By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

The Federal Reserve raised interest rates by 25bp Wednesday and Fed Chair Janet Yellen’s optimism plus hawkishness caught the market by complete surprise. Traders leaned heavily into short dollar positions after the morning’s weak consumer spending and inflation reports. Economists had been looking for retail-sales growth to stagnate but instead it contracted by -0.3%, the largest decline since January 2016. Demand for products outside of auto and gas also fell short of expectations last month. Consumer prices turned negative, driving the year-over-year inflation rate down to 1.9% from 2.2%. After these reports, investors were sure that the Fed would drop its plans to raise interest rates again this year expecting mostly dovish comments from Janet Yellen. Instead, the complete opposite happened. The Fed maintained its view for a third hike in 2017 and aside from acknowledging the drop in inflation, which she downplayed by attributing to one-off factors, everything Yellen said was hawkish. She put on a brave face, talked up the improvements in the labor market and economy and shared the central bank’s plans to reduce its balance sheet by unwinding asset purchases. The dollar traded sharply higher in response. The Fed also raised its GDP forecasts, lowered its unemployment rate estimates and cut its projection for inflation. However the lack of follow through after Yellen’s testimony tells us that investors don’t believe her. The proof is in the data, which is telling a very different story. Nonetheless, with the Fed looking beyond the recent weakness and seeing the need for another hike this year, losses in the dollar should be limited. Buyers are likely to swoop into USD/JPY near 109.25 with sellers coming into EUR/USD from 1.1215 to 1.1250.

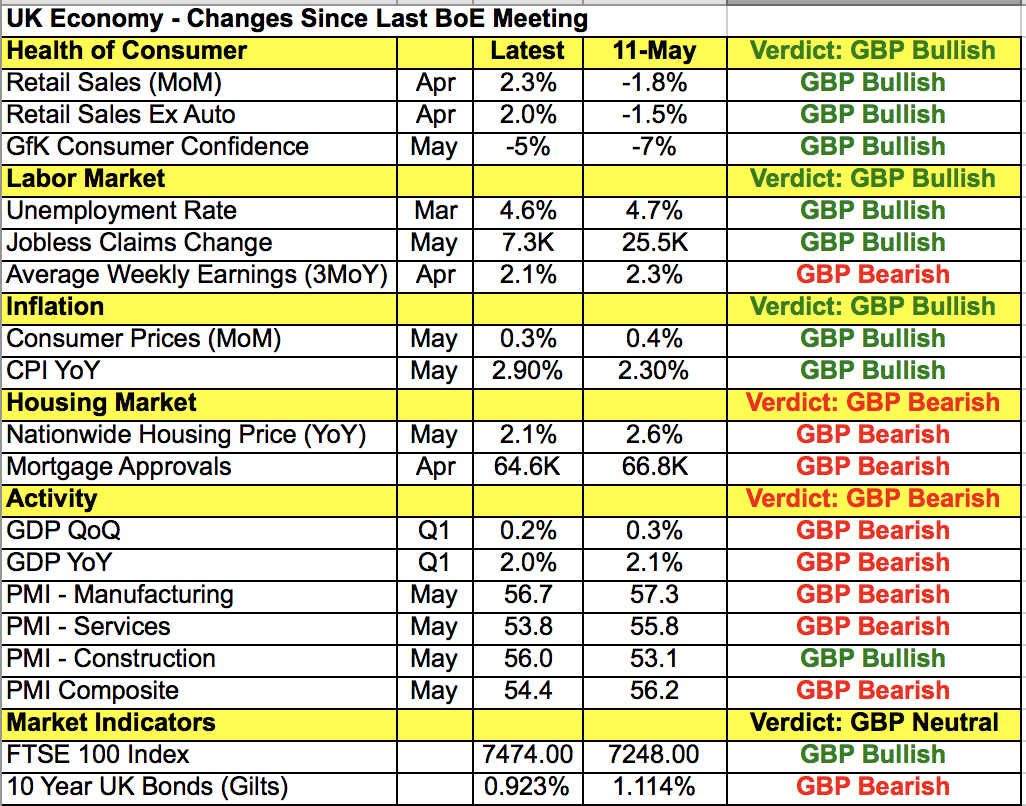

The Swiss National Bank and Bank of England are up next. No changes are expected from either central bank. Recent Swiss data has been mixed with stronger GDP and CPI growth offset by lower retail sales and manufacturing activity. So the central bank will most likely reiterate its desire to see the Franc lower. As for the BoE, having just updated its economic projections, no major breakthroughs are expected this month. Although the following table shows improvements in spending, jobs and inflation, Governor Carney is worried about low wage growth and the impact on household demand. Combined with the latest political uncertainty, there’s very little reason for the BoE to express fresh optimism or alter its guidance. If Kristin Forbes continues her dissent in favor of a hike, we may see a shallow rally in GBP. If she votes to keep policy unchanged, we will see a sharper decline and if another member joins her tightening bias, GBP/USD could hit 1.2850. Retail sales are due for release ahead of the rate decision and we are looking for a pullback after the strong rise in April.

The Australian and New Zealand dollars were in play Wednesday evening. Both currencies performed very well on Wednesday and only gave back part of their gains post FOMC. Of the 2, we believe that the New Zealand dollar will outperform with GDP growth expected to rise strongly in the first quarter. Retail sales and trade have been significantly better, translating to solid growth in the first 3 months of the year. Australian labor-market conditions on the other hand should weaken with job growth slowing in the services and manufacturing sectors according to the latest PMI reports. If we are right on both reports, AUD/NZD could sink to 1.04. USD/CAD rebounded off its lows Wednesday on the back of lower oil prices as crude was crushed by the inventory report. But even with this recovery, the downtrend remains intact.