- A challenging H2 2023 lies ahead for investors

- But, technology, consumer, and healthcare sectors offer opportunities

- This is your chance to get first-hand information that can affect stocks going ahead. Request your free 7-day trial of InvestingPro here.

- InvestingPro Summer Sale is on: Check out our massive discounts on subscription plans!

As we approach the year's second half, investors are actively analyzing the market outlook, macro risks, and forecasts for the upcoming corporate earnings season. The aim is to reposition portfolios to align with potential opportunities strategically.

In its outlook report for the second half of 2023, investment manager Carmignac emphasizes the importance of preparing for multiple scenarios due to central banks' dependence on economic data. The experts assert that despite persistent wage inflation, a declining potential growth rate, and a low equity risk premium, it remains premature to declare the end of the monetary tightening cycle in 2023.

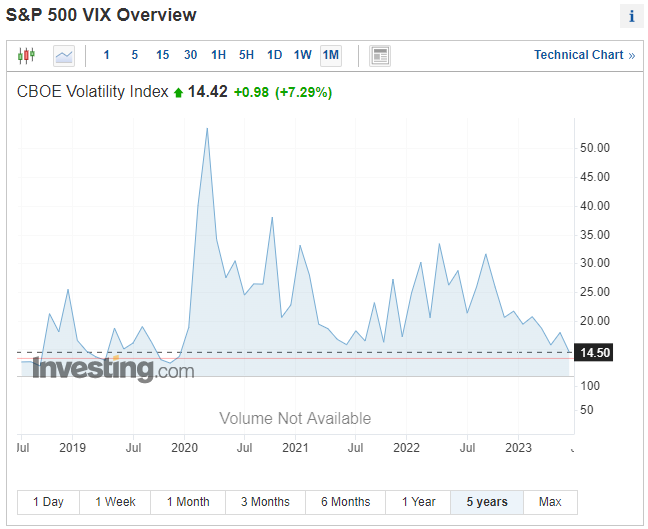

When evaluating equity markets, Carmignac analysts highlight the significant decrease in volatility, with the VIX index reaching its lowest point in three years. This decline, in relation to its correlation component, creates a favorable environment for effective stock selection.

Joining the sentiment, the experts at Federated Herme also anticipate a positive outlook for the stock market in the second half of 2023. They expect earnings growth to act as a catalyst, driving an upward trajectory in stock prices.

As summer arrives, numerous investors are capitalizing on the opportunity to reposition their portfolios strategically. Some are even placing their bets on tourism stocks, recognizing the potential in this sector.

According to the eToro platform, the global travel and tourism industry contributes approximately 8% to the world economy and is projected to experience a 23% growth rate this year, reaching a value of $9.5 trillion. This anticipated growth would mark the sector's third consecutive year of surpassing 20% expansion.

Growth Vs. Value

According to analysts at Federated Hermes, the upbeat earnings forecast comes against a backdrop of rising interest rates, something that typically benefits growth stocks more than their value-focused counterparts.

Analyzing investment opportunities by sector, the experts favor two choices in defensive sectors for this second half of 2023: Technology and consumer.

- Technology (NYSE:XLK): Carmignac analysts highlight the opportunities created by artificial intelligence and the tendency of this sector to evolve favorably, given the prevailing economic climate in which long-term rates are falling and growth is slowing.

- Consumer: The focus in this sector lies in achieving a lower cost base and capitalizing on the eventual turnaround in monetary policy. However, Carmignac notes that the rotation from countercyclical to discretionary consumption is still far away. Factors such as disinflation, economic slowdown, and intensifying price wars among retail distribution groups shape the key considerations.

Other sectors that may also benefit in the second half of 2023 include:

- Healthcare (NYSE:XLV): according to Carmignac analysts, this sector combines short-term resilience and long-term growth prospects. Federated Hermes experts concur, adding that the trend in this sector will continue to rise. However, the pace of ascent seems much more modest compared to the strong growth expected for the technology and communications sectors.

- Some commodities, such as gold: according to Carmignac, are potentially attractive in a period of geopolitical uncertainty and growing concerns about recession.

In a landscape filled with market opportunities, it becomes crucial to have access to reliable and impactful market information that can influence portfolio decisions. InvestingPro, a professional tool, can be a valuable resource.

