Everyone has been waiting with bated breath to see if Prime Minister May loses her job or manages to get Parliament to support a deal with the European Union. The talks between Trump and Xi are extremely important because the US is widely expected to slap China with another round of tariffs next year so if China wants any chance at avoiding new tariffs, Xi needs to make a deal with Trump. As for the Fed, the big question is whether or not they pause after raising interest rates in December. We will discuss all of this and more but first, let's talk about recent moves.

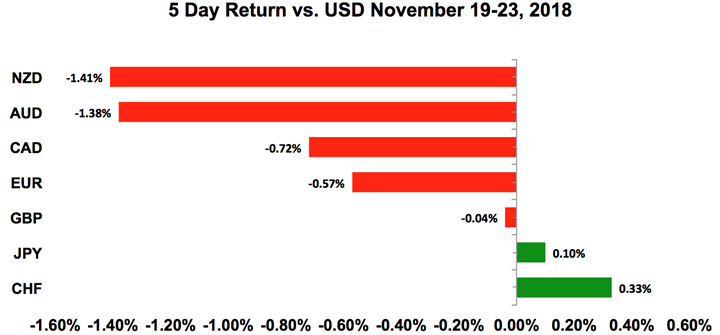

The biggest story last week was the meltdown in equities that spilt over to currencies. US stocks turned negative for the year after erasing all of its gains. This is significant because less than 2 months ago, the S&P 500 was up about 9%. It lost all of that in a matter of a month, recovered briefly and is now back in the red. As a result risk aversion drove all of the major currencies lower against the US dollar. The Canadian dollar was hit the hardest although a large part of that had to do with the decline in oil prices. The Japanese yen and Swiss franc were the best performers, which is natural in a risk-averse environment while the Australian and New Zealand dollars were the worst. Looking ahead, the last week of November brings a renewed focus on Brexit and trade in the lead up to the EU’s Brexit summit and the G20 meeting. There’s also data on the calendar that could be market moving including Germany’s IFO and unemployment reports, the US’ confidence, trade, personal income, personal spending, Q3 GDP revisions, the Fed minutes, New Zealand’s trade balance and Chinese PMIs.

US Dollar

Data Review

- Housing Starts 1.5% vs 2.2% Expected

- Building Permits -0.6% vs -0.8% Expected

- Durable Goods Orders -4.4% vs -2.6% Expected

- Durables Ex Transportation 0.1% vs 0.4% Expected

- Existing Home Sales 1.4% vs 1.0% Expected

- U. of Mich. Sentiment 97.5 vs 98.3 Expected

- U. of Mich. Current Conditions 112.3 vs 113.2 Prior

- U. of Mich. Expectations 88.1 vs 88.7 Prior

- Manufacturing PMI 55.4 vs 55.8 Expected

- Services PMI 54.4 vs 55.0 Expected

- Composite PMI 54.4 vs 54.9 Prior

Data Preview

- Consumer Confidence - Potential for downside surprise given that stocks declined & University of Michigan Sentiment index fell

- Advance Goods Trade Balance and Annualized GDP - Potential for downside surprise in trade given lower ISM manufacturing but GDP revisions are hard to predict

- New Home Sales - Potential for upside surprise given stronger existing home sales

- Personal Income, Personal Spending and PCE Deflator - Potential for upside surprise given stronger spending and decent wage growth

- FOMC Meeting Minutes - Likely to be hawkish but we do not trade minutes

- Chicago PMI - Potential for downside surprise given stronger Empire State but Philly Fed was weaker

Key Levels

- Support 112.00

- Resistance 114.00

Fed – Shaping Up For An Early 2019 Pause?

Starting with the US dollar, there’s been some upside surprises in US data but mostly disappointments. This included the NAHB housing market index, which measures builder confidence, building permits, durable goods, jobless claims and the University of Michigan Consumer Sentiment index. While none of these reports affects the Fed’s outlook enough to cast doubt on a December rate, they are certainly giving the central bank reason to start downplaying additional tightening next year. There’s no question that the Fed will continue to normalize monetary policy but the case is building for an early 2019 pause. Some economists argue that the central bank will take a break from rate hikes immediately after the December move while others are calling for a spring pause. Regardless, data, cautionary comments from US policymakers and the sell-off in stocks that could curtail business investment and hiring are all reasons why the Fed could pause. The Fed fund futures strip show the central bank keeping rates steady after their December hike which means that Fed and Chairman Powell could have a less hawkish tone in December. We’ve already seen evidence of that in Powell’s recent comments on global headwinds but his concerns could turn domestic in December. While important, the Fed’s bias should be less of a focus this coming week than Brexit and the G20.

