The US Martin Luther King Day saw holiday trading conditions continue today, with North American traders enjoying the rest of their day off and Asian traders coping with the liquidity vacuum that has been left.

Today’s Asian session is all about the Chinese data dump and whether the PBOC feel they can afford to print a number that could send both domestic and world markets into a nosedive. With every major stock index sitting precariously on trend line support, today’s data is setting up as a real make or break release.

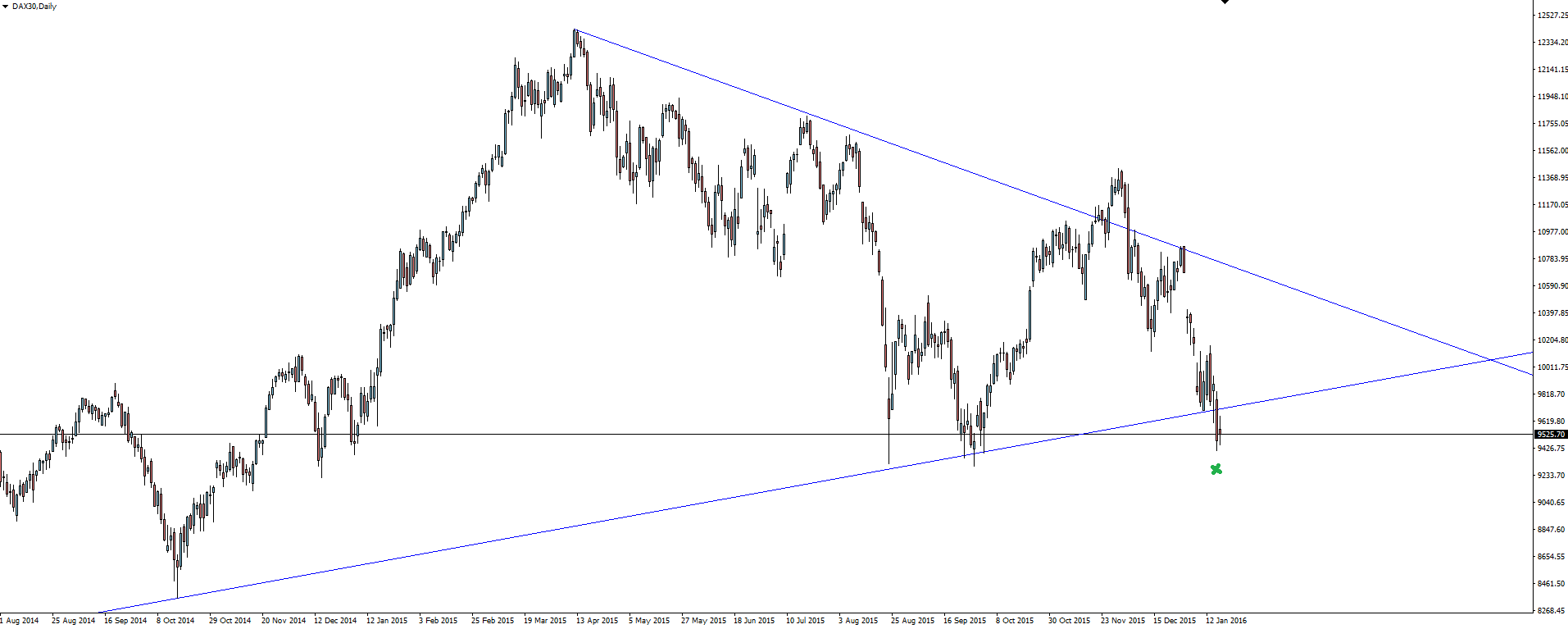

DAX Daily:

With the US market closed, European markets had a relatively quiet start to the week. Something that isn’t expected to last long! Keep your eye on the Technical Analysis section of the Vantage FX News Centre following today’s Chinese data release as we take a deeper look at just how perilously close almost all stock markets are sitting from some BIG technical break-outs.