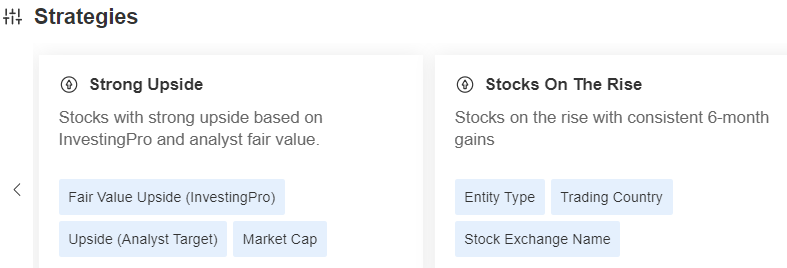

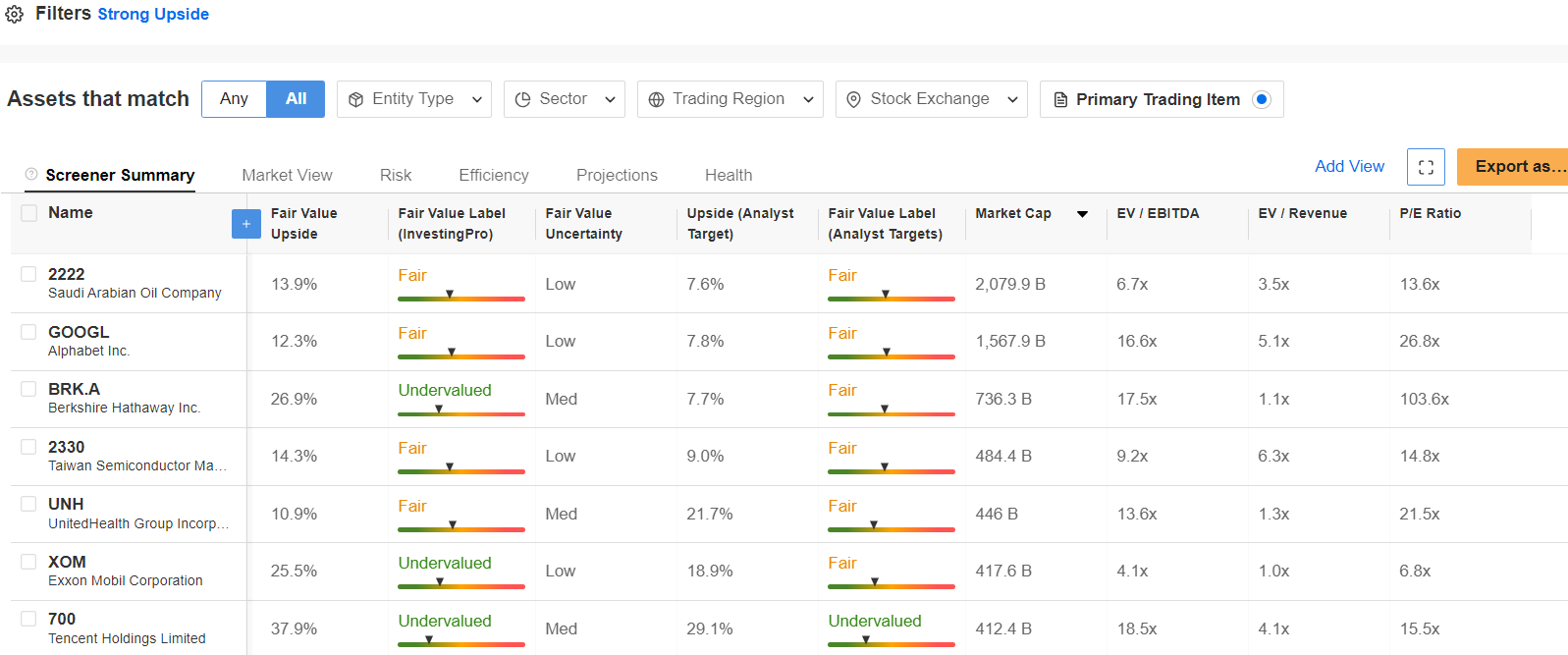

Among its various features, InvestingPro enables users to identify stocks exhibiting a strong uptrend according to both its algorithms and analysts' fair value assessments. Additionally, it provides insights into bullish stocks with consistent six-month earnings performance, offering valuable information for investors.

Source: InvestingPro

Source: InvestingPro

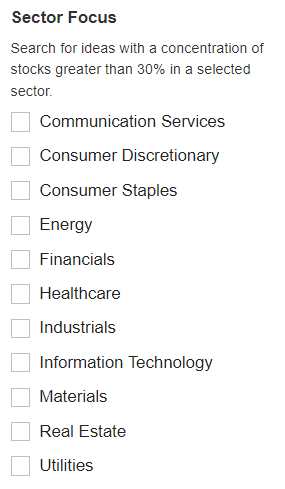

InvestingPro also allows you to search for investment ideas with more than 30% stock concentration in a given sector.

Source: InvestingPro

Are you considering new stock additions to your portfolio or divesting from underperforming stocks? If you seek access to the finest market insights to optimize your investments, we recommend trying the InvestingPro professional tool for free for seven days.

Access first-hand market data, factors affecting stocks, and comprehensive analysis. Take advantage of this opportunity by visiting the link and unlocking the potential of InvestingPro to enhance your investment decisions.

And now, you can purchase the subscription at a fraction of the regular price. So, get ready to boost your investment strategy with our exclusive summer discounts!

As of 06/20/2023, InvestingPro is on sale!

Enjoy incredible discounts on our subscription plans:

- Monthly: Save 20% and get the flexibility of a month-to-month subscription.

- Annual: Save an amazing 50% and secure your financial future with a full year of InvestingPro at an unbeatable price.

- Bi-Annual (Web Special): Save an amazing 52% and maximize your profits with our exclusive web offer.

Don't miss this limited-time opportunity to access cutting-edge tools, real-time market analysis, and expert opinions.

Join InvestingPro today and unleash your investment potential. Hurry, the Summer Sale won't last forever!

Disclaimer: This article was written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel, or recommendation to invest, nor is it intended to encourage the purchase of assets in any way.