DXY looks like its consolidating for breakout:

But AUD is already there!

Commodities rebounded:

And EM stocks (NYSE:EEM):

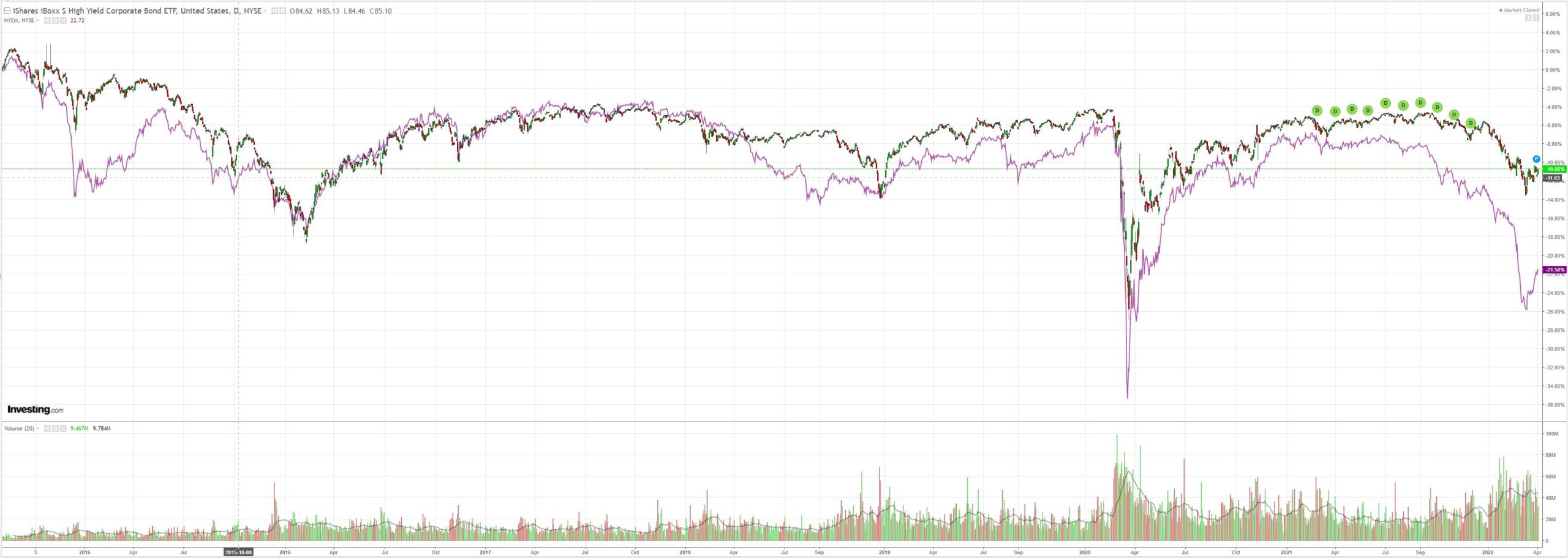

Junk (NYSE:HYG) jumped:

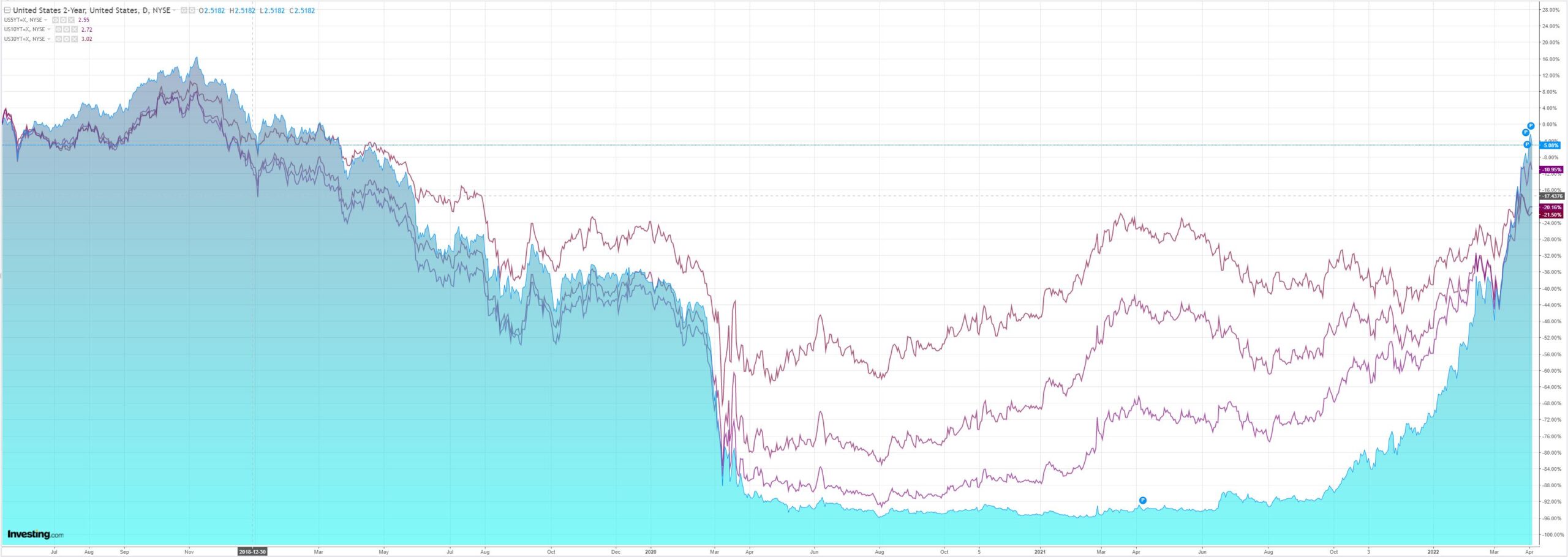

The curve steepened for once:

Stocks to the moon as tech flies Elon Musk and Twitter (NYSE:TWTR):

Westpac has the wrap:

Event Wrap

US factory orders in Feb. fell 0.5%m/m (est. -0.6%m/m, prior revised to +1.5%m/m from +1.4%m/m), with ex-transport +0.4%m/m (est. +0.3%m/m. prior revised to +1.2%m/m from +1.0%m/m). Durable goods were finalised at -2.1%m/m (est. -2.2%).

Germany’s trade surplus in Feb. recovered to EUR11.5bn (est. EUR10.1bn), with gains in both exports and imports.

BoE’s Cunliffe (the dovish dissenter at the last MPC meeting) acknowledged that further tightening may be necessary, but was concerned about high commodity depressing activity, and also that medium-term inflation could undershoot due to the Ukraine war.

Event Outlook

Aust: The RBA will keep rates on hold at their April meeting; focus will be centered on any shift in rhetoric concerning the timing of the tightening cycle, which Westpac expects to begin in August 2022.

Japan: Elevated cost pressures and weaker wages growth are expected to begin squeezing household spending in February (market f/c: 2.7%yr). The final estimate of the March Nikkei services PMI is also due.

Eur/UK: The final estimate for the Markit services PMI is due for both the Eurozone and the UK (market f/c: 54.8 and 61.0).

US: The trade deficit is set to remain wide in February given the strength in demand and inventory procurement (market f/c: -$88.5bn). The Markit and ISM services PMI should continue to reflect a robust pace of growth in the sector (market f/c: 58.9 and 58.4 respectively). Meanwhile, the FOMC’s Brainard and Williams are due to speak at different events.

Elon Musk is quietly buying up Twitter taking a 9% passive stake and that is enough to save the world for a day. The rising number of rate cuts being priced into the US curve did nothing to hurt long-duration tech, either:

“Risk on” lifted AUD and a boom and bust lies ahead.