Last week started with a sell-off, and when it came to the buyers' turn in the second half of the week, they failed to show. Friday was the icing on the cake as whatever small gains achieved during the week were snipped back.

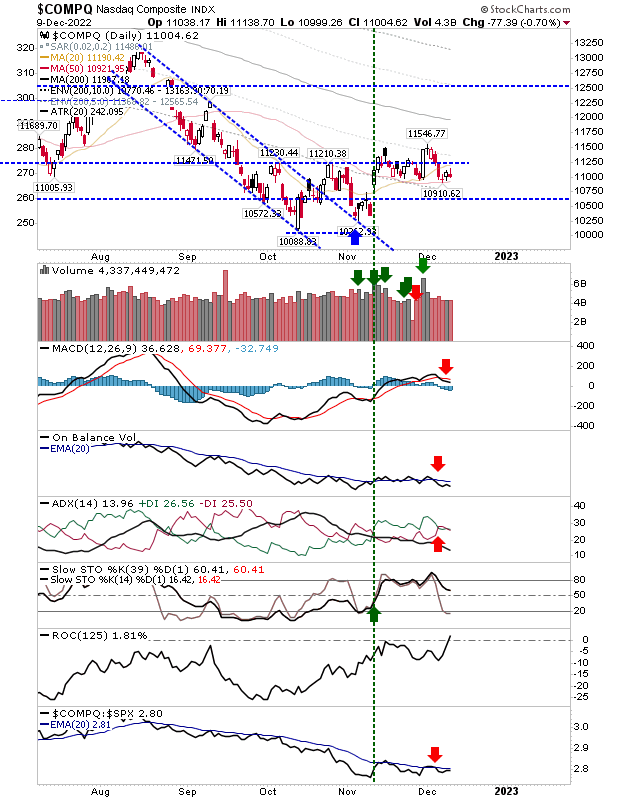

The NASDAQ Composite is still holding on to its 50-day MA, with Rate-of-Change crossing the bullish 'zero' line as part of a breakout in this indicator. On the flip side, the ADX, On-Balance-Volume, and the MACD are all on 'sell' triggers.

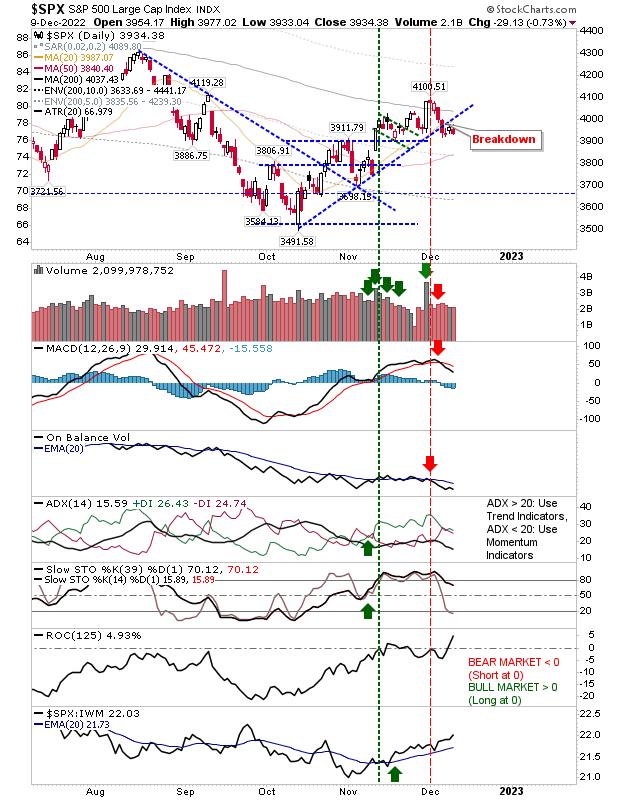

The S&P 500 rejected its 200-day MA and in the process broke below the rising trendline support. However, like the NASDAQ, the S&P 500 also offered a breakout in Rate-of-Change which has the potential for a 'bear trap' if buyers can strike on Monday - ideally with a move which also returns the index above its 200-day MA. The MACD and On-Balance-Volume are on 'sell' triggers, and Friday's selling does suggest the 'bear trap' might not be so easy to come by.

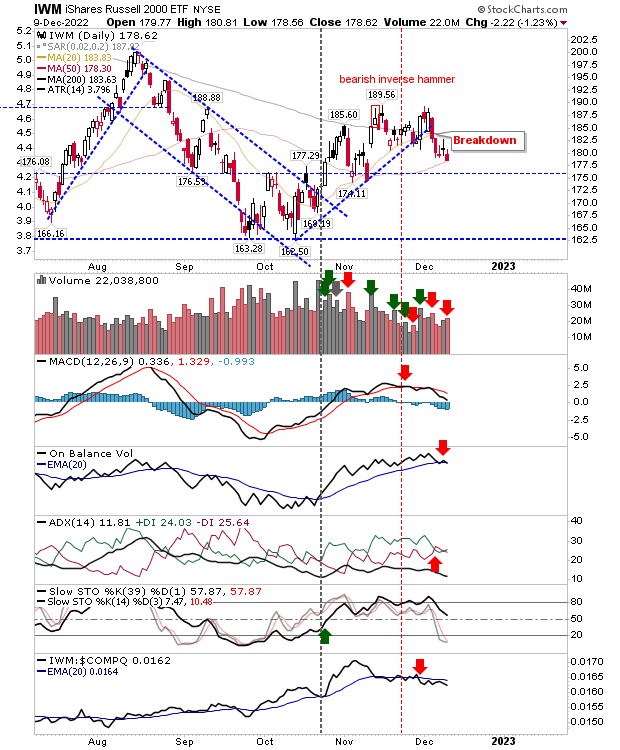

The Russell 2000 ($IWM) failed at its 200-day MA twice and has now returned to its 50-day MA. Friday's selling registered as distribution and to add insult to injury, the selling undercut the lows of the last two days.

If bulls are able to make an early appearance this week then the S&P has the chance to lead out an end-of-year rally, but time is running out. A loss of the 50-day MA in the Russell 2000 ($IWM) would likely see a similar loss in the NASDAQ, and be the nail in the coffin for the S&P. Only a few weeks left until the end of what has been a dismal year for bulls.