Most of us are inundated with financial advice. Whether it’s TikToks that tell you how to cheat the banks and pay $0 in interest, or your cousin who knows about this start up company that he guarantees is the new Uber, there’s lots of conflicting information about how to maximise your personal wealth.

As someone who would love nothing more than a get rich quick scheme, I’m always investigating leads like this and can sadly report they are, for the most part, nonsense. The truth is that in a world where analysts on millions of dollars a year frequently make catastrophically wrong predictions, no one can predict the future, and there’s downside risk to whatever you choose to do with your money.

However, there is merit to some of the more standard pieces of advice you’ll hear. You likely are familiar with sound bites like ‘real estate is always a good investment’ or ‘safe as houses’. Through history, property has traditionally been a more secure investment (2008 notwithstanding). With inflation rampant right now, you may hear that property is the only way to protect your personal wealth from it. But is that true?

What is inflation?

Inflation is simple to understand. If you’ve ever been at the shops confused why baked beans are twice the price they were a year ago, that’s inflation. It’s measured as growth in the Consumer Price Index (CPI) - a numerical representation of how much a standard basket of common goods costs, and is typically expressed as an annual growth figure. The RBA aims to keep annual inflation between 2 and 3%. It’s currently running well over double this (although recent CPI data suggests we may have passed the peak).

There are all sorts of things that can contribute to inflation, but it basically occurs when demand for a good is far ahead of its supply. Much of the current inflation can be traced back to supply issues caused by Covid-19 and the war in Ukraine. If there isn’t enough of something to go around, its price increases.

When the RBA thinks inflation is too high, it brings up interest rates so people need to spend more of their income on mortgage repayments. In theory, this brings down spending, cooling demand and reducing inflation.

How your savings are affected

All going to plan, the current high inflation period won’t be permanent. In March’s monetary policy statement, RBA Governor Dr Philip Lowe said he and the board expect inflation to be back around 3% by 2025, in line with target levels. Ideally, demand should always slightly outstrip supply, so new businesses are incentivised to enter the market, creating new jobs and growing the economy. No inflation at all would see the economy stagnate, while deflation means there isn’t enough demand for goods and services, likely destroying many jobs and businesses and prompting a recession. Inflation isn’t likely to go away anytime soon, nor do we want it to entirely.

What it does mean though is that over time, your money loses value. Imagine you were given a $10 note in February 2022. At the time, you could buy your favourite lolly for 30 cents a pop, but as of February 2023, they now cost 32 cents. Last year you could have bought 33 of them, while now you can only get 31. Leaving money untouched for years means the amount of goods or services you could buy with that money will decrease. You want your savings to grow with inflation, so it’s a bad idea to just keep your money stuffed under your mattress.

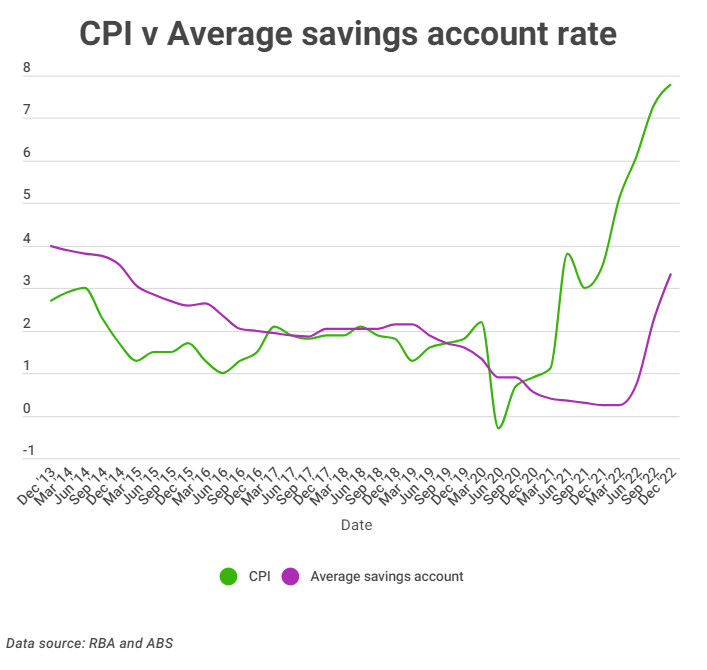

Even if you diligently invest into stocks or bonds though, you aren’t necessarily safe. Take the second half of 2022 for example. The RBA’s response to rampant inflation was to make ten consecutive increases to the cash rate. Investment takes a back seat when the cost of borrowing money is so high, so businesses were less likely to expand, meaning share prices suffered. Consumers having to spend more of their money on goods also tends to translate to a weak stock market, as everyday Australians have less money to invest in shares. Saving accounts are less volatile, but even then, if your interest rate is lower than inflation for a period, you still will have lost ground. As you can see from the below graph, this is often the case.

How does inflation affect the property market?

So finally, we get to the point of this article. The first thing to note is that while the property market does not usually fluctuate with inflation, there are a couple of ways that it can be influenced by high prices of goods and services.

Interest rates

As we’re seeing in 2023, when inflation is above target levels, the RBA is likely to increase interest rates to try to dissuade people from spending as much. RBA Governor Dr Philip Lowe has emphasised the importance of preventing inflation from becoming ‘entrenched’ in people’s expectations. If people believe continued inflation is inevitable, they will likely increase spending so they don’t end up spending more after prices go up. This can put some downward pressure on property prices, as prospective new buyers might be put off by the high cost of borrowing money. Dr Asti Mardiasmo of PRD research says that the longer high inflation and a rising cash rate persists, the less resilient the property market is.

“People’s borrowing capacity and household budgets/savings lessen more and more; which impacts their ability to purchase,” Dr Mardiasmo told Savings.com.au.

For landlords, higher mortgage repayments can be partially offset by passing these increases on to tenants through rent rises.

Higher maintenance fees and property taxes

The construction industry was hit particularly hard by supply chain issues caused by Covid-19. Labour costs soared as lockdown rules limited the amount of workers on a site, while materials were impacted by extra production costs. There’s also been a widely reported dearth of qualified tradespeople across Australia, an issue the government is scrambling to correct. Consequently, the cost of repairs and maintaining property have severely inflated in recent times.

Property tax can also be relied upon to increase with inflation. The government’s cost of operations increases with inflation like everyone else’s, so you can rest assured adjustable taxes like property will be upwardly amended accordingly.

Is property an inflation safe haven?

Dr Mardiasmo believes that, in general, property tends to be a more inflation proof asset, for several reasons.

1. Inelasticity

Elasticity is an economic term for how much demand for a product or service changes with its price. For example, cereal would tend to be more elastic, because if prices go up, there are many other alternative foods consumers can just switch to, reducing the demand. Inelastic goods tend to be those where demand is relatively stable (medication like insulin, for example, that the same people are likely to always need). Since people will always need a roof over their heads, property is also like this. You can easily replace cereal by buying bacon and eggs, for example, but if you’re struggling with the cost of living, you can’t really buy a car instead of a house to live in (though doubtless some have tried).

This means inflation has less of an impact on property prices than other assets. While inflation can see assets like shares or bonds devalued, this is partly due to people with less money in their pockets choosing to invest less of it. As property is a necessity, with reasonably constant demand, this downward pressure is less intense. While you might be reading this thinking ‘won’t people just rent instead of buy?', you should remember that rent typically is susceptible to inflationary pressures, so it might not work out to be a much cheaper option.

2. Availability of supply

With the rise of micro investing apps, trading in stocks is as simple as it has ever been. Anyone with a spare $50 can trade on the ASX or even international markets. Some platforms will also allow you to buy bonds or gold. Finding both a property that suits you and an owner willing to sell is more complicated. This is one of the reasons why demand for property is constant, because the supply is limited. When people are looking to buy property, they will have specific needs in terms of location, size, number of bedrooms, etc. Buyers will typically have limited options that suit their needs, so are less likely to be able to switch to cheaper alternatives during times of inflation.

Dr Mardiasmo pointed out this is more true for some types of property than others. Houses and townhouses are more resilient to inflation than units, because they tend to have a more limited supply.

“Units tend to feel the shocks due to higher levels of supply, especially now that in most places the tendency is to build up than wide,” she told us.

“In Queensland, Victoria and New South Wales, incoming unit builds are in the tens of thousands, but incoming new house builds are in the thousands, almost only a third of the number of units.”

3. The size of the investment

Let’s say you have a property that is worth the median dwelling value in Australia. As of March 2023, that's $702,136 (data sourced from CoreLogic). Now imagine the alternative portfolio you could have built up with that amount of money. It is likely heavily diversified, made up of lots of small investments. In this second scenario, if one of the stocks you hold is underperforming due to inflation, you might decide to cut your losses and reinvest elsewhere. This is a much less viable option when it comes to property.

While this might seem like a negative, when you consider this on a macro scale, you realise it means that during down periods, property owners are less likely to dump their investment and sell, which would devalue the broader market further.

We might be seeing this play out in 2023. At the start of the year, analysts were falling over themselves to warn of a further 15-20% blowout to property prices, but the evidence so far has suggested real estate has proven far more resilient than anticipated. CoreLogic data shows that this has coincided with a far lower than average rate of properties going to auction. It seems property owners are choosing to hold their investment while prices are lower rather than cop a loss on such a big investment, which in turn protects the market as a whole.

Savings.com.au's two cents

It’s true that property can be a good asset to protect your wealth against inflation. As with any investment though, this isn’t guaranteed. Few would have foreseen the Global Financial Crisis, for example, which was partially triggered by the collapse of the property market. No one really knows what’s going to happen, so the only thing you can do is to inform yourself as much as you can, and make your guesses (investments) as educated as possible.

"Can you protect yourself from inflation by investing in property?" was originally published on Savings.com.au and was republished with permission.