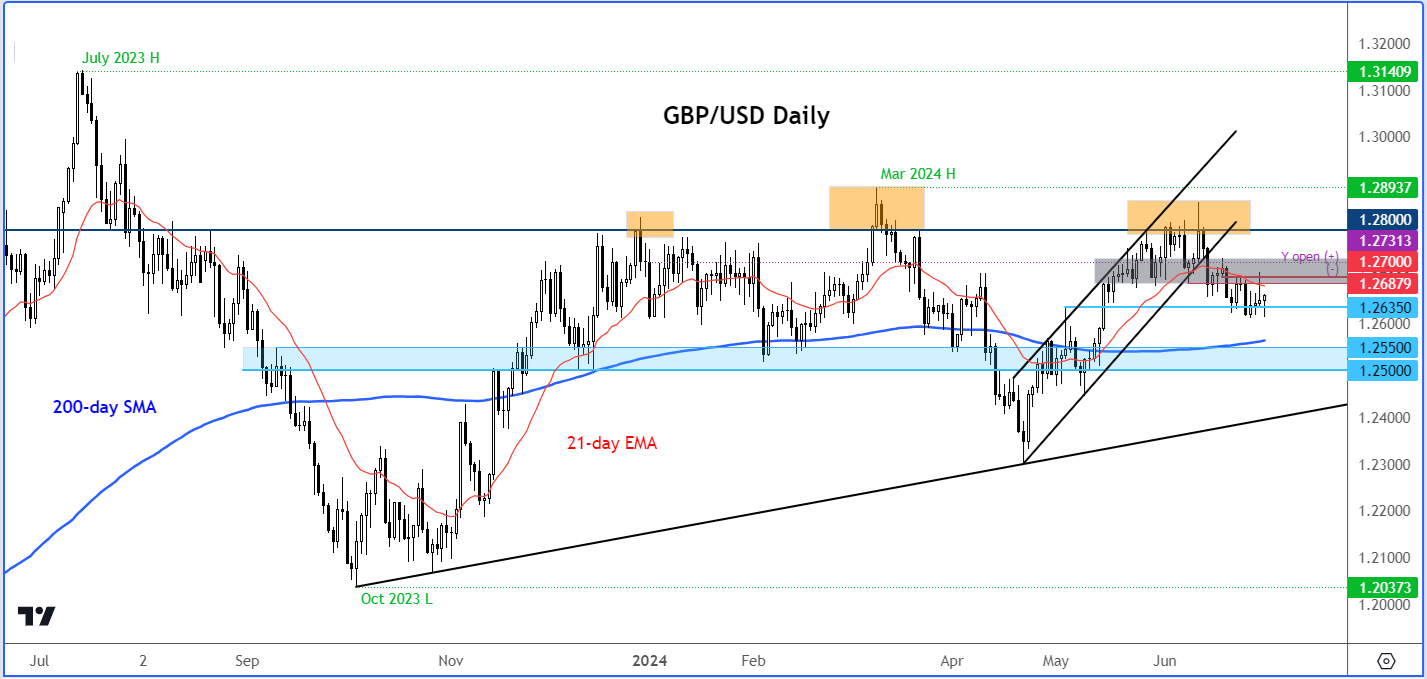

The GBP/USD’s technical outlook is not very clear right now. This is hardly surprising given that many traders are unwilling to commit to a particular direction ahead of the abovementioned macro events coming up in the next couple of weeks.

Recently, the cable came out of its bullish channel, which thereby signaled at least a temporary end of its bullish trend that had been in place since the last week of April.

Source: TradingView.com

Short-term resistance now comes in between the 1.2685 to 1.2730 area (shaded in grey on the chart) which needs to be reclaimed if we are to see another attempt at breaking above that study 1.2800 longer-term resistance area. Support comes in around 1.2635, followed by 1.2550.

The good news is that hopefully by the end of this week, we may have a cleaner trend on the and other major FX pairs, which have been largely in a holding pattern amid the US dollar strength and political uncertainty in Europe.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.