- Stocks rebounded last week with major US indexes closing in the green.

- But is this a sign of a turnaround, or a temporary blip before potential headwinds?

- A sharp drop in bullish sentiment indicates this turnaround may not last that long as we await key data, Fed.

- For less than $9 a month, access our AI-powered ProPicks stock selection tool. Learn more here>>

The stock market staged a dramatic comeback last week. The S&P 500 notched its best week in six months, and the Nasdaq secured its best daily move in two months.

This sudden upswing begs the question: Was the recent market correction merely a buying opportunity for savvy investors?

Fear often grips investors when faced with negative market signs. Many worry about calling a bear market or predicting a crash, fearing even deeper declines.

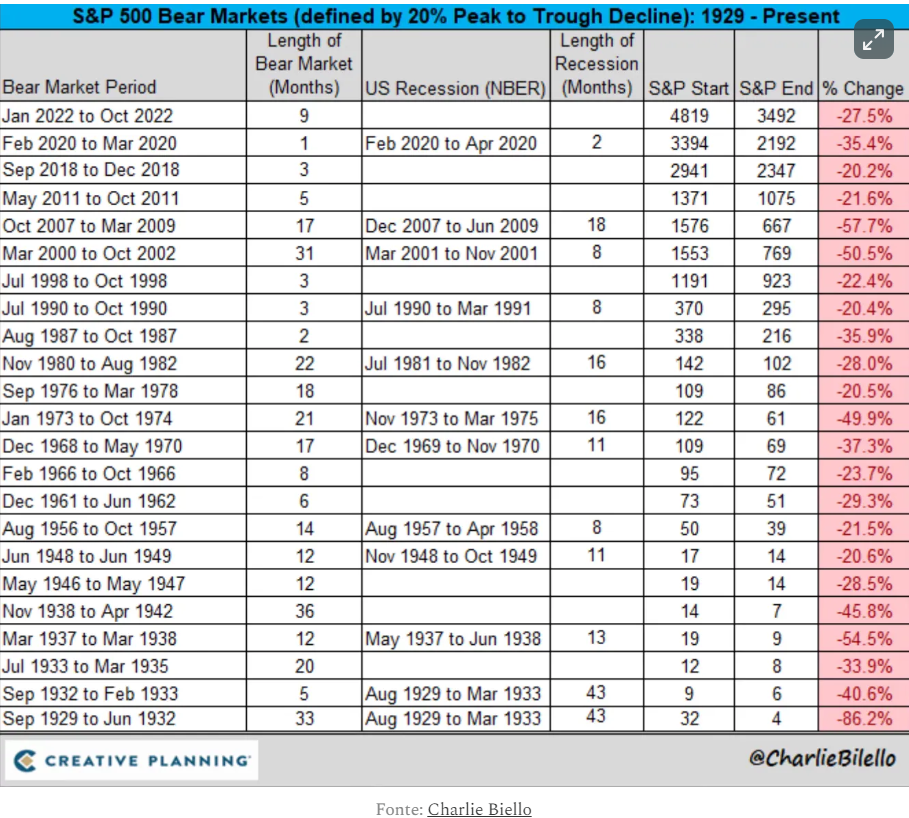

However, history shows that significant drops exceeding 20% from a peak are less frequent than many anticipate.

The following chart illustrates the sharp declines experienced by the S&P 500 since 1929, highlighting the infrequency of such dramatic falls.

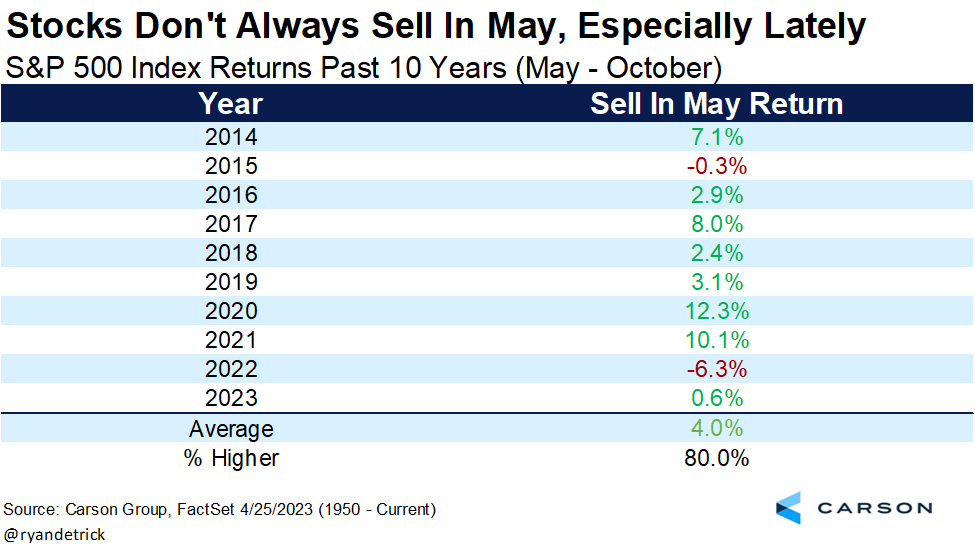

Furthermore, focusing on the performance of the past decade reveals a positive trend in May. Over the last ten years, the market has risen in May roughly 80% of the time, with an average gain of +4%.

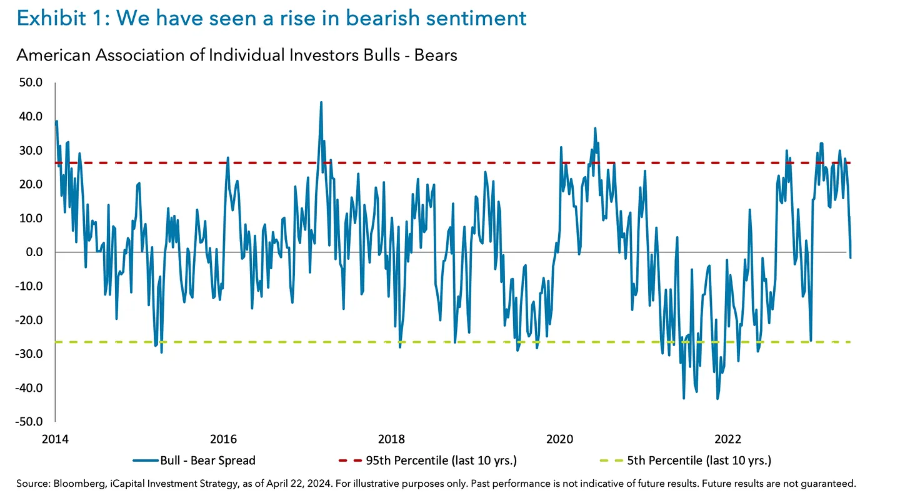

Despite the positive signals, a concerning trend emerged last week. For the first time in six months, bearish sentiment outweighed bullish sentiment.

The American Association of Individual Investors (AAII) indicator revealed a sharp drop in bullish sentiment for the sixth time in two months.

While last week's rebound offers some hope, the significant decline in investor optimism cannot be ignored. The market's trajectory will likely hinge on how this shift in sentiment interacts with upcoming data and the Fed meeting.

***

Ready to analyze more stocks? follow us in upcoming hands-on lessons, subscribe now with an additional DISCOUNT, and CLICK HERE to join the PRO Community.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.