This article was written exclusively for Investing.com

- China prepares to unleash a digital currency with domination plans

- US and Europe: asleep at the wheel

- Control of global money supply paves the way towards China’s goals

- The RMB is not a convertible currency; a digital RMB could be a different story

- A digital dollar and crypto euro are no longer a luxury but a necessity

Digital finance or fintech is a natural extension of the technological era. Over the past four decades, technology has changed our lives. In the 1970s, a computer had lots of tubes housed in a cold room. Today, we carry around more computing power in our back pocket with a smartphone. That phone also includes a professional camera, high-speed internet access, maps, and many other devices that replace products.

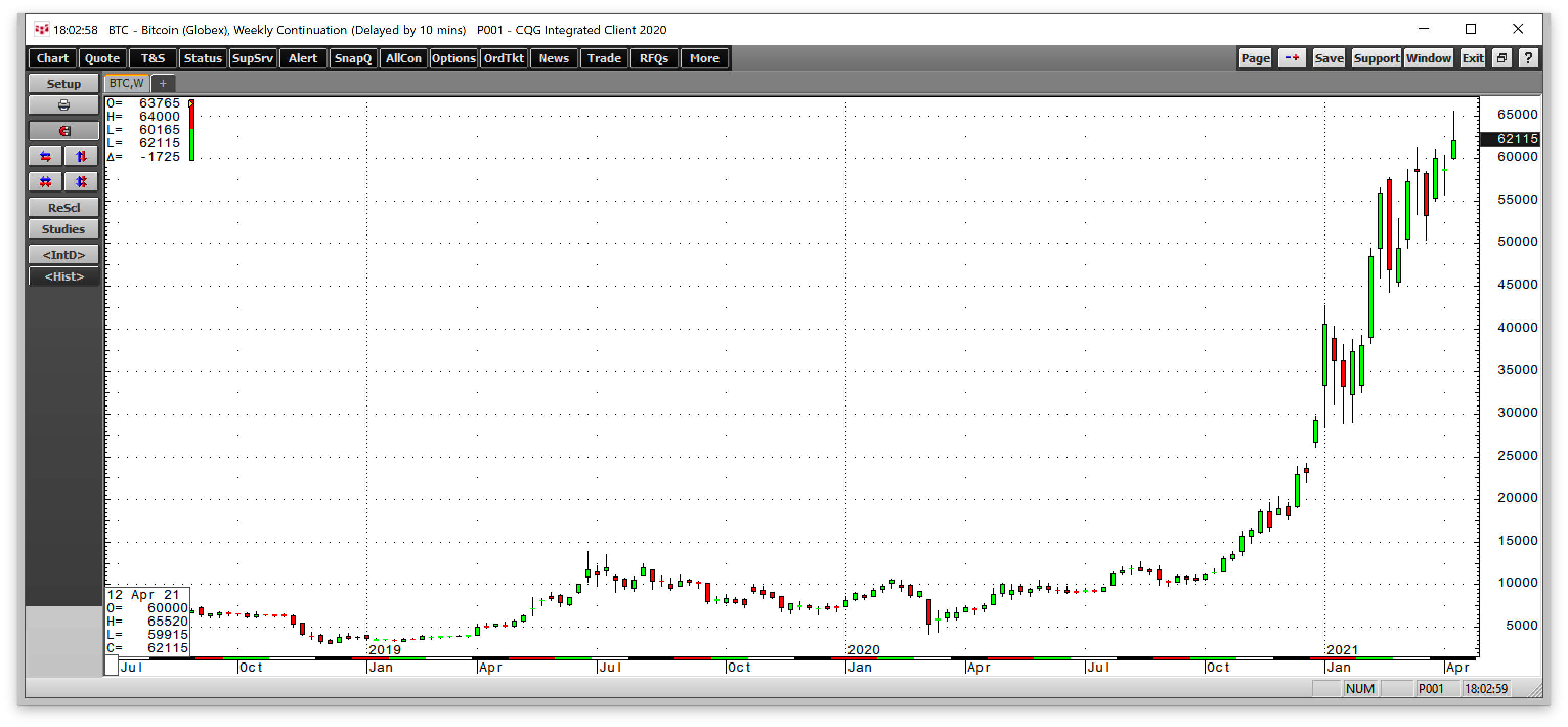

Digital currencies burst on the scene around 2010, but most of us didn't notice the emergence of Bitcoin. At six cents per token, mining for Bitcoin seemed like a video game. At over $62,000 per token as of last week, it was far from a game with over 9,260 other tokens circulating and the asset class’s market cap over the $2.247 trillion level.

Digital currencies are the future. However, they create problems for governments that control the money supply. Money creates power, so central banks, monetary authorities and governments are not excited about this new asset class that seeks to replace money with a technological alternative.

Still, it won't be long before they capitulate and reach a happy medium by rolling out their own digital currencies. China looks to be the first country to do so, on the verge of a digital yuan, which fits right in with the Asian nation's goal of domination for its currency as well as for the world’s second largest economy and the largest population.

China prepares to unleash a digital currency with domination plans

Bitcoin and most of the other 9,266 cryptocurrencies are decentralized, meaning they are a global means of exchange that transcend borders. They are not controlled by any central authority such as a central bank, monetary authority, or government.

The crypto asset class’s philosophy along with its devotees, are libertarian, which embraces liberty as a core principle. While the rise of the digital currency asset class reflects technological advances and the blockchain’s central element, it also represents mistrust of central authority control of the money supply.

China is the world’s most populous nation with the second largest economy. President Xi Jinping plans to become the world leader. In 2014, the Chinese began working on a national digital currency, recognizing the burgeoning asset class’s potential growth.

Unlike the other cryptos, the Chinese version is on the cusp of being issued as a digital yuan or Digital Currency Electronic Payment (DCEP) controlled by the PBOC, the People’s Bank of China, the Sino central bank. Distribution will be via a two-tiered system.

The PBOC will distribute the digital yuan to commercial banks responsible for getting the currency into the hands of consumers. China has been pushing for the internationalization of its currency over the past years. Then digital yuan could expedite the process.

The PBOC has worked with central banks from Thailand, United Arab Emirates, and Hong Kong to explore a cross-border digital currency payment system. The group is exploring the use of distributed ledger technology.

US and Europe: asleep at the wheel

Meanwhile, the US and European governments appear far behind China in embracing the currency market’s evolution. US Treasury Secretary Janet Yellen has called Bitcoin an “extremely inefficient” way to conduct monetary transactions. She has highlighted the digital currency’s use for “illicit finance.”

Christine Lagarde, the European Central Bank President, has said that central banks will not be holding Bitcoin as a reserve currency and highlighted what she called “funny business,” stressing the rising need for regulations.

What Secretary Yellen and President Lagarde did not say is that digital currencies are a direct challenge to the government’s control of the money supply. Power comes from purse strings, so cryptocurrencies pose an immediate threat.

While the Chinese have recognized the technological transformation underway, the US and Europe have yet to embrace technology. The development of a digital dollar or crypto euro remains far behind China’s efforts.

Control of global money supply paves the way for China’s goals

A digital yuan will not undermine China’s control of the money supply since the PBOC would have authority over that means of exchange. However, as the first country to bring a digital version of its currency to the market, China will enhance its goals of rising to become the leading economy with significant global influence. A digital yuan that becomes the currency of choice worldwide, even outside the US and Europe, could substantially impact international finance while potentially undermining the US dollar's postion as the global reserve currency.

Meanwhile, Russia is working on a digital ruble as President Vladimir Putin and President Xi realize that greater impact on the global purse strings leads to increased power.

A digital payment system’s speed and efficiency could cause commodity producers and consumers worldwide to use a digital yuan or digital ruble when they emerge. China and Russia are powerful commodity-producing nations, and China’s population makes it the world’s leading raw material consumer. China and Russia together could dictate terms that support the use of their digital currencies for international, cross-border transactions.

While there is no word that the US or Europe are working on their own digital currencies in order to pursue the Chinese and Russian efforts, the Biden Administration is stepping up scrutiny of China’s plans. A digital yuan could be the first step toward replacing the dollar as the world’s reserve currency. President Xi would like nothing better than to do that, supplanting the dollar and controlling the global financial system with a digital yuan that dominates international trade.

The RMB is not a convertible currency; a digital RMB could be a different story

One of the problems facing China over the past years has been balancing the control of its currency with allowing its value to float freely, permitting it to become totally convertible without restrictions. The dollar and euro are freely convertible currencies, creating the liquidity necessary to attain reserve currency status.

A digital RMB that becomes a world currency could solve China’s control problems. With China’s central bank, the PBOC, in control, the digital currency could become freely convertible, experience the benefits of distributed ledger technology, and allow for constant monitoring and regulation of the flow of funds worldwide.

The more ubiquitous the digital yuan becomes, the more power and information the Chinese government will have at its fingertips. Making the digital yuan fully convertible to other traditional and digital currencies will provide the data that increases financial power.

Companies like Apple (NASDAQ:AAPL), Amazon (NASDAQ:AMZN), Alibaba (NYSE:BABA), Facebook (NASDAQ:FB), and many other technology leaders have profited from data accumulation and artificial intelligence that understands and manipulates consumer trends. China’s ability to roll out a digital currency that competes with the dollar, euro, and other world foreign exchange instruments could yield the same kinds of benefits the tech companies enjoy.

Dominant positions in the industry because of data for the tech companies could translate to a dominant role in world trade and influence for the Chinese if the digital yuan becomes the world’s reserve currency.

A digital dollar and crypto euro are no longer a luxury but a necessity

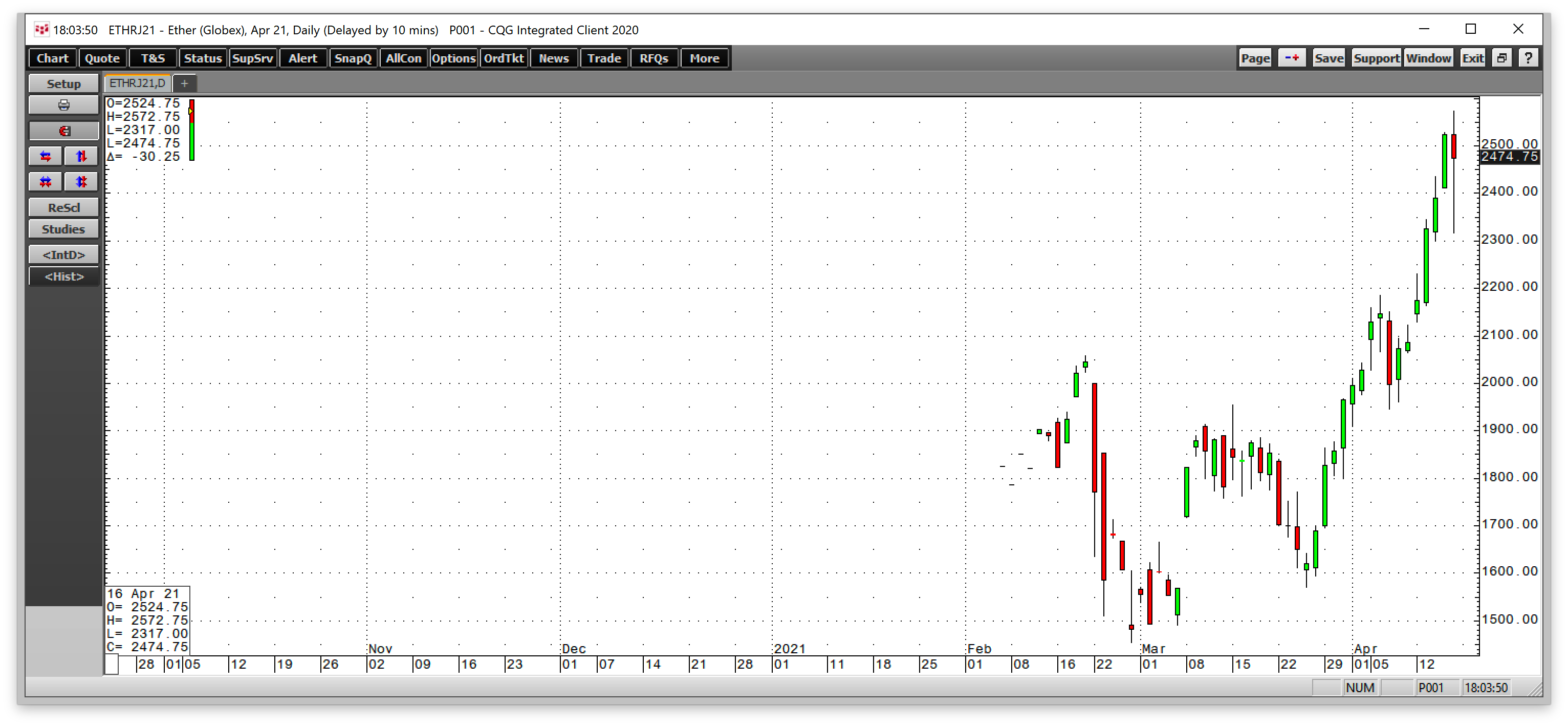

Last week, Bitcoin and Ethereum prices rose to new highs, pushing the digital currency asset class’s market cap over the $2.247 trillion level.

Source all charts: CQG

The chart above shows that Bitcoin rose to a new high at $65,520 on Apr. 14 and was trading near the high ahead of the weekend.

Ethereum hit a new record peak at $2,572.75 on Apr. 16 just weeks after CME futures trading began. Last Wednesday, Coinbase (NASDAQ:COIN), a US-based digital currency platform, went public in a highly successful direct listing. The rise of the asset class is a sign that technology will not wait for laggards. While the asset class may reject government control of its tokens, regulators and leaders can exert influence via laws, ordinances, statutes, and restrictions on businesses.

Meanwhile, it is a national security imperative for the US and Europe to keep pace and surpass Chinese efforts to issue a digital currency. A Chinese victory in the digital currency arena that boosts the yuan’s role as a leading reserve currency would have substantial ramifications for the balance of world power.

China’s efforts in digital currencies are sending a message to the halls of power in the US and Europe that has wide-ranging consequences for the world’s future. A digital dollar and crypto euro that embrace blockchain technology are not a luxury anymore. Rather, they're now a necessity.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI