By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

It is only the third official trading day in September and we’ve already gotten a taste of the wild swings that can be expected in currencies over the next few weeks. The Bank of Canada surprised the market by raising interest rates for the second meeting in a row, sending the Canadian dollar down 200 pips to 1.2142, its weakest level in 2 years. The European Central Bank, which meets Thursday, is at the cusp of changing monetary policy and its decision or lack thereof is also expected to have a significant impact on the currency. On top of all this, Federal Reserve Vice Chairman Stanley Fischer submitted his resignation hours before President Trump and congressional leaders agreed to raise the debt ceiling for 3 months. Fischer’s announcement initially sent USD/JPY tumbling to 108.70 but the debt deal allowed USD/JPY to recover all of those losses and touch 109.40. China also seems to be tightening the noose on North Korea with reports that they closed part of their border and according to the White House, President Trump and President Xi are committed to taking further action with the goal of achieving denuclearization of the Korean Peninsula with military action not the first choice according to Trump.

So if you are wondering if the reversal in the dollar will last, consider that effectively two of the major risks plaguing USD diminished, which helps to justify the greenback’s recovery. U.S. data was also better than expected with the trade deficit increasing only marginally and non-manufacturing activity rising strongly in August despite the softer labor-market report. The Beige Book was even-keeled with economic activity characterized as having expanded at a modest-to-moderate pace and while employment growth slowed some, labor-market activity is seen as tight with limited wage growth. Looking ahead with no major U.S. economic reports scheduled for release on Thursday, we would not be surprised to see USD/JPY extend its gains. However while the dollar is up against the yen, it is steady or lower versus all other major currencies except for the New Zealand dollar and Swiss franc. This tells us that the market is not entirely convinced that the U.S.’ troubles are over and instead sees the short-term debt deal as nothing more than the White House and Congress kicking the can down the road. We’ll know soon enough with North Korea but that’s certainly true of the debt ceiling. In addition to all of the central-bank rate decisions, September also brings elections in New Zealand and Germany along with a big Brexit speech by Prime Minister May, which could be set for September 21.

Although the U.S. debt deal had the most dramatic impact on the currency market, the single-most unanticipated announcement was the Bank of Canada’s 25bp rate hike. In Tuesday’s note, we said there was a very small chance of a rate hike but we didn’t expect the central bank to pull the trigger at a meeting with no press conference. But perhaps that was exactly what the BoC wanted, which is to tighten and then stay mum until it sees how the markets and the economy absorb the move. They may have also felt that it could not wait any longer with the economy running on all cylinders. The BoC did not provide much explanation outside of saying that removal of some considerable stimulus is warranted with growth becoming more broad based and self sustaining as business investment and exports strengthened. Their comment about excess labor capacity and subdued wage pressure along with geopolitical risks, trade uncertainties and a stronger currency suggests to us that this could be the BoC’s last rate hike of the year. As it said in the monetary-policy statement, future decisions are not predetermined and they have to pay close attention to the economy’s sensitivity to higher rates. So while USD/CAD tanked Wednesday after the central bank’s rate hike, we would not be surprised to see a near-term bottom as the big event has now passed, giving investors a reason to cover their short positions.

