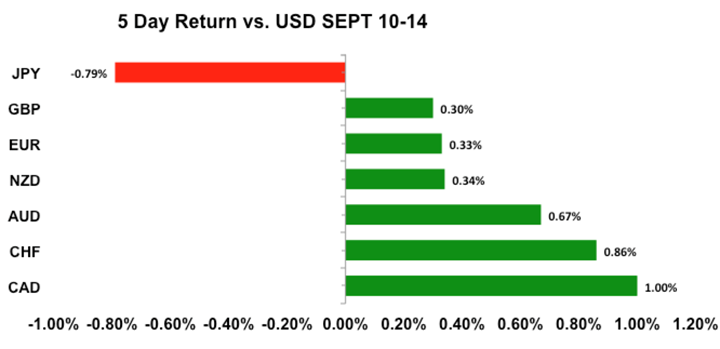

Everyone wants to know if the US dollar will continue to rise. USD/JPY defied fundamentals this past week to hit a 7-week high but the greenback did not perform as well against other major currencies.

Euro, sterling, the Australian and Canadian dollars extended their recoveries, but after the US retail sales report on Friday, US dollar bulls are slowly regaining control. This strength is confusing to some investors because it is not consistent with US data, which has surprised to the downside. Federal Reserve districts are also worried about trade tensions but dollar bulls don’t want to give up control. After rallying at the start of the week, major currency pairs such as EUR/USD and AUD/USD tested and rejected key resistance levels and now they are vulnerable to deeper corrections.

US Dollar

Data Review

- PPI Final Demand -0.1% vs 0.2% Expected

- PPI Ex Food and Energy -0.1% vs 0.2% Expected

- PPI Ex Food, Energy and Trade 0.1% vs 0.2% Expected

- Beige Book Shows Concern over Trade Tensions

- CPI 0.2% vs 0.3% Expected

- CPI Ex. Food and Energy 0.1% vs 0.2% Expected

- Retail Sales Advance 0.1% vs 0.4% Expected

- Retail Sales Ex Auto 0.3% vs 0.5% Expected

- Retail Sales Ex. Auto and Gas 0.2% vs 0.5% Expected

- Industrial Production 0.4% vs 0.3% Expected

- Manufacturing Production 0.2% vs 0.3% Expected

- U. of Mich. Sentiment 100.8 vs 96.6 Expected

- U. of Mich. Current Conditions 116.1 vs 110.3 Prior

- U. of Mich. Expectations 91.1 vs 87.1 Prior

Data Preview

- Empire Manufacturing - Potential for downside surprise given the stronger dollar. Trade tensions should have also dampened activity

- Current Account Balance, Housing Starts and Building Permits - Housing data is difficult to predict but rising interest rates aren't good for real estate

- Philadelphia Fed Business Outlook and Existing Home Sales - Will update after Empire State and housing starts

- Bank of Japan Rate Decision - BoJ has been engaging in stealth tapering, look for related comments

Key Levels

- Support 110.00

- Resistance 113.00

The main reason why the US dollar defied fundamentals this past week is that regardless of all the data misses, the Federal Reserve is still expected to raise interest rates this month. Also, every policymaker who spoke on Friday said more tightening beyond September is needed. Even FOMC voter and Fed President Brainard who is traditionally a dove suggested that the Fed could continue to raise rates beyond the long-term neutral rate. Evans who is not a voting member of the FOMC described the economy and labor market as very strong and suggested that 4 hikes for 2019 are still reasonable because he wouldn’t be surprised if inflation goes a little above 2%. Kaplan agreed that the US consumer is strong. Hawkish comments such as these drove 10-year Treasury yields above 3% on an intraday basis on Friday and this move took USD/JPY to its highs of the day above 112. However, the slowest pace of retail sales growth in 6 months and the first drop in producer prices in 18 months cannot be ignored especially with consumer price growth easing. There are no major US economic reports on the calendar this week so the USD strength that we saw toward the end of last week could continue, especially versus euro, Australian, Canadian and New Zealand dollars.

The yen and the Swiss franc, on the other hand, are vulnerable to the outcomes of the Bank of Japan and Swiss National Bank monetary policy meetings. No changes are expected from either central bank but the BoJ has been actively engaged in stealth tapering and investors will be watching closely for comments on these actions. The Swiss National Bank’s view on the currency will be the most important – for the past 4 meetings, they described the franc as “highly valued,” but it is currently trading at its strongest level in 14 months versus the euro. If the SNB shifts their tone and describes the currency as “significantly overvalued,” we could see a sharp recovery in EUR/CHF and USD/CHF.

Euro

Data Review

- ECB Keeps Rate Unchanged

- GE ZEW Survey Current Situation 76 vs 72 Expected

- GE ZEW Survey Expectations -10.6 vs -13.5 Expected

- EZ ZEW Survey Economic Sentiment -7.2 vs -14.0 Expected

- EZ Industrial Production -0.8% vs -0.5% Expected

- GE CPI 0.1% vs 0.1% Expected

- EZ Trade Balance 12.6b vs 16.2b Expected

Data Preview

- EZ CPI - Final figures are hard to predict but revisions can be market moving

- SNB Rate Decision - Beware of tougher FX comments by SNB

- GE and EZ PMI’s - Potential for downside surprise as stronger ZEW is offset by weaker German industrial production and factory orders

Key Levels

- Support 1.1500

- Resistance 1.1700

After racing to a high of 1.1721 following the European Central Bank’s monetary policy announcement, the momentum for EUR/USD shifted back to the downside. The ECB left interest rates unchanged, lowered their growth forecasts for this year and next, expressed concerns about protectionism and emerging-market turmoil. Yet EUR/USD rallied on the rate decision because the central bank is less concerned about inflation. They expect inflation to pick up toward the end of the year and rise gradually in the medium term, thanks to rising domestic cost pressures and a lower euro. As a result, they described the risks to their economic outlook as broadly balanced. However, EUR/USD u-turned on Friday following reports that some policymakers wanted a more cautious tone that suggested the risks were tilted to the downside. During his press conference, Draghi did not mention the recent weakness in German and Italian data or the drop in Eurozone industrial production and trade activity. It is hard to ignore the numbers, especially as the Eurozone’s trade surplus shrank to its smallest level in 4 years in July. That’s why next week’s inflation and economic activity reports will be very important. If CPI and PMIs also surprise to the downside, EUR/USD will fall to 1.15. However, if Draghi is right and the PMIs show that the outlook for the economy remains bright, EUR/USD could squeeze back above 1.17.

British Pound

Data Review

- Bank of England Keeps Rates Unchanged

- Visible Trade Balance -9.97b vs -11.74b Expected

- Trade Balance Non-EU -2.8b vs -3.3b Expected

- Trade Balance -0.11b vs -2.1b Expected

- Industrial Production 0.1% vs 0.2% Expected

- Manufacturing Production -0.2% vs 0.2% Expected

- GDP 0.3% vs 0.2% Expected

- Claimant Count Rate 2.6% vs 2.5% Prior

- Jobless Claims Change 8.7k vs 10.2k Prior

- Average Weekly Earnings 2.6% vs 2.5% Expected

- Average Weekly Earnings Ex. Bonus 2.9% vs 2.8% Expected

- ILO Employment Rate 4.0% vs 4.0% Expected

- Employment Change 3k vs 9k Expected

Data Preview

- Consumer Price Index - Potential for upside surprise given rise in BRC Shop price index. Manufacturing and services PMIs report faster price growth

- Retail Sales - Potential for downside surprise given stronger wage growth but BRC reports weaker retail sales. Last month's number was also strong so retracement is possible

Key Levels

- Support 1.2900

- Resistance 1.3200

Sterling, on the other hand, should continue to outperform the euro and hold its own versus the US dollar. Unlike the Eurozone, UK data has been good with the trade deficit narrowing and wages rising. The Bank of England voted unanimously to leave interest rates unchanged. Their decision wasn’t a surprise since they just raised interest rates in August. The BoE expects inflation to ease next year due to an energy price cap but pay could be stronger due to a healthy labor market. Ongoing tightening will be needed according to the central bank but future rate hikes will be limited and gradual. Brexit talks are moving in a positive direction but the Irish border is still the big problem. UK Brexit minister Davis thinks they are closing in on a deal but the EU denied the progress. Either way Brexit headlines and UK data put sterling in focus this week. Consumer prices and retail sales numbers are due for release – CPI should be stronger as growing price pressures were reported in the manufacturing and service sectors. Retail sales should benefit from stronger wage growth although last month’s report was very strong so a slight slowdown is possible as well.

AUD, NZD, CAD

Data Review

Australia

- AU Consumer Inflation Expectation 4.0% vs 4.0% Prior

- AU Employment Change 44.0k vs 18.0k Expected

- AU Unemployment Rate 5.3% vs 5.3% Expected

- AU Full Time Employment Change 33.7k vs 20.1k Prior

- AU Part Time Employment Change 10.2k vs -24.4k Prior

- Chinese PPI 4.1% vs 4.0% Expected

- Chinese CPI 2.3% vs 2.1% Expected

- Chinese Retail Sales 9.0% vs 8.8% Expected

- Chinese Industrial Production 6.1% vs 6.1% Expected

New Zealand

- Manufacturing PMI 52.0 vs 51.2 Prior

Canada

- Housing Starts 201.0k vs 216.3k Expected

Data Preview

Australia

- RBA September Meeting Minutes - RBA likely to remain cautious and neutral

New Zealand

- Q2 GDP - Potential for upside surprise given much stronger retail sales and trade

Canada

- Retail Sales and CPI - Price component of IVEY increased slightly but employment and wage growth weakened so difficult to predict

Key Levels

- Support AUD .7100 NZD .6500 CAD 1.3000

- Resistance AUD .7200 NZD .6600 CAD 1.3200

Although the Australian and New Zealand dollars hit fresh 2-year lows this past week, both currencies rebounded on the back of stronger data. In Australia business conditions improved and job growth strengthened with a total of 44K job created in August, most of which were full time. The Australian economy is doing very well despite slower Chinese growth and Chinese-US trade tensions. In New Zealand, manufacturing activity accelerated for the first time in 4 months. There are no economic reports from Australia but second-quarter GDP numbers are due from New Zealand. Despite the decline in dairy prices, stronger retail sales and trade activity should bolster growth in Q2. Trade headlines will continue to pose a risk to both currencies as the US threatens China with additional tariffs while proposing a new round of trade talks. Both currencies turned lower on Friday, shifting momentum back to the downside.

Canada – US trade talks have yet to yield any meaningful progress. Canadian Foreign Minister Freeland should be back next week to continue negotiations but the amount of time that it has taken shows how each side is unwilling to bend on key issues. The main one is dairy – Canada restricts how much foreign milk is sold to the benefit of its local industry but the US wants those restrictions relaxed so US producers can sell more milk and cheese to Canada. Freeland is the first to admit that plenty of work still needs to be done and according to reports last week, President Trump is willing to drop Canada from the US-Mexico-Canada pact if they don’t agree to his terms. The talks haven’t completely broken down but investors aren’t happy with the progress so far. Canada’s economy is also in focus this week with retail sales and consumer price reports due for release.