By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

Who would have thought that Prime Minister May’s plans for a hard exit from the European Union would trigger the strongest one-day rally for the sterling versus the U.S. dollar since 2008?

She said a lot in her Tuesday-morning speech but at the end of the day, there were 4 main takeaways:

- Britain is not seeking partial membership of EU: No Half In, Half Out

- May won’t be proposing membership in the EU Single Market

- Government will put final deal to vote in Parliament

- May will seek to avoid a disruptive Brexit cliff edge -- will aim for Phased Transition

The first two present serious issues for the U.K. economy. A clean break from the European Union without single-market access means new trade agreements will need to be made between the U.K. and its most important trading partners. This raises the question of whether the country would be given any preferential trade access, especially as EU nations may seek to discourage other immigration restrictions and avoid encouraging future departures. A hard exit poses significant risks to U.K. jobs, investment, spending and the economy with immigration restrictions alone estimated to shave 0.4% off GDP growth. In the best-case scenario, we see the U.K. economy growing by 1.3% this year and in the worst case, there could be a contraction.

But none of that mattered Tuesday as GBP/USD squeezed above 1.24. There’s no question that short covering played a big role in the currency pair’s reversal because a hard exit has little positive ramifications for the U.K. economy. Yet uncertainty breeds volatility and while we definitely saw vol spike Tuesday in the pound, market participants were happy to see a clear path forward. They also cheered the news that the government will put the final deal to vote in Parliament and that it will strive for a phased transition that would limit the inevitable damage on the economy and the market. At this stage, its almost certain that the U.K. Supreme court will vote in favor of Parliament’s approval in triggering Article 50, which could take GBP/USD to 1.25. But as the reality of a hard exit sets in, sellers will return. This week’s U.K. economic reports support the rally in sterling with cpi rising strongly in December. Wednesday’s labor-market report is also expected to show firm job growth but the focus will be on wages.

Here in the U.S., politics also overshadowed economics with the dollar tanking after a senior adviser to U.S. President-elect Donald Trump warned that the strengthening dollar will be “the biggest challenge” for the economic outlook over the coming year. It is hard for us to believe that this will translate into official criticism of the rising currency by the new president after he takes office on Friday. However the drop in U.S. rates and the slide in the dollar certainly reflect a worry that has been validated by the lower Empire State manufacturing index. Yet U.S. policymakers continue to talk about the need for higher interest rates. We heard from FOMC voters Dudley and Brainard on Tuesday -- two doves who are optimistic about the economic outlook with the more cautious Brainard saying rates may need to rise faster if fiscal policy shrinks fast. After 7 days of losses in USD/JPY, we believe that the consistent optimism from Fed officials should help the currency pair find support near 112.

The euro also traded extremely well versus the U.S. dollar, gaining over 1%. The rally was supported by stronger-than-expected Eurozone data. Thanks to the weakness of the currency and improvements in the economy, investor confidence rose strongly in January. While the expectations component of the German ZEW survey fell short of forecast, it was still firmly higher than the previous month with upside beats seen in the current conditions report. Also, the broader Eurozone ZEW survey expectations rose to 23.2 from 18.1, which is the highest level since December 2015. This means that investors have not been this optimistic about the Eurozone economy in over a year. On Wednesday, Eurozone consumer prices are scheduled for release and given the jump in German and French CPI, a sharp increase in the regional report is anticipated.

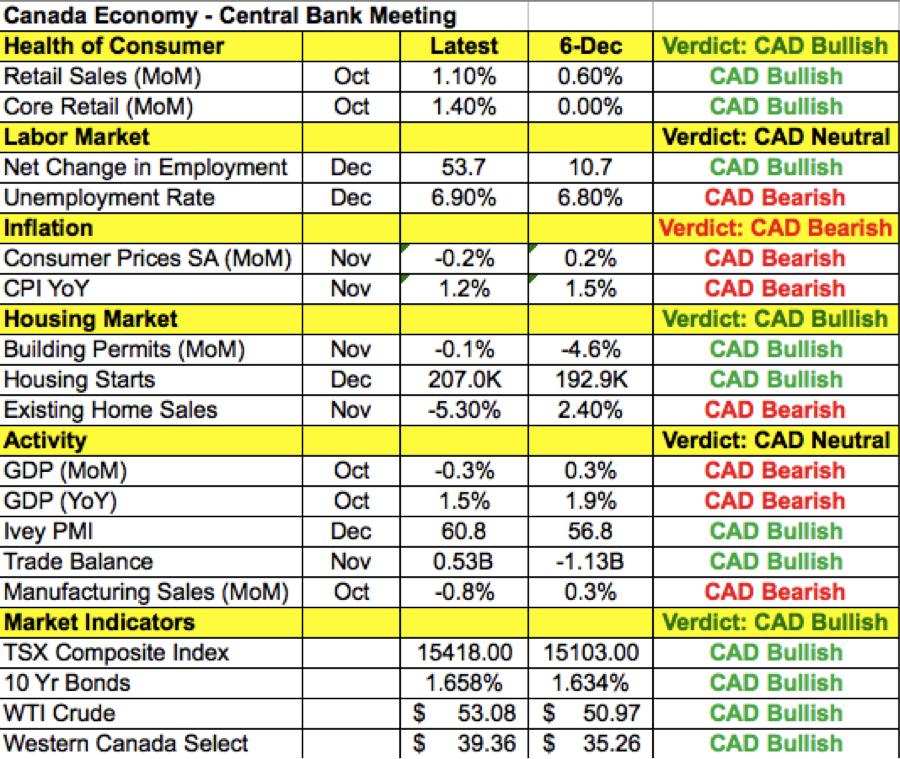

All three of the commodity currencies traded higher against the greenback with the New Zealand dollar leading the gains. NZD benefitted the most as dairy prices increased 0.6% in January. This rise comes after a 3.9% drop at the beginning of the year and a 0.5% drop in late December. The recent trend of softer New Zealand data and lower oil prices has weighed heavily on the currency and Tuesday’s data was the first time since November that prices did not grow at a slower pace, which was enough for NZD traders to rejoice. The Australian dollar was propelled higher by another 1% rally in gold prices. Oil on the other hand barely budged, but that did not stop Canadian dollar traders from buying loonies ahead of the Bank of Canada’s rate decision. When the BoC last met in December, it maintained a firmly neutral monetary policy bias. BoC said the dynamics of Canada’s growth were largely as anticipated and that the current monetary policy stance was appropriate. Since then, data has been mostly better with retail sales, trade, employment and the IVEY PMI index rising. However consumer price growth has eased and CAD's recent rise could put further downward pressure on prices. The Canadians are also nervous about Trump’s plans to renegotiate NAFTA. So we’ll have to see if that affects the central bank’s views. The following table shows how Canada’s economy changed since BoC's last monetary policy meeting.