Chinese Currency Devaluation:

China’s Central Bank, the People’s Bank of China (PBOC) yesterday weakened it’s currency by 1.9% to it’s lowest level in more than 2 decades. The move was swift and unexpected by markets. With traders waiting patiently for Australian NAB Business Confidence data less than 15 minutes before the PBOC made its move, many were left scrambling to change their AUD/USD plan of attack.

After a run of poor economic data releases, including dismal Trade Balance and Inflation numbers over the weekend, Chinese policy makers felt their hand was forced as they became the latest nation to join the currency wars.

When an economy the size of China’s is failing to generate sufficient growth, its impact will be felt throughout the global system. And with China essentially conceding that growth is no longer sufficient, correlated markets such as the commodities currencies, including the Aussie dollar are in for a rude shock.

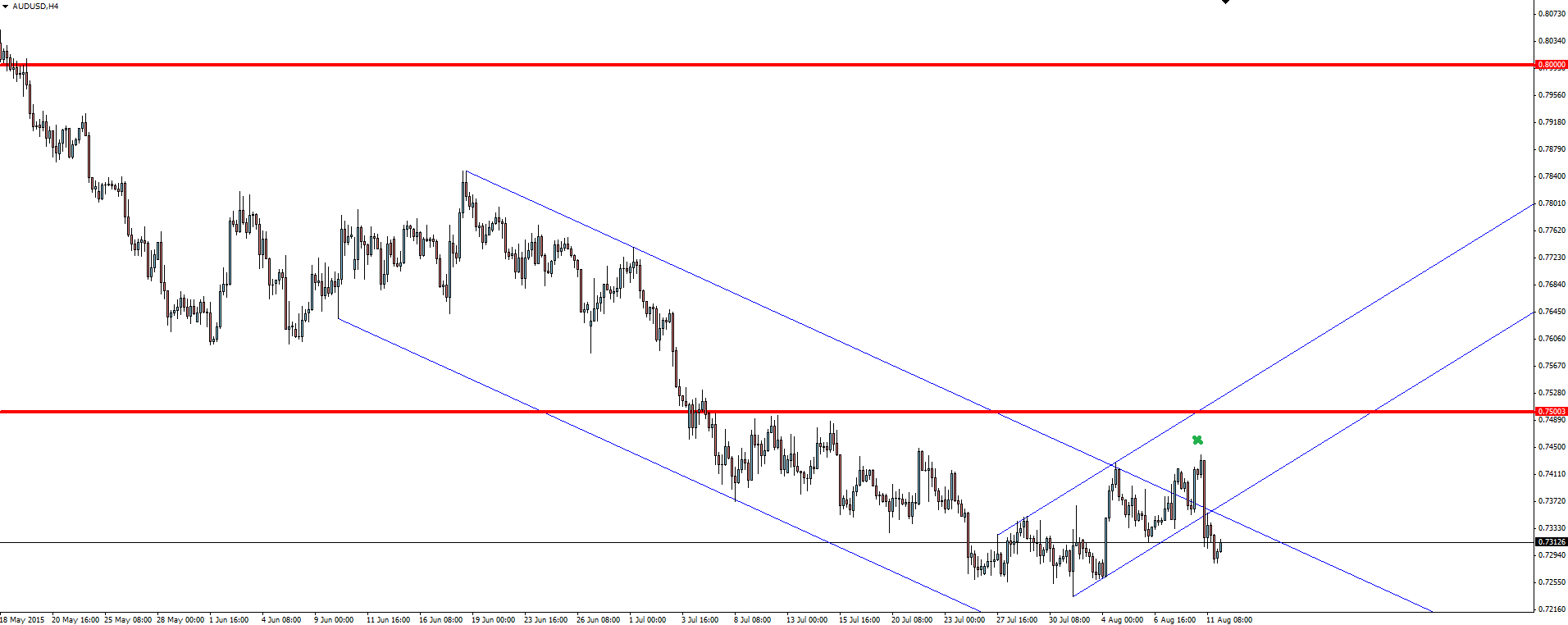

AUD/USD 4 Hourly:

In yesterday’s Daily Market Update, I expected the Aussie to potentially react to the up-side if NAB Business Confidence data beat expectations. Well the Chinese devaluation move put an end to that scenario as the Aussie was swiftly hammered back inside it’s descending channel.

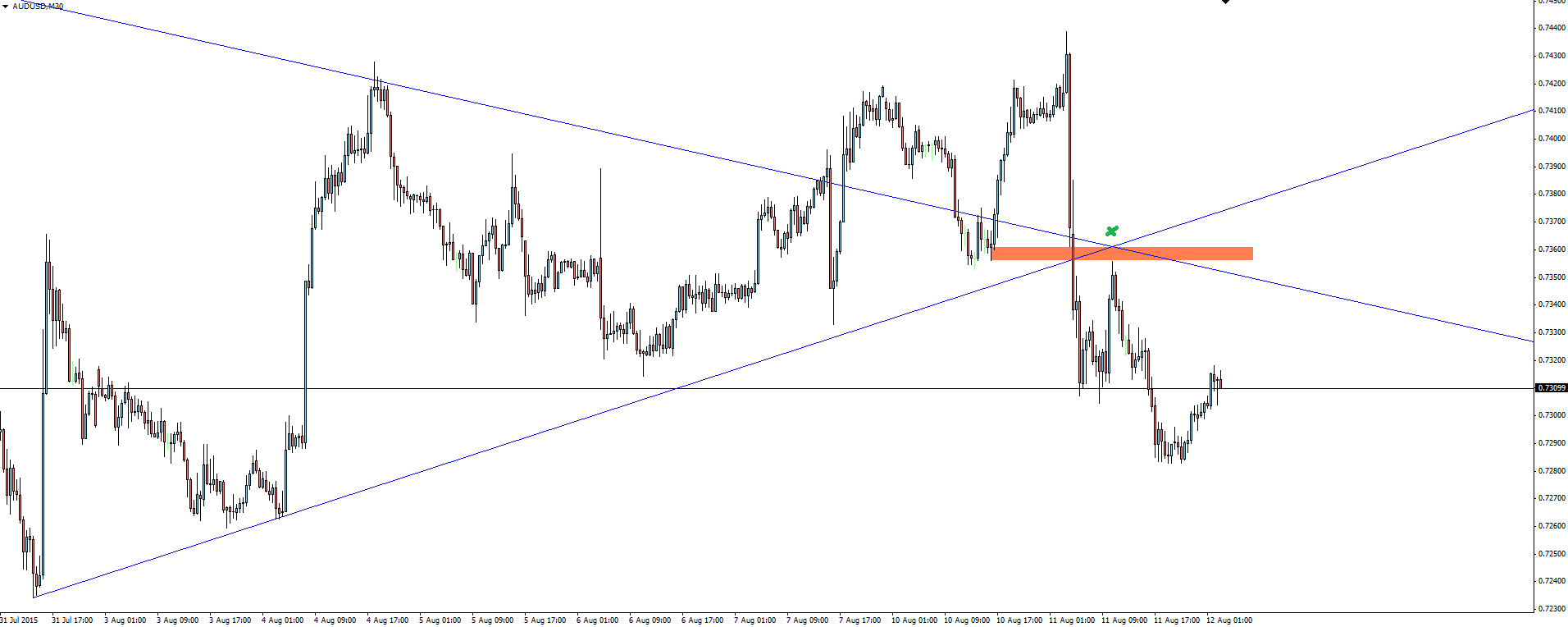

AUD/USD 30 Minute:

So often after trend lines or channels have been broken, they re-activate. We read a lot about trend lines that have, for example, been broken as resistance, then being re-tested as support but not a lot is written about lines being re-activated in their original direction. Zooming into the 30 minute chart, I have marked one such re-activation of a broken trend line.

This was a beautiful shorting opportunity as price pulled back during the London session to re-activate the descending channel, retest the short term previously broken trend line support level as resistance and finally a horizontal zone where sellers were waiting. How about that for confluence!

Also just remember that it’s no coincidence that a sharp move like that goes with the major trend rather than against it. Why swim hard against the tide if you don’t have to?

Will This Delay the Fed?

The big question on traders' lips becomes ‘Is the uncertainty around growth issues in the Chinese economy enough to warrant the Fed to delay raising rates?’

I’m of the opinion that this PBOC move was in anticipation of a Fed rate hike and to guard against the subsequent currency increase that would come alongside its USD peg post liftoff. China has given itself some breathing room as September looks more and more like the month we see liftoff.

From here, all we can do is wait and monitor the reaction across world markets, but we know from the past how quickly artificial central bank inspired moves can be swamped by the market and I expect nothing different here.

On the Calendar Wednesday:

JPY Monetary Policy Meeting Minutes

CNY Industrial Production

CNY Fixed Asset Investment

CNY Retail Sales

GBP Average Earnings Index

GBP Claimant Count Change

GBP Unemployment Rate

AUD RBA Deputy Gov Lowe Speaks

USD FOMC Member Dudley Speaks

USD JOLTS Job Openings

USD Crude Oil Inventories

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd, does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. The research contained in this report should not be construed as a solicitation to trade. All opinions, news, research, analyses, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently any person acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the actions of the reader. We always aim for maximum accuracy and timeliness and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on the service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.