But for now we focus our attention back to China and the obvious slump in growth being experienced. This has been known for some time and the risks associated with the slowdown have been modestly priced into markets over the last couple of months. The expected Chinese GDP print of 6.9% would see the emerging economy experiencing the slowest rate of growth since 1990 with economists predicting this trend to continue throughout 2016 and beyond.

Following the tier 1 releases of GDP and Industrial Production, we get tier 2 Fixed Asset Investment data and a NBS Press Conference which will shed light on the PBOC’s plan heading forward. Something that nobody is convinced that they have!

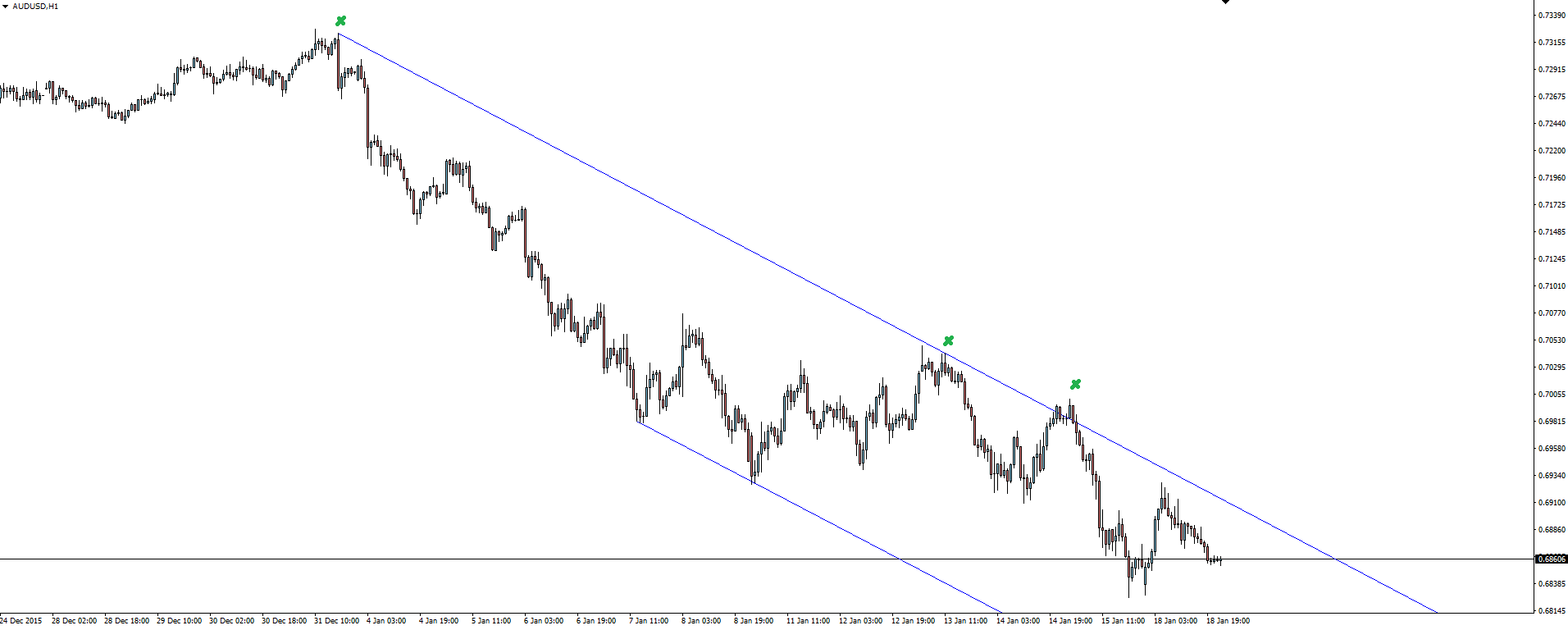

AUD/USD Hourly:

With no major US data releases on the calendar to start the week, the majors have been mixed. The Aussie will obviously have some of the biggest exposure to event risk around today’s Chinese numbers and its position at the upper end of a bearish hourly channel highlights just how much damage a worse than expected number could easily inflict from a technical standpoint.