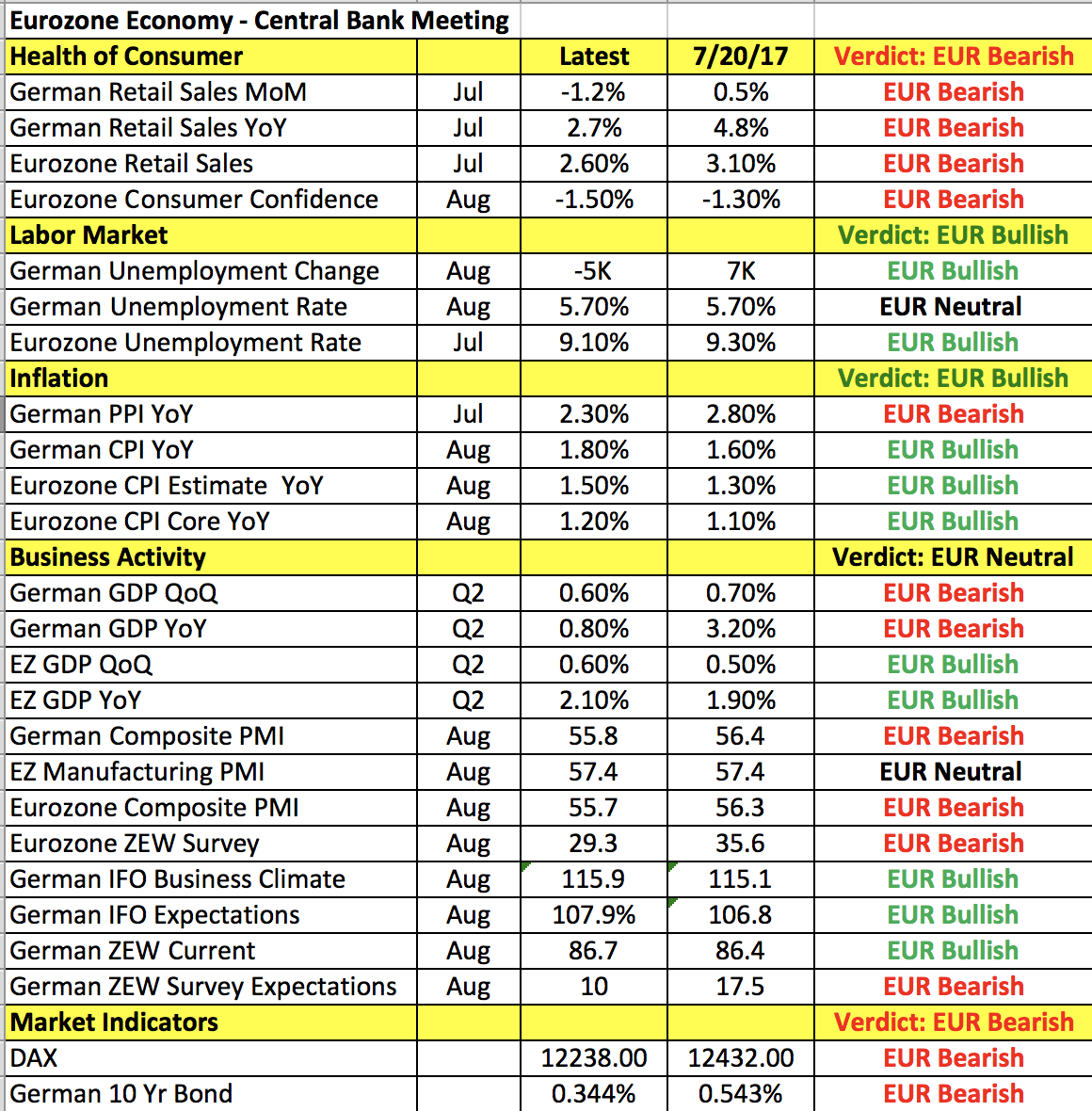

The focus now shifts to the European Central Bank meeting. Originally the market had high hopes for this ECB meeting but expectations were tempered significantly last week when Bloomberg reported that it may not have the appetite to rush into a decision in September and is unlikely to reach a QE decision before October 26. They also suggested that inflation forecasts could be cut, which would explain the central bank’s reluctance. With that in mind, EUR/USD is still holding above 1.19 indicating that a large subset of the market still expects the central bank to announce plans to taper bond purchases. Taking a look at the table below, there’s been only slightly more improvement than deterioration in the Eurozone economy since the last meeting. So the case for reducing stimulus is there and while we’ve seen significant gains in EUR/USD over the past few months, the currency is still trading below its 5-year average. For this reason, we think the ECB will go ahead with reducing asset purchases on Thursday. The only question, then, is if this will be a dovish taper. Most economists expect the ECB to cut asset purchases by 20B euros and if that’s all we see, EUR/USD will break 1.20 but probably struggle to extend its gains above 1.21. If ECB cuts by 30B or more, EUR/USD should hit 1.21. However if they forgo reducing asset purchases and postpone the decision to October or December, EUR/USD will fall to 1.1800 and possibly even lower.

Sterling also came off its highs when the U.S. dollar recovered and with no economic data on the calendar, the currency’s flows were driven entirely by the market’s appetite for U.S. dollars and euros. As for the Australian and New Zealand dollars, they moved in completely opposite directions. AUD found its way back above 80 cents despite the U.S. dollar’s recovery while NZD extended its losses below 72 cents. Although Australian GDP growth missed expectations in the second quarter, the 0.8% increase was significantly stronger than Q1, which is a reflection of the general strength in the economy. This divergence took AUD/NZD back above 1.11 toward its 1-year high of 1.1142.