By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

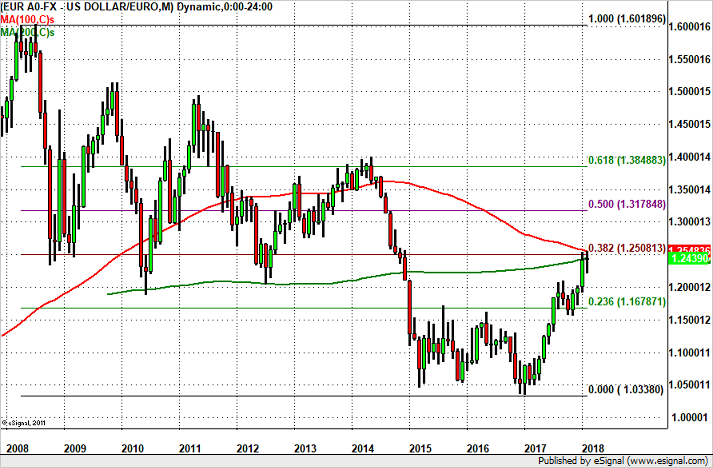

EUR/USD had a great run this past week but the sell-off on Friday screams of a deeper reversal. Technically, the rally stopped just short of the 100- and 200-month simple moving averages near 1.2550. These are significant resistance levels that would be the perfect points for reversal. Technically, we see reasons for a near-term recovery in the U.S. dollar but fundamentally there are plenty of reasons supporting the euro's rise. The latest Eurozone economic reports show ongoing strength in the Eurozone economy. The European Central Bank is optimistic with members like Benoit Coeure saying the central bank will discuss changes to its policy language in early 2018. There's no doubt that the positive momentum in the economy has ECB officials thinking about normalizing monetary policy and they could make the move as early as next month. This would be irrespective of how next week's economic reports fare. EUR/USD will be in focus with a number of market-moving data scheduled for release including the ZEW survey, February PMIs and the German IFO report. So even if EUR/USD dips, we expect buyers between 1.2250 and 1.2375.

Next week's U.S. economic reports could help seal the deal. Although the latest U.S. report show American pocketbooks being pinched by rising prices - inflation increased 0.5% in January while retail sales fell -0.3%, this will not stop the Federal Reserve from raising interest rates next month. Despite this week's softer spending report, Fed-fund futures are pricing in a 100% chance of tightening in March. Next week's FOMC minutes will reinforce those expectations as the central bank upgraded its inflation outlook and touted improvements in the economy at its last meeting. Existing-home sales should also recover after falling at the end of last year but before getting too excited about a full-fledged dollar recovery, investors should watch U.S. yields carefully because they continue to pose a serious danger to the markets and the economy. If they peak at 2.91%, we should see a stronger recovery in USD/JPY, risk appetite and stocks but if 10-year rates head toward 3%, sellers will return. Although Friday's price action suggests that investors are not entirely convinced that USD/JPY deserves to rise, between the move in U.S. equities and Treasuries and the presence of the 200-month simple moving average at 105.60, USD/JPY should recover in the coming week.

Meanwhile a series of softer economic reports did not stop the British pound from participating in the risk-recovery rally. Inflation is lower, retail sales growth slowed and there's been zero progress on Brexit negotiations. Sterling should be trading much lower given these latest developments but investors are still hopeful that the central bank will raise interest rates later this year. Despite the European Union's resistance, we continue to believe that a Brexit deal will be done but if Wednesday's labor-market report shows a significant slowdown in wage growth, we could see a sharp pullback in the British pound. According to the PMIs, the labor market continued to improve at the start of the year but wage growth has also been very firm and a pullback would overshadow the claimant count.

All three commodity currencies traded higher against the greenback with the New Zealand dollar leading the gains. NZD was the best-performing currency behind the Japanese yen and is trading at a 6-month high versus the U.S. dollar. While better-than-expected economic data played a big role in this week's outperformance, the New Zealand dollar was also one of the most resilient currencies when stocks tumbled. According to the latest reports, manufacturing activity accelerated in January, house sales increased along with inflation expectations and food prices. Producer prices and retail sales are due for release next week, which leaves the New Zealand dollar in play. The Australian dollar also had a nice run despite slightly weaker labor data. Although the increase in job growth was in line with expectations, full-time jobs declined for the first time in 6 months. It was bound to happen but if it continues it could be a big problem because consumer confidence is already falling. The minutes from the last RBA meeting will be the main focus. Having heard from RBA Governor Lowe, we know that they are not extremely concerned about the level of the currency. Although consumer spending remains uncertain and they believe the next move in rates will be higher, they don't see a compelling reason to change policy in the near term. Last but certainly not least, the Canadian dollar benefitted the least from the risk rally. Although oil prices rebounded, existing-home sales and manufacturing sales were weaker than expected. However these reports are not significant enough to explain the currency's underperformance. Instead, investors are still hopeful that Canada's economy is going strong and we're set to learn if that's true with retail sales and consumer prices scheduled for release.