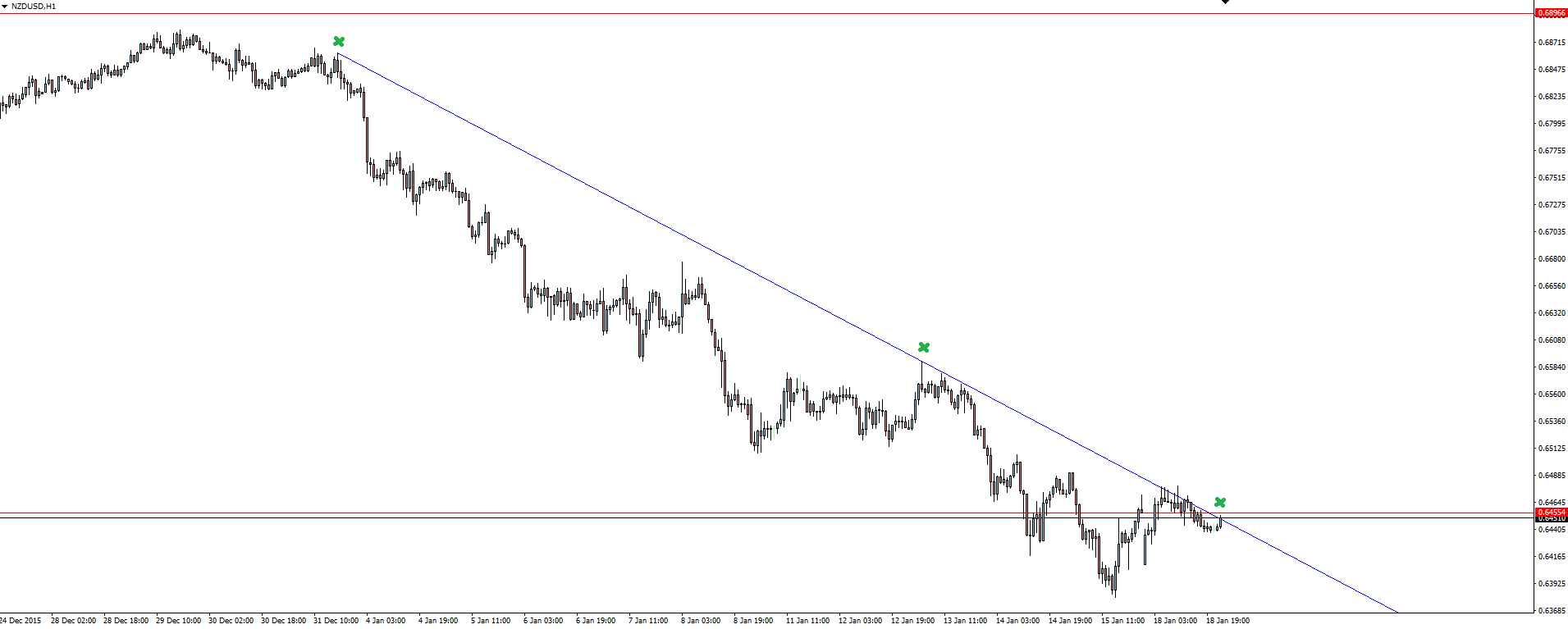

Chart of the Day:

The Kiwi is in the same boat as its big brother across the ditch, sitting even closer to hourly trend line resistance

NZD/USD Hourly:

Heading into major data releases, the charts always tell the story of where the greater risk lies if the release misses expectations. As a trader, your number 1 job is to manage this risk.

I’ve made it pretty clear that I see the biggest risk being a miss to the downside, with a lack of support to halt any technical drops in both the Aussie and Kiwi.

In which direction do you see the greatest risk?

On the Calendar Tuesday:

CNY GDP q/y

CNY Industrial Production y/y

CNY Fixed Asset Investment ytd/y

CNY NBS Press Conference

GBP CPI y/y

EUR German ZEW Economic Sentiment

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Forex Broker Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently any person acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the actions of the reader. We always aim for maximum accuracy and timeliness, and Forex broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.