This article was written exclusively for Investing.com

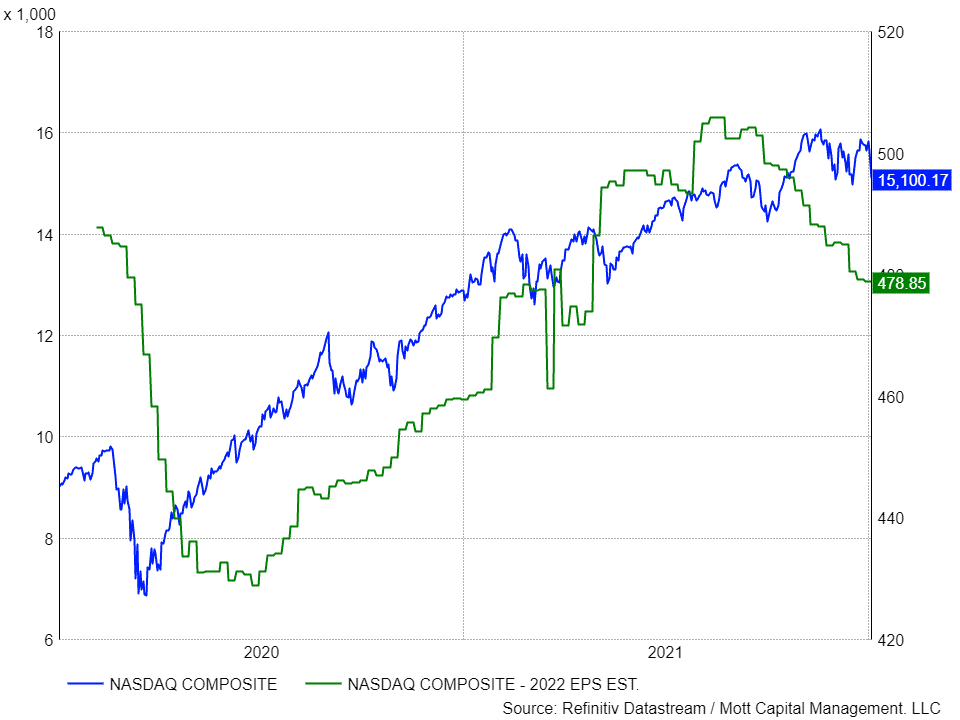

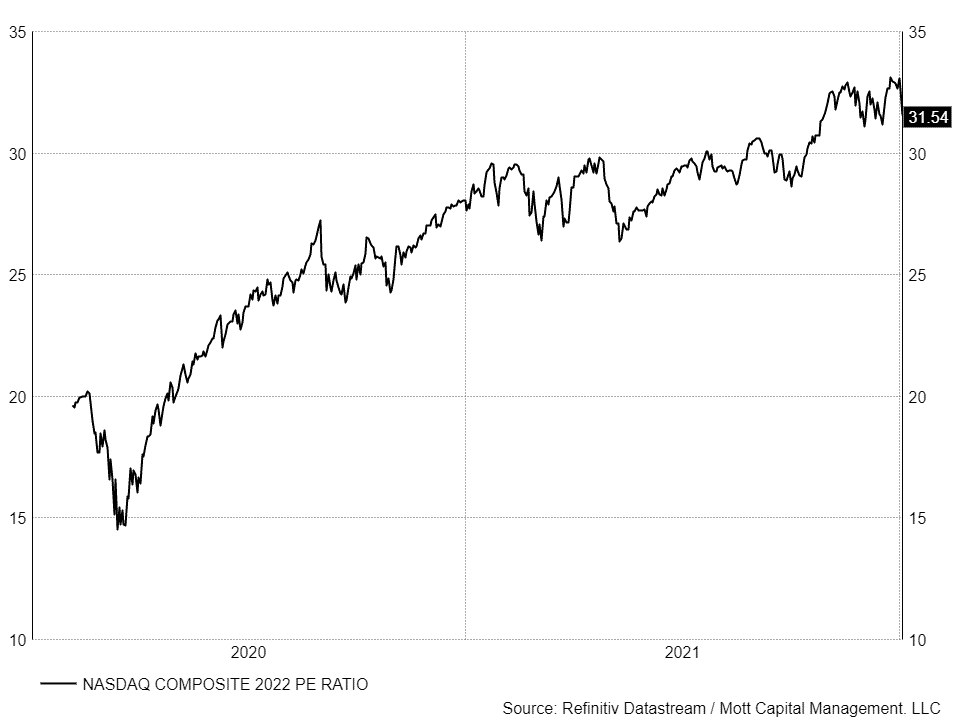

Since the end of September, a considerable divergence has occurred in the NASDAQ Composite. The index has rocketed higher, while earnings estimates for 2022 and 2023 have been moving sharply lower. This divergence has led to the Price-to-Earnings ratio for the NASDAQ to rise to its highest levels over the past year.

The fall in earnings estimates and rising PE ratio places the NASDAQ in a precarious spot as it could result in the index dropping by an additional 10%. What makes the next couple of weeks even trickier is that we are now entering the period just before earnings season when we typically see sell-side analysts update their rating and price targets on individual companies, which could add further pressure to NASDAQ earnings already trending lower.

Falling Earnings Estimates

For now, the NASDAQ is trading with a PE ratio of around 31.5 times 2022 earnings estimates of $478.85. That PE ratio is up from approximately 28.6 at the beginning of October. Meanwhile, earnings estimates have fallen from a peak of $505.82 at the end of August, a decline of 5.3%.

Should the earnings multiple move lower and in line with the falling earnings estimates and return to previous levels of around 28.6, it would result in the NASDAQ composite falling back to 13,695, a decline of almost 10% from its closing level on Jan. 5. That’s assuming that earnings estimates do not continue to decline, of course. If earnings estimates were to decrease, it would start a painful process, with the index needing to drop even more to see the PE ratio begin to contract.

Entering Earnings Season

Unfortunately, as we enter earnings season, we are likely to see sell-side analysts begin to update their models and, as a result, their ratings and price targets. That could lead to earnings estimates falling even further should analysts begin to downgrade their expectations.

That process may have already started when UBS came out recently and made two significant downgrades on Adobe (NASDAQ:ADBE) and Salesforce (NYSE:CRM), citing slower growth and the pull-forward of sales. With these being two of the biggest technology companies around, it raises eyebrows that perhaps other companies may experience the same type of commentary with more downgrades from other sell-side analysts still to come.

The Hawkish Fed

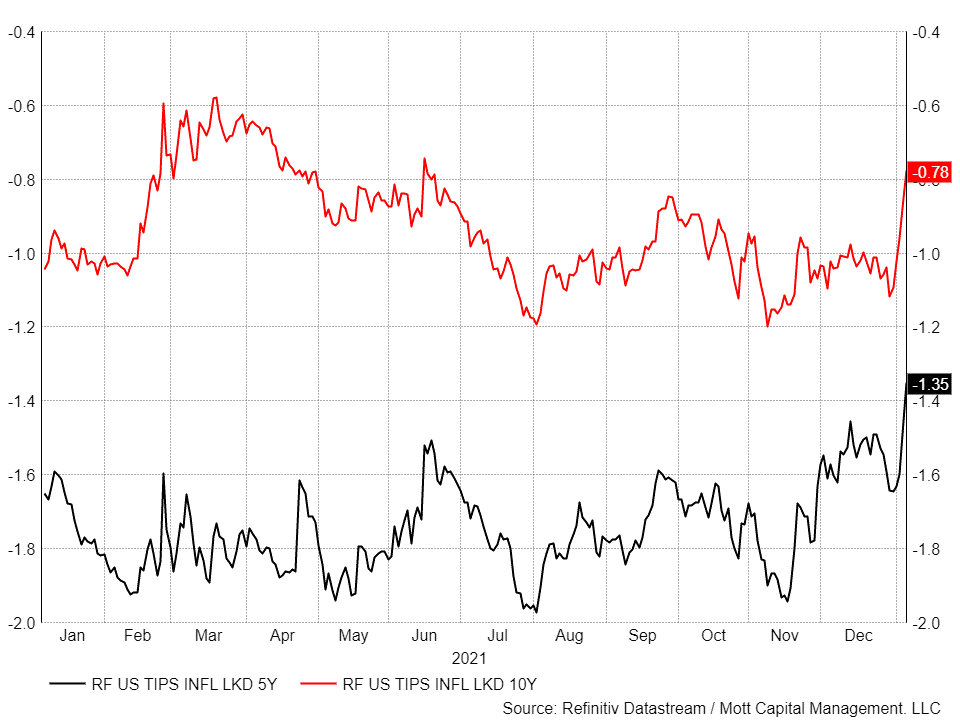

What makes all of this even more complex is the Fed and its plans to end QE, raise rates, and perhaps start the process of reducing the balance sheet. The latest FOMC minutes from the December meeting revealed that the process might begin much sooner than previously expected. It has sent nominal and real yields sharply higher, creating a massive blow to the bullish narrative predicated on the low-rate story, which helped fuel the overly exuberant rise in many technology and growth stocks that the NASDAQ Composite encompasses.

However, the timing of this is not ideal, with everything coming together potentially all at the wrong time with the Fed getting more hawkish, putting upward pressure on rates and the potential for further downward revisions on earnings estimates, leading to PE multiple compression. It is likely to make life difficult for the NASDAQ Composite and the entire stock market as it tries to navigate these turbulent shifts in monetary policy, high multiples, and falling earnings expectations.

2022 is likely to be a very different year than 2021, and probably not in a good way. When these many changes are happening at one time in the market, it tends to increase volatility, which may lead to much lower prices in the process.