Euro

Data Review

- EZ Current Account 17b vs 23.9b Prior

- GE PPI 0.3% vs 0.3% Expected

- EZ Consumer Confidence -3.9 vs -3.0 Expected

- GE GDP (QoQ)-0.2% vs -0.2% Expected

- GE Manufacturing PMI 51.6 vs 52.2. Expected

- GE Services PMI 53.3 vs 54.5 Expected

- GE Composite PMI 52.2 vs 53.1 Expected

- EZ Manufacturing PMI 51.5 vs 52.0 Expected

- EZ Services PMI 53.1 vs 53.6 Expected

- EZ Composite PMI 52.4 vs 53 Expected

Data Preview

- GE IFO Report - Potential for downside surprise given lower ZEW and PMIs

- GE Unemployment Change and Unemployment Claims - Potential for downside surprise as PMIs report the lowest level of employment growth since May

- EZ Consumer Confidence – Will have to see how Ifo & GfK fares but ZEW was lower

- GE CPI - Weaker euro is inflationary but oil prices tumbled quite a bit

- EZ Unemployment Rate and CPI Core - Will have to see how German labour data and CPI fares

Key Levels

- Support 1.1300

- Resistance 1.1500

Italy And Growth Means Double Trouble For Euro

Meanwhile, Italy’s troubles continue to plague the euro. Last week, the European Commission opened disciplinary measures against Italy for refusing to submit a budget proposal that complies with their rules. EU member states have 2 weeks to agree with the EC’s decision to begin the Excessive Deficit Procedure (EDP) and if they do, the EC will give Italy the opportunity to prepare a response on how they will rein their deficit in and bring it back into compliance with EU rules. If their response is unsatisfactory, they could be slapped with sanctions. Unfortunately, it seems like Italy is prepared for the clash with the EU because a day after disciplinary procedures were opened, Italian Deputy Prime Minister Matteo Salvani said “We will not take a backward step, we are not spending this money at random. The idea is for Italy to grow.” Between Italy’s political troubles and weaker Eurozone growth, any recovery in EUR/USD should be limited to the 100-day SMA near 1.1550. As indicated by last week’s PMI reports, the Eurozone economy is slowing with German, French and Eurozone PMIs falling sharply in the month of November. German manufacturing activity, in particular, grew at its weakest pace since 2014. Therefore this week’s German IFO, unemployment and CPI reports should be softer, reinforcing the trend of weaker growth. Although the ECB will proceed with its plan to end asset purchases this year, further steps to normalize monetary policy could be delayed by the deterioration in data, decline in oil and meltdown in global equities. They could even lower their economic projections at the next policy meeting.

British Pound

Data Review

- Rightmove House Prices -1.7% vs 1.0% Prior

- PSNB Ex Banking Groups 8.8b vs 6.2b Expected

- PSNB 7.95b vs 5.6b Expected

Data Preview

- Mortgage Approvals - Potential for downside surprise as housing activity likely to slow further on Brexit uncertainty

Key Levels

- Support 1.2700

- Resistance 1.3000

Brexit – What Will The EU And UK Parliament Do?

With European leaders scheduled to hold a special Brexit summit on Sunday, by the time the forex market reopens, we should know if the meeting went well. Earlier in the week, sterling popped after Prime Minister May managed to secure a deal with the European Union but the agreement does not resolve many of the major issues that put the deal at risk. For the EU, Gibraltar, the Irish backstop and fishing rights are lingering problems that could scuttle the deal. Spain made it clear that they will reject any agreement that leaves them out of talks involving the status of Gibraltar. Now the UK needs a majority (not all) of the 27 member states to support the agreement but given Spain’s role, the agreement will most likely be amended which could lead to further back and forth to satisfy their concerns. For the UK, even if EU leaders approve the agreement, Prime Minister May still needs to sell it to Parliament. She needs 320 votes to pass a deal and there are 650 seats in Parliament. She should have at least 316 conservative votes but there’s almost no chance that she’ll get any of the 10 DUP votes so her job will be to convince members of the opposition Labor party to support her deal. It will be an uphill battle because Labor thinks most of their members will reject her agreement but there are Labor rebels and Brexit supporters who could be swayed. What this means is that even if the EU approves the Brexit agreement over the weekend and we think they will, GBP/USD will rally but beware of jumping in too quickly because the big battle will be Parliament.

AUD, NZD, CAD

Data Review

Australia

- RBA Meeting Minutes Show a Neutral Tone

- CBA PMI Manufacturing 54.5 vs54.5 Prior

- CBA PMI Services 52.6 vs 51.7 Prior

- CBA PMI Composite 52.9 vs 52.0 Prior

New Zealand

- Performance Services Index 55.4 vs 54.2 Prior

- PPI Output (QoQ) 1.5% vs 0.9% Prior

- PPI Input (QoQ) 1.4% vs1.0% Prior

- GDT Prices Drop 3.5%

Canada

- Wholesale Trade Sales -0.5% vs 0.3% Expected

- Retail Sales 0.2% vs 0.0% Expected

- Retail Sales Ex-Autos 0.1% vs 0.3% Expected

- CPI 0.1% vs 0.3% Expected

Data Preview

Australia

- CH Manufacturing, Non-Manufacturing PMI and Composite PMI - Chinese data is very market moving but hard to predict

New Zealand

- Trade Balance - Potential for upside surprise given stronger manufacturing activity which should equate to a stronger trade

Canada

- Current Account Balance - Potential for upside surprise given a sharp improvement in trade

- GDP - Potential for downside surprise given a sharp improvement in trade, slightly worse retail sales for the quarter

Key Levels

- Support AUD .7200 NZD .6700 CAD 1.3100

- Resistance AUD .7300 NZD .6900 CAD 1.3300

AUD – Don’t Expect Much from Trump-Xi Meeting

All three of the commodity currencies traded lower against the greenback last week with the Australian dollar leading the slide. There’s a lot riding on US President Trump and US President Xi’s meeting at the end of the month but we have every reason to believe that it will be a disappointment. Trump believes that Xi, who wants to avoid a third round of tariffs is desperate for deal and Xi probably doesn’t trust that the US is willing to make an agreement that works for both sides. In the lead up to the meeting, the US has accused China of stepping up its hacking of American companies to steal their intellectual property. Pence and Xi also had serious disagreements at the recent APEC meeting that resulted in no release of a final statement for the first time in its 24-year history. The only good news is that White House Trade Advisor Navarro, who has been a key architect in the trade war has been excluded out of Trump-Xi dinner in what White House chief economic adviser Larry Kudlow described as an attempt to inject a note of optimism. For Australia who has no major economic reports scheduled for release next week, China-US trade relations will be the main focus. Technically with AUD/USD trading above the 20-day SMA, we still see some upside bias in the pair.

No Relief For NZD Dairy Prices

The New Zealand dollar, on the other hand, is weaker as the pair finds resistance underneath the 200-day SMA. Fundamentally, the latest economic reports were mixed. Service sector activity and producer prices are on the rise but dairy prices continued to fall and credit card spending contracted in the month of October. With the 3.5% decline, dairy prices have officially entered a bear market. As one of New Zealand’s biggest industries, it is hard to see the currency rising further without a recovery in dairy. With that in mind, October trade data could still be good because of the weakness in NZD/USD last month and an uptick in manufacturing activity.

CAD Suppressed By Oil

Last but not least, the Canadian dollar has been hit hard by the decline in oil prices. Since peaking in the beginning of October, the price of crude has fallen more than 30% with prices dropping to a fresh 1 year low last week. The problem is even more severe for Canada because Western Canada Select, the primary blend sold by Alberta’s oil sands closed at their lowest level in a decade. Weakening demand combined with new oil sands projects compounded the problem for Canada and with each passing day, the pressure grows. If this trend continues, it will be very difficult for the Bank of Canada to raise interest rates even if next week’s monthly and quarterly GDP numbers surprise to the upside. The latest Canadian retail sales and inflation numbers were mixed – while CPI and headline retail sales rose more than expected, core spending growth missed expectations. So instead of strengthening, the Canadian dollar weakened after the release with USD/CAD ending Friday sharply higher.