By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

Since the beginning of the year, commodity currencies have been on a tear and after a brief dip, the Canadian, Australian and New Zealand dollars have reached for new highs. On Tuesday morning, the loonie rose to its strongest level in 9 months versus the greenback -- and while similar milestones have yet to be reached by AUD and NZD -- both currencies came within 50 pips of multi-month highs Tuesday. Reports that Saudi Arabia may have reached an oil-production freeze agreement with Russia sent oil prices sharply higher, providing support for all commodity currencies. The improvement in risk appetite also contributed to a move that will likely see new highs for all of the comm dollars. Chinese trade numbers were scheduled for release Tuesday evening and after the sharp fall in exports last month -- along with the near 50% decline in the trade surplus -- stronger numbers are expected for March. Both the Caixin and the official government release showed an improvement in manufacturing activity last month that is consistent with healthier trade numbers. An upside surprise in China’s trade balance report could be just what AUD and NZD need to hit new highs.

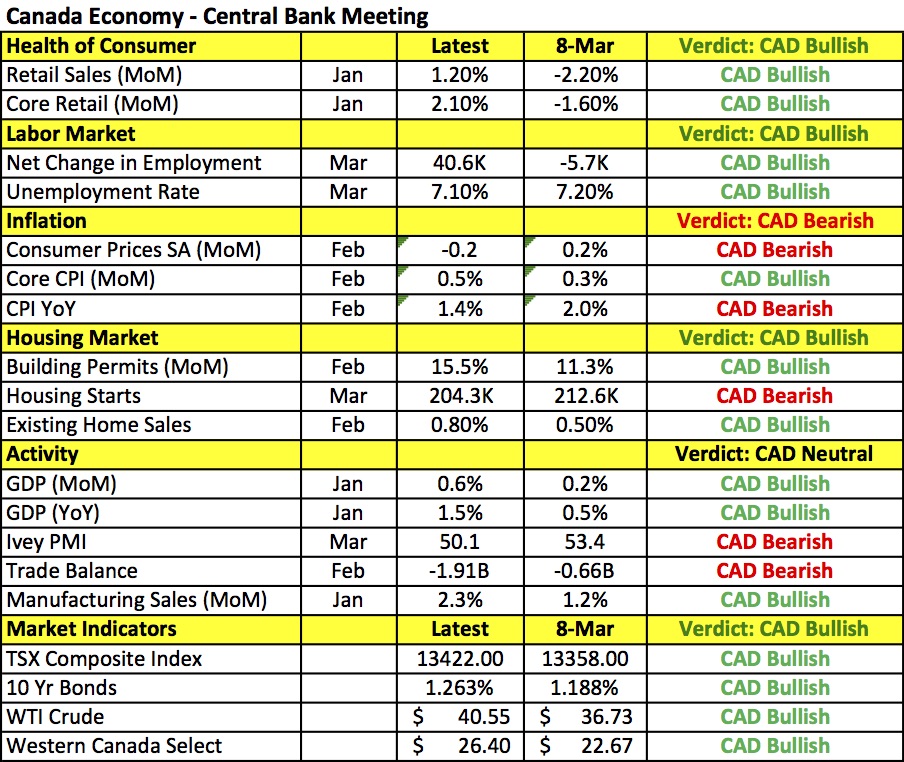

CAD traders on the other hand will be waiting for the Bank of Canada’s blessing. The following table shows the extent of the improvements in Canada’s economy since the March meeting. Retail sales rebounded strongly, job growth surged, the unemployment rate declined, building permits and existing home sales increased and GDP growth accelerated. While consumer prices fell, core CPI, which is less volatile, increased. The only area of concern is manufacturing activity and trade, which saw significant deterioration. However with oil prices up 10% since the last central-bank meeting and the Federal Reserve slowing its pace of tightening, the BoC has a lot less to worry about this month compared to March when it wasn't all that concerned to begin with. We will still be watching for comments on the currency because with the latest gains, it is up more than 4.5% since BoC last met. If they express any concern about CAD strength, the currency will peak and USD/CAD will make its way back to 1.30. If BoC sounds nonchalant, the next stop should be 1.2680, the level at which the 20-month SMA and 38.2% Fibonacci retracement of the 2011 to 2016 rally converge.

Although the U.S. dollar is down against all 3 commodity currencies and sterling, it was up versus the yen, euro and Swiss franc. Import prices and small-business confidence were the only pieces of U.S. data released and both deteriorated in March. We also heard from Fed Presidents Harker and Kaplan -- neither is a voting member but they agree that rates could rise in the near future and that policy can truly normalize as we move into the second half of the year. Fed officials -- doves and hawks included -- continue to see tightening in 2016 even though the market is pricing in no rate hike until 2017. Someone’s bound to be wrong and Wednesday’s U.S. retail sales report will affect these views. We are looking for consumer spending to rise because wages increased, job growth accelerated, which we have yet to see translate into stronger spending. March should be the month that happens -- especially given the improvement in demand that has been reported by Johnson Redbook. The Fed’s Beige Book is also scheduled for release and given the divergence between market expectations and Fed guidance, the central bank’s report on economic conditions in the Fed districts could take on increased importance.

While sterling traded higher against the U.S. dollar and euro on Tuesday, it ended the North American trading session well off its highs. Consumer prices rose 0.4% in March and 0.5% year over year. Both of these readings along with core CPI report were stronger than expected and are likely to move higher in the coming month if oil prices stay above $40 a barrel. Following 2 days of gains, Tuesday’s reports extended sterling's rally. However the details show some affects of an early Easter and with Brexit risks looming, sterling failed to hold onto its gains. Denmark also voted against the Association Agreement (a trade pact) between the European Union and U.K. And while the vote is nonbinding and the EU could undermine Denmark’s decision, it is a sign of the growing resentment toward the European Union that the Brits could end up sharing. No major U.K. economic reports are scheduled for release Wednesday but the Bank of England meets on Thursday.

After rising to a fresh 6-month high, the euro gave up early gains to end the day lower against the U.S. dollar. Even with Tuesday’s pullback, the currency pair continues to hold above 1.13 and remains comfortably within its narrow trading band. Eurozone industrial production numbers are scheduled for release Wednesday and while the recent drop in German IP points to a softer number, we believe the impact on euro should be limited. The U.S. dollar and Fed policy are the main focus and as long as stocks hold steady, EUR/USD will still be aiming for 1.15.