Another quarter down and the run into Christmas is now in sight! While not the greatest result overall for stock indices, the day traders were thrown a bone overnight with some nice little rallies in both Europe and the US.

The rallies were more to do with end of quarter position squaring after a period of sustained selling than any fundamentals, although the month’s ADP employment report beating expectations did give the markets hope for Friday’s NFP number.

“USD ADP Non-Farm Employment Change (200K v 192K expected)”

The close in Frankfurt saw the DAX end over 2% higher.

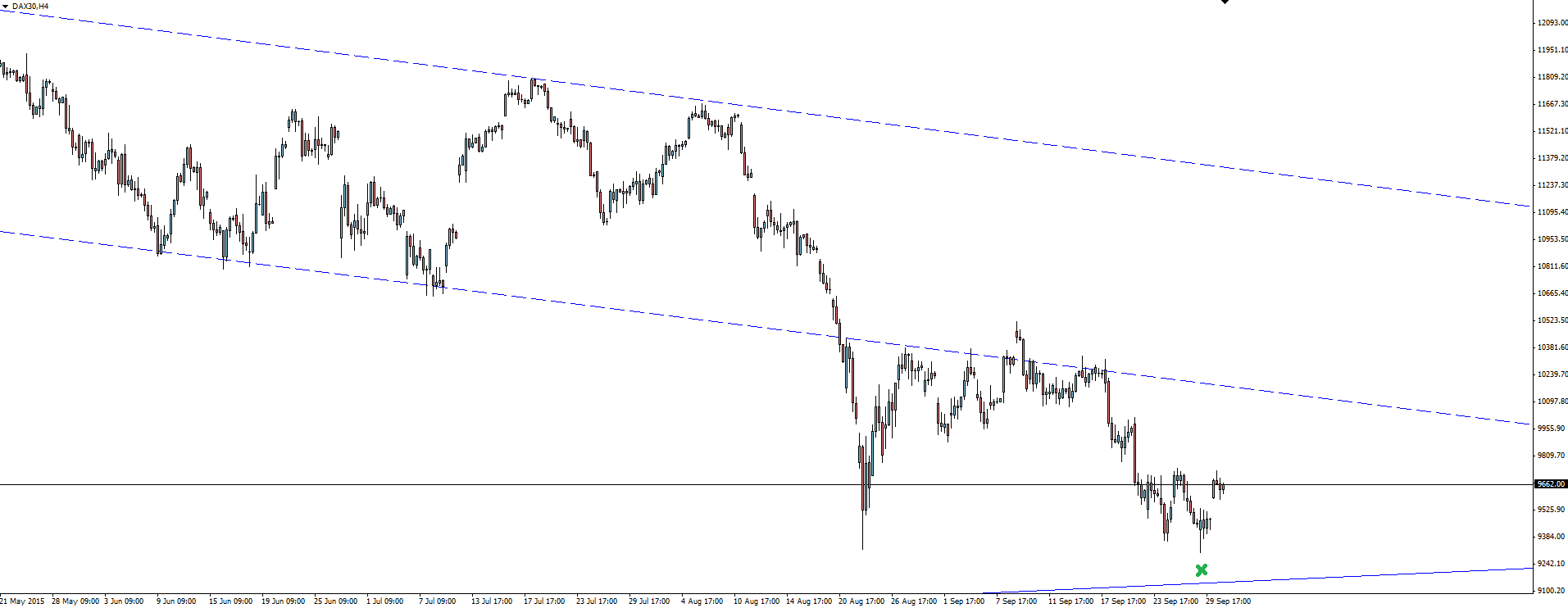

DAX 4 Hourly:

The DAX weekly trend line that we highlighted in last week’s Technical Analysis post, is holding strong and another reason to show some bullish optimism in indices if you’re looking for a turn.

Likewise across the Atlantic, the S&P 500 rallied solidly through yesterday’s trading session, closing above the 1900 psych level that if zoomed into the 15 minute chart, you can see was a level of interest for traders on the day.

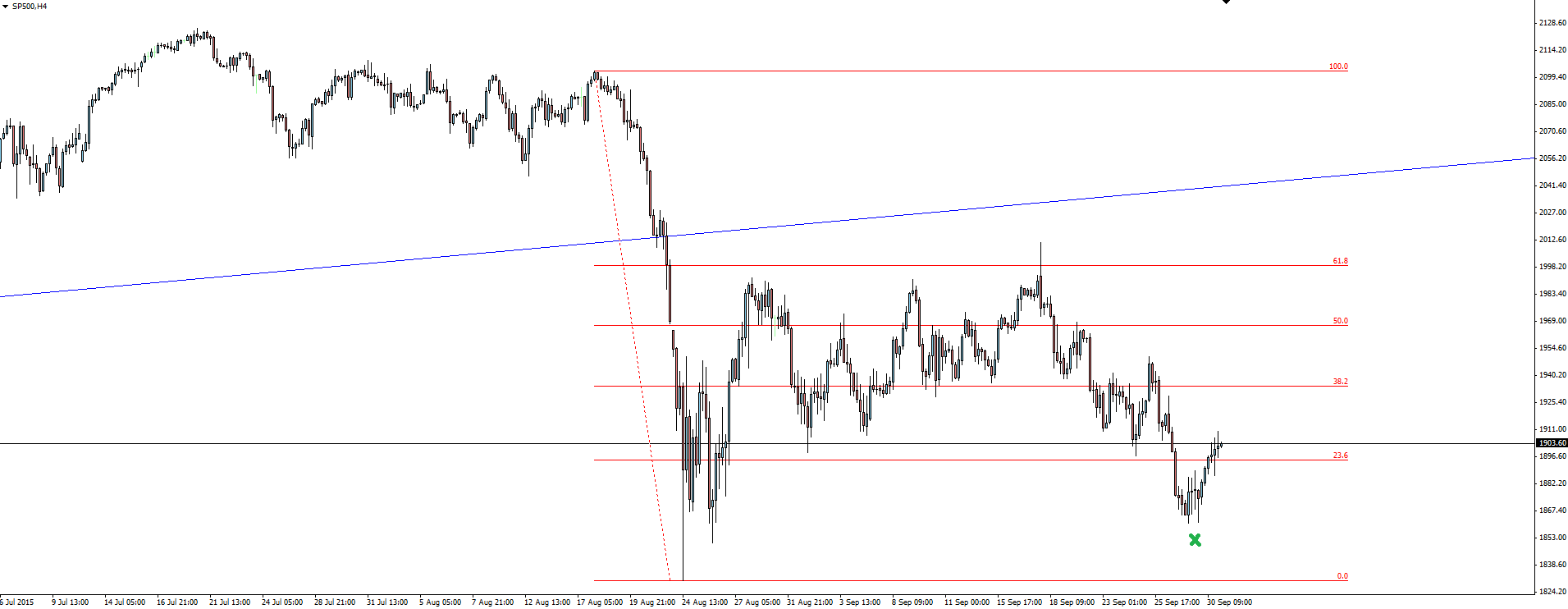

SP500 4 Hourly:

I’m leaving those Fib levels on the chart from the Black Monday drop until price makes a new high/low.

Just be aware that the end of quarter position squaring has distorted both markets that are still full of negative fundamental sentiment. It might not yet be time to stick out your hand and try to catch the falling knife but Indices trading on MT4 is another string you should definitely add to your bow.

On the Calendar Thursday:

Just keep in mind that even though we see major manufacturing data released, China will actually be closed today through to next Thursday in celebration of their National Day.

“The National Day of the People’s Republic of China (Chinese: 国庆节; pinyin: Guóqìng jié) is a public holiday in the People’s Republic of China to celebrate their national day.”

“The PRC was founded on October 1, 1949 with a ceremony at Tiananmen Square. The Central People’s Government passed the Resolution on the National Day of the People’s Republic of China on December 2, 1949 and declared that October 1 is the National Day.”

CNY: Bank Holiday

CNY: Manufacturing PMI

CNY: Caixin Final Manufacturing PMI

GBP: Manufacturing PMI

USD: Unemployment Claims

USD: ISM Manufacturing PMI

Chart of the Day:

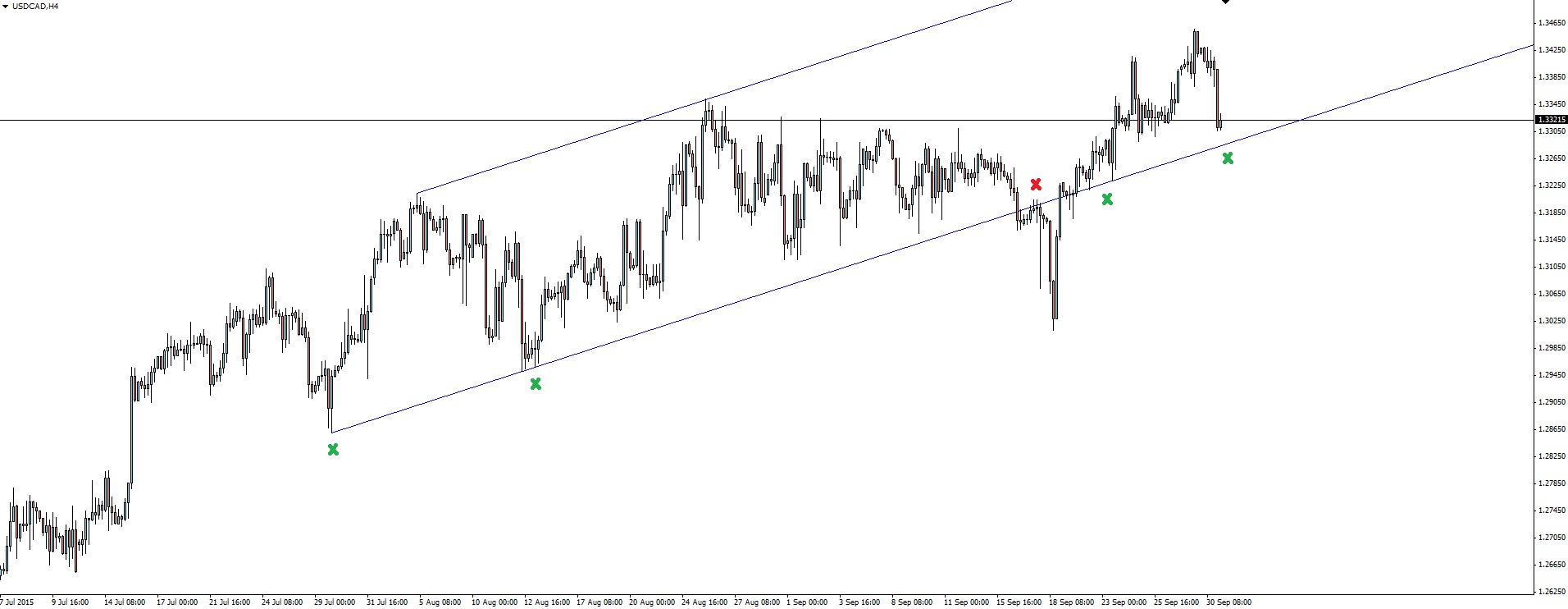

Today’s chart of the day takes a look at last night’s drop in USD/CAD and a possible trend line re-activation.

“CAD GDP m/m (0.3% v 0.2% expected, with previous revised down to 0.4% from 0.5%)”

USD/CAD 4 Hourly:

If you’re a reader of the Vantage FX News Centre blog, then you’d know that I’ve talked about these trend line re-activation setups in the past.

Once a trend line has been broken like this, a huge proportion of these breaks are not sustained. This means that price will actually tuck back into the original channel again and ‘re-activate’ the trend line just like this. Don’t rush to clear your charts of long term trend lines just because they’ve been broken.

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by MetaTrader 4 Broker Vantage FX Pty Ltd, does not contain a record of our prices, or an offer of, or solicitation for, a transaction in any financial instrument. The research contained in this report should not be construed as a solicitation to trade the Forex Market. All opinions, news, research, Forex analysis, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently any person opening a Forex trading account and acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the actions of the reader. We always aim for maximum accuracy and timeliness and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on the service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.