This article was written exclusively for Investing.com

Earnings season may be about three weeks away, but earnings estimates are already starting to change. While the S&P 500 is down sharply this year, S&P 500 earnings are not.

But they are finally beginning to show signs of coming down. While this process started in the NASDAQ 100 and NASDAQ Composite weeks ago, it was a long wait before the S&P turned.

These revisions could get more prominent as we get closer to earnings season, resulting in EPS estimates sliding more. Revisions down could be the next shoe to drop for the index.

Estimates Are Now Rolling Over

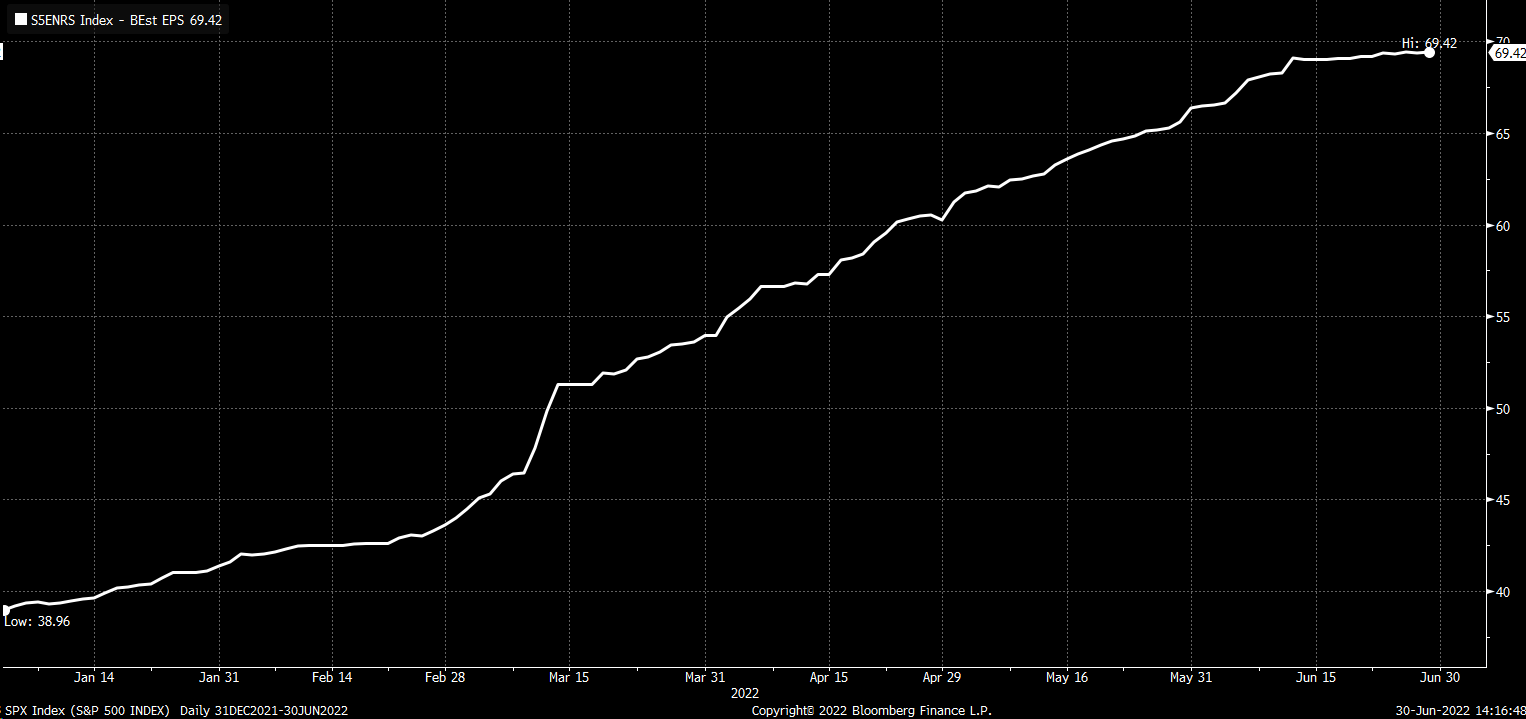

This year so far, earnings estimates for the S&P have continually climbed, reaching a high of $228.54 per share on June 13, after starting the year around $220 per share.

While they have fallen off those highs, it has been less than 1%, dropping to just $227.86. Meanwhile, the S&P has slumped around 20%. It tells us a lot that all of the declines in the S&P 500, to this point, have been on multiple contractions.

Of course, the S&P 500 now finds itself trading at 16.75 times 2022 forecast earnings, down from 22.7 at the start of the year and the high point. This poses another problem for the stock market, should earnings estimates begin to decline. Declining earnings estimates will push up P/E ratios if the index does not fall at the same pace as earnings.

So, if earnings estimates start dropping, the S&P will need to slide with those earnings in order to maintain the current 16.7 P/E ratio. For the P/E ratio to fall to 14, the index would need to drop even faster than earnings estimates.

Increasing earnings estimates during H1 2022 have helped cushion some of the blow to the index. Declines could have been much worse.

Energy Saving The Day

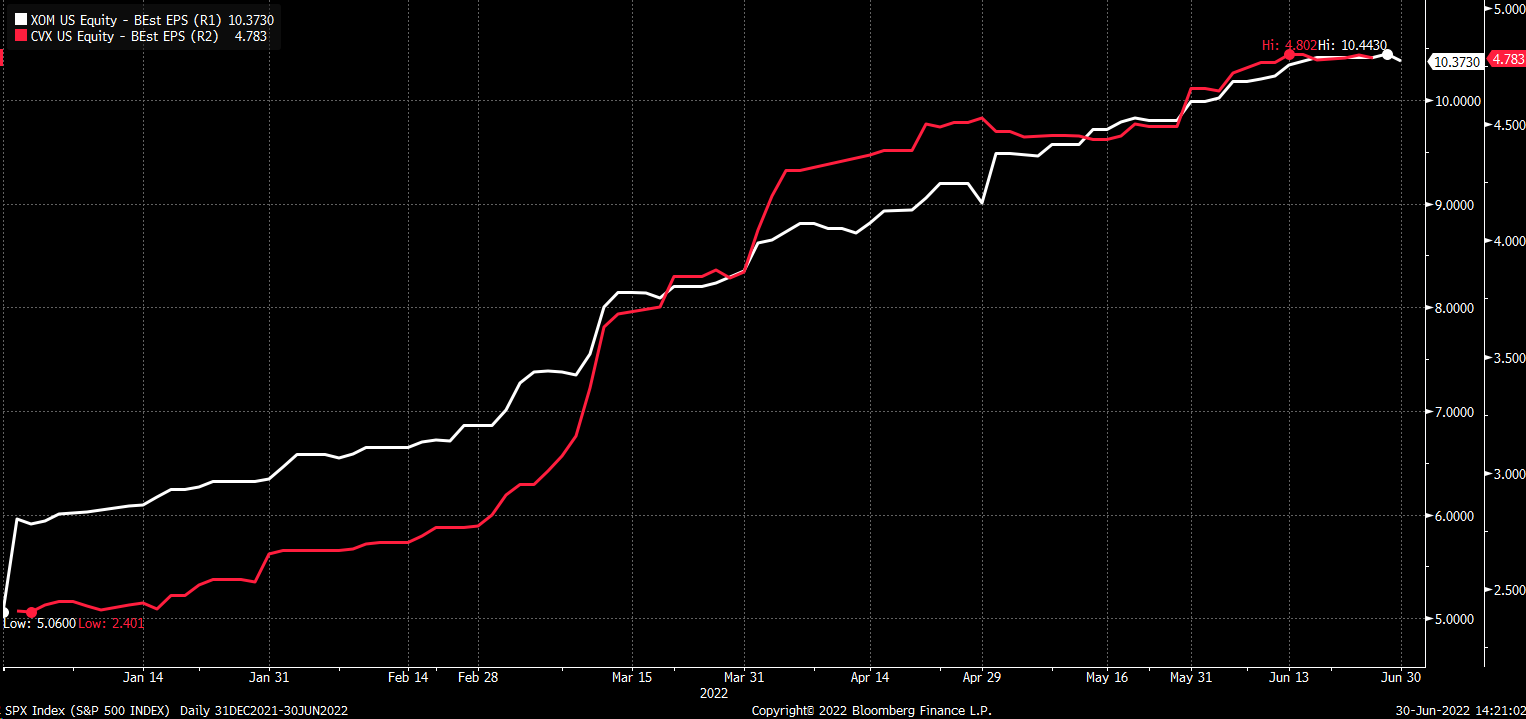

One reason S&P earnings have held up better than NASDAQ is the energy sector. Earning forecasts across the sector have soared, almost doubling. This is due to the soaring price of crude oil and other commodities like natural gas and gasoline.

But as the chart shows, earnings estimates for the energy sector have now started to flatten, and that could be because energy commodities have started to top out. If those commodity prices fall further, it could begin to push earnings estimates for the sector lower, pushing earnings estimates for the entire S&P 500 even lower.

The two largest S&P energy companies are Chevron (NYSE:CVX) and Exxon (NYSE:XOM). Their earnings estimates have also stopped rising. Now it is possible that as earnings season nears, those estimates may start to be revised up.

But with oil prices starting to fall, they may also be revised lower. This means that Chevron and Exxon maybe two of the most important stocks to keep an eye on as earnings season approaches.

it is worth noting that Chevron and Exxon's share prices have fallen dramatically in recent weeks. This could be an indication of what the market is thinking regarding their future earnings.

If price leads earnings estimates, the second half of 2022 will see earnings estimates fall dramatically.