- EUR/USD pauses at parity

- Potential for short squeeze rally

- Will ECB deliver a surprise 50bps hike?

The EUR/USD has been in focus this week as it descended towards parity before breaking it and then bouncing back. However, it hasn’t held below 1.0000 for very long, making me wonder whether we have seen at least a short-term low as the focus turns towards the ECB meeting in the week ahead.

As we had expected in June and last week, the EUR/USD continued to lower this week. But after a sustained period of selling, we were always going to see at least a pause, especially around such a significant psychological level, which is what has happened here.

It doesn’t mean the bear trend is over, although I think we are now very close to seeing a bottom for the currency pair.

For now, the fact that the EUR/USD didn’t hold its breakdown below parity has raised the prospects of a short-squeeze rally, especially with rates being somewhat oversold:

A move above the most recent high of 1.0123 could trigger the short squeeze I am looking for. Several stop-buy orders are likely resting above this level from those who are already short—and also those who are looking to take advantage of a potential short squeeze.

A break above 1.0123 could pave the way towards 1.0200 initially. However, we could see a deeper pullback towards 1.0350/66 area, which is the next key area of resistance, having acted as support previously.

On a macro level, some US data could trigger a sharp move in the dollar today. We have US retail sales, UoM consumer sentiment, and industrial production, among others.

If US data comes in mostly weaker, expectations of a recession in the world’s largest economy should gain further traction.

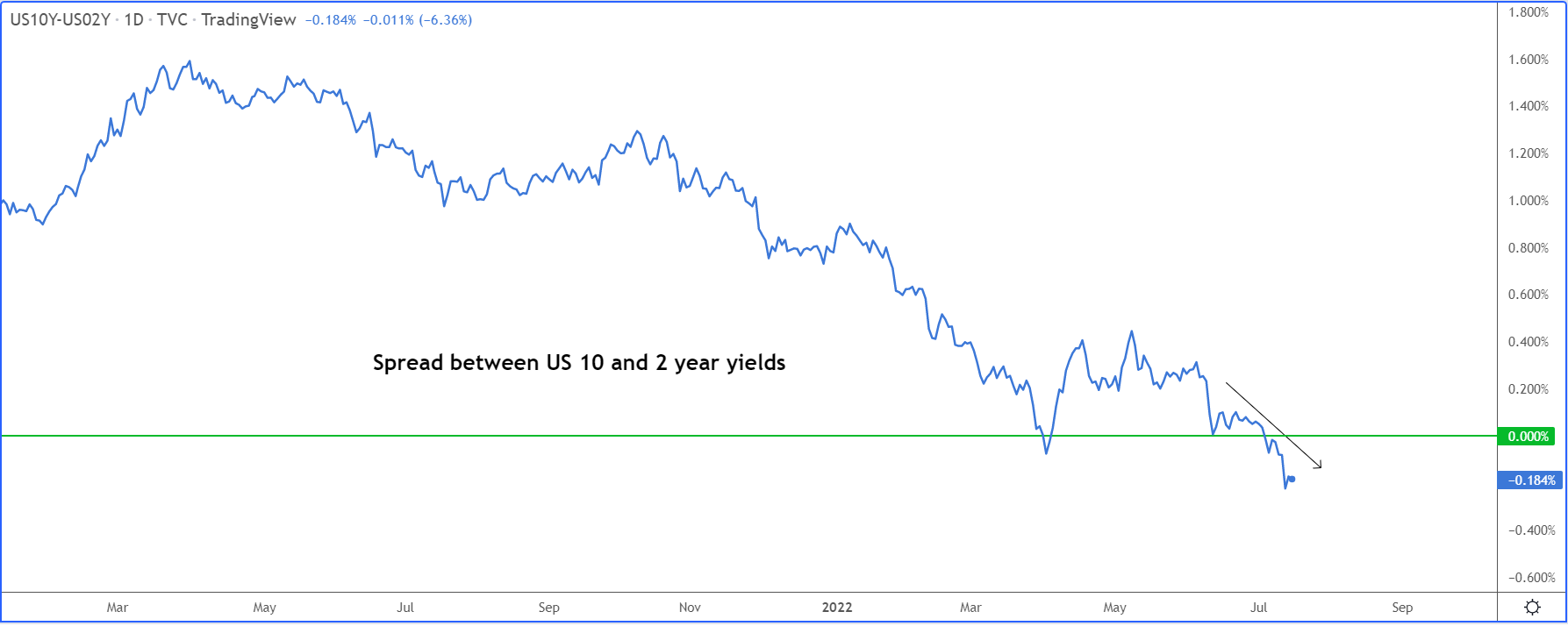

In fact, the sharp inversion of the yield curve suggests a recession is looming large anyway:

Although recession concerns have supported the dollar for now due to haven flows, this could come back to hurt the greenback at some point.

Meanwhile, the focus will turn to the ECB policy decision next week ahead of its first rate hike since 2011.

The ECB has pre-announced a 25bp rate rise, which is very small when considering what other central banks have been doing. But with inflation continuing to overshoot, there is a risk the ECB could surprise with a larger 50bp hike—which could ignite a rally in the single currency.

Disclaimer: The author currently does not own any of the securities mentioned in this article.