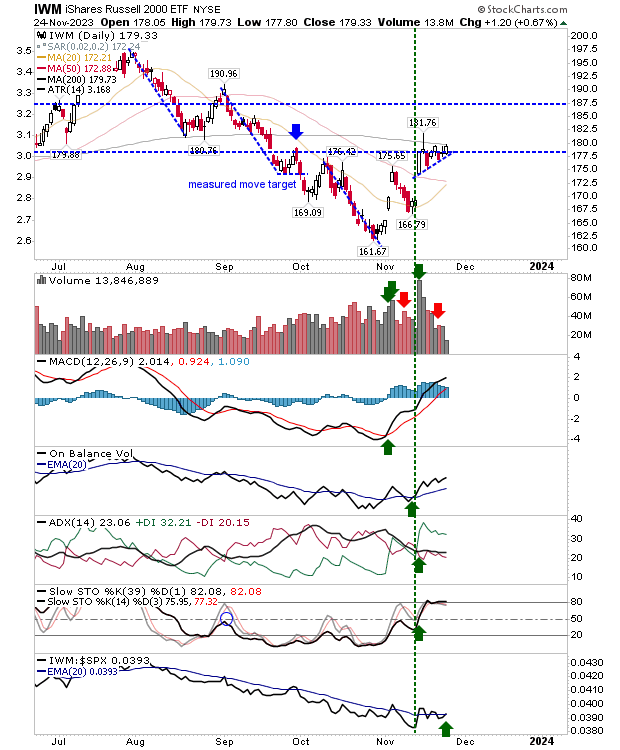

Whether you see the past week-and-a-half action in the Russell 2000 (IWM) as a bullish ascending triangle or pennant, it's clear there is a significant bullish turn in momentum since the early November gap higher (on higher volume accumulation).

Obviously, we can't read too much into Black Friday's trading, but we have a broader bullish picture on net bullish technicals.

Even relative performance against the S&P 500 looks to be turning in bulls favor. The only key resistance level left to break is the 200-day MA, and it is interesting that prices have stayed consistently below since the failed attempt on the inverse hammer spike.

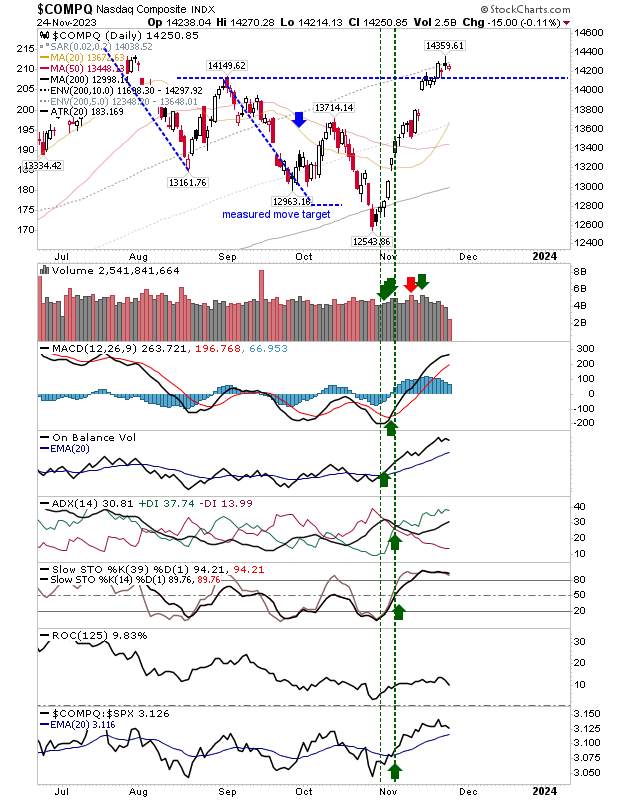

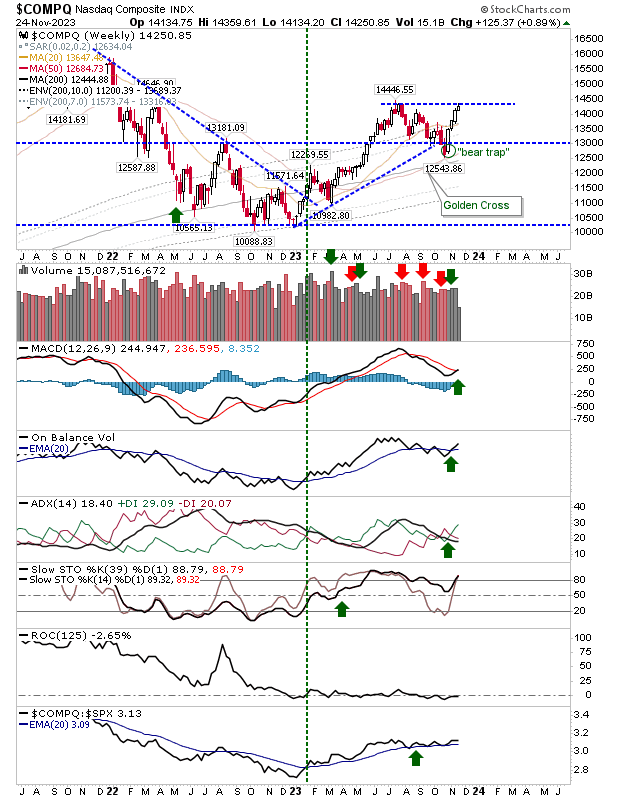

While the Russell 2000 sets up for a bullish week, other indices reached a logical end point of their October-November rally. For the Nasdaq, a sequence of narrow range days above the August swing high has the potential to generate a 'