By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

At the start of the week the Dollar Index climbed to its strongest level in 8 months. On Tuesday it sank below 100 on the back of falling U.S. yields and a softer ISM manufacturing report. In the past week more U.S. data surprised to the downside than upside, raising concerns about whether the economy is ready for a rate hike. Tuesday morning we learned that manufacturing activity contracted at its fastest pace since 2009 and while the employment component rose strongly, prices paid continued to fall. Manufacturing-sector weakness is tied directly to the strong dollar but the sharp slide in U.S. rates signals that investors are either questioning the Federal Reserve's resolve or looking past a rate hike. Either way, we'll only be long dollars right up to the FOMC rate decision and not beyond it.

Dollar bulls are now looking to Janet Yellen for help. She makes 2 separate appearances on Wednesday and will be testifying before the Congressional Joint Economic Committee on Thursday. A number of other Fed officials such as Vice Chair Fischer will also speak but the focus will be on Yellen. On Tuesday afternoon we heard from Fed President Evans who is one of the most dovish members of the FOMC and it sounds like he isn't completely opposed to raising interest rates this month. While Evans said he favors later liftoff, he will be going into the December meeting "with an open mind" because he feels the path is more important than the precise timing of the first rate hike. Yellen has been pretty clear about her views and even when data was weak in late October/early November, she reminded us that December is a live meeting and that it is prudent to move in a timely fashion so that they can "move at a more gradual and measured pace" in the future. It seems that the central bank just wants to get the first hike over with and if her comments echo this sentiment in the next 2 days, the dollar could recover its losses. Aside from Yellen, the ADP report is the main focus on Wednesday and economists are looking for slightly stronger job growth.

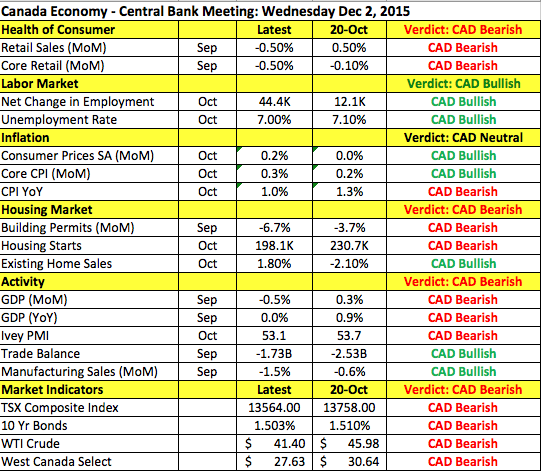

However the Canadian dollar could receive greater focus during the early North American session with the Bank of Canada schedule to deliver it monetary policy announcement. Taking a look at the table below, there has been more deterioration than improvement in Canada's economy since the October meeting. Tuesday morning we learned that the economy contracted 0.5% in September, which was significantly worse than market expectations. Retail sales also fell sharply that month. The trade deficit narrowed but manufacturing activity grew at a slower pace and oil prices declined further. Housing activity was also weak with building permits and housing starts deteriorating. The only good news was in the labor market where the unemployment rate dropped and job growth accelerated. On a monthly basis, consumer prices increased but year over year, CPI growth slowed to 1% from 1.3%. While we are not looking for the Bank of Canada to lower rates, it has every reason to remain dovish.

In contrast, the Australian and New Zealand dollars rose strongly versus the greenback. The RBA left monetary policy unchanged but the uptick in manufacturing activity and rise in building approvals coupled with the central bank's view that the "moderate expansion in the economy continues" sent AUD sharply higher. Q3 GDP numbers were scheduled for release Tuesday evening and we've been looking for a sharp acceleration in growth that could lead to further gains in AUD, particularly versus the CAD.

The New Zealand dollar was the day's best performer. For the first time since early October, dairy prices increased. While the 3.6% rise was small, it was all NZD traders needed to send the currency higher by more than 1% versus the USD, CAD, GBP, CHF and JPY. With the ECB poised to ease, higher-yielding currencies like NZD and AUD are seeing unusually voracious demand.

Better-than-expected Eurozone data helped EUR/USD stage its strongest recovery in 8 trading days. German unemployment rolls dropped by 13K, the unemployment rate fell to a record low of 6.3% and manufacturing activity was revised higher in November. The Eurozone's official jobless rate also declined to 10.7% from 10.8%, the best level since January 2012. These reports helped to ease the selling as the ECB prepares for aggressive easing. According to Nowotny, the QE program is flexible on size, scope and duration, which is important given the challenges that they face in reaching their employment goals.

Sterling also appreciated versus the U.S. dollar despite the slowdown in manufacturing activity. The PMI index fell to 52.7 from 55.5. Bank of England Governor Carney avoided discussing the economy or monetary policy in his speech on Tuesday and as a result, limited the volatility in the British pound.