It was an earlier-than-expected but welcome rally that closed the week out with indexes exhibiting bullish technicals and looking in good shape, even if it's a bit of a slow burn.

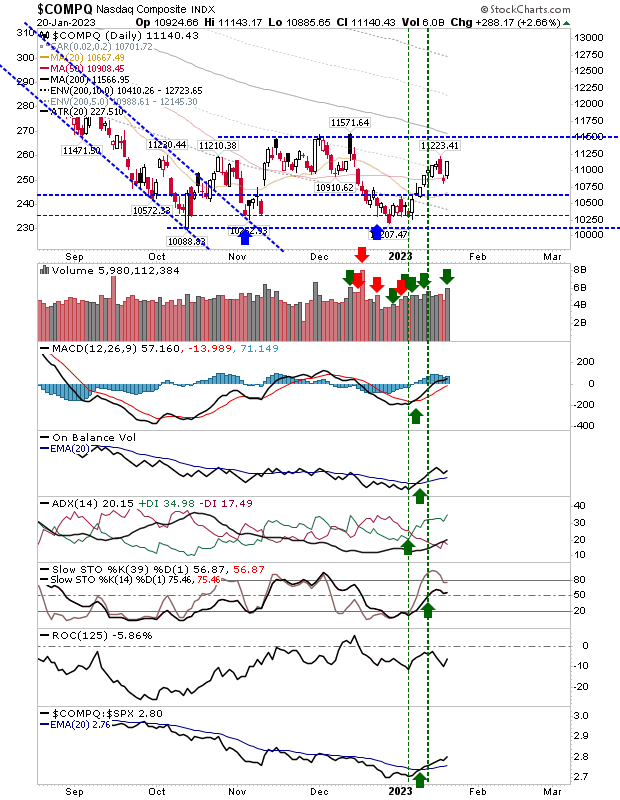

The Nasdaq 100 has yet to challenge the December highs and the 200-day MA, but the index is accelerating its relative outperformance to the S&P 500, with on-balance-volume trending higher. Buying volume registered as accumulation, and while it hasn't knocked out last week's swing high, it should do so this week and build on a challenge of 11,500.

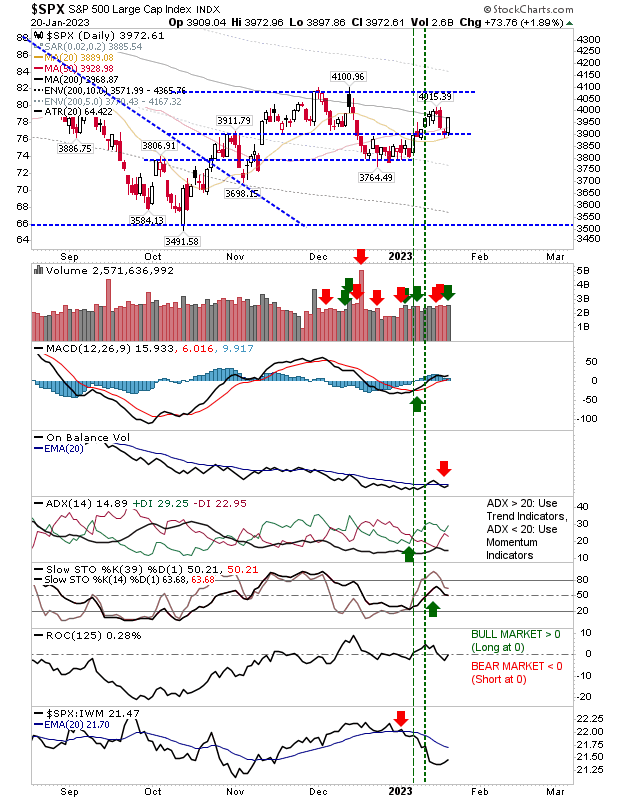

The S&P 500 bounced off the 20-day MA, finishing at its 200-day MA. Despite this, the index could register an accumulation day as it held mid-line stochastic support. It still has work to do to regain the lost relative performance against the Russell 2000, but the 'sell' trigger in On-Balance-Volume could be reversed early next week.

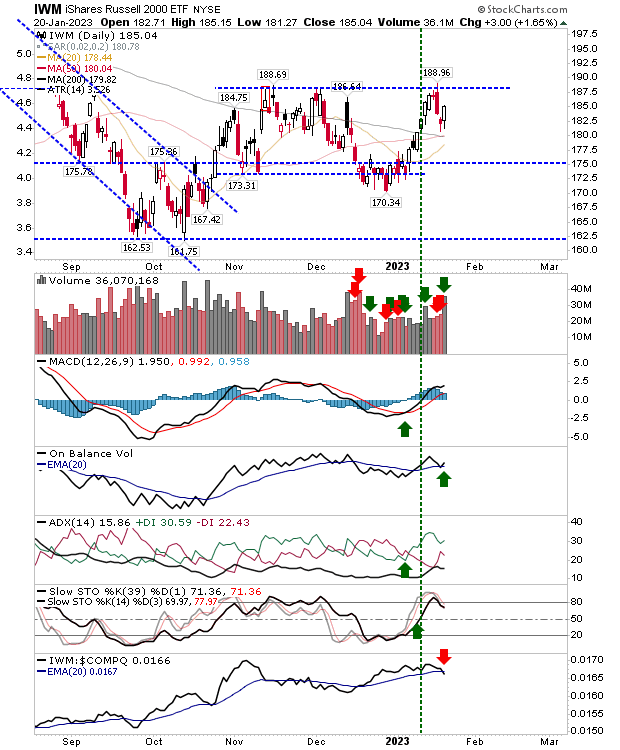

The Russell 2000 is again becoming an index of interest. Friday's gain came after strong accumulation, which included an uptick in On-Balance-Volume but a disappointing downtick in relative performance. However, unlike the S&P 500 and Nasdaq, it's above all key moving averages with a pending 'golden cross' between the 50-day MA and 200-day MA.

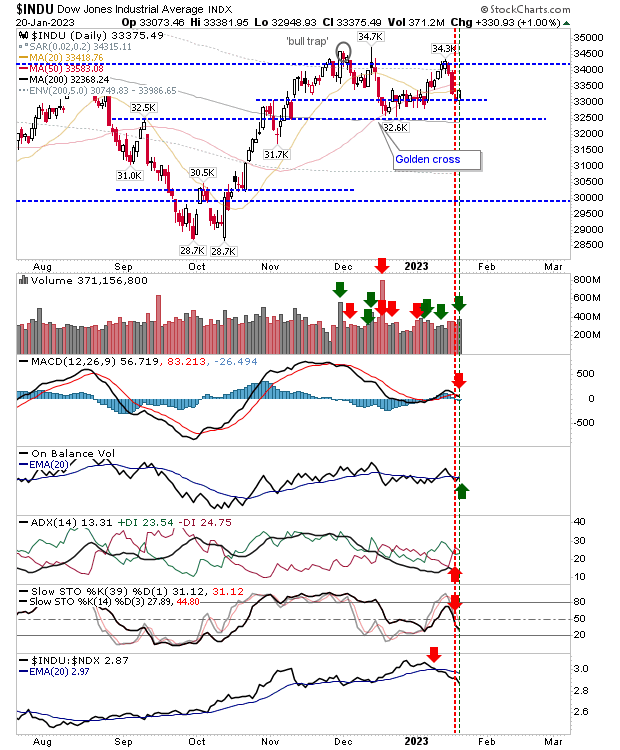

The Dow Jones has returned to a support level near December's congestion after challenging highs. As with the aforementioned indexes, it registered an accumulation day, but technicals have turned more mixed - this could stall a breakout to new highs, taking longer than could have otherwise been expected. With the improvement in the Russell 2000, we could find this index back on the back burner. However, if you want to buy, now is not a bad time.

It's amazing what one day of good (or bad) trading can do to markets. With indexes protected by recent swing highs, there won't be too many algo systems acting on Friday's action, but Friday was a marker for a more bullish setup. The Russell 2000 has the best setup, using the 'golden cross' to measure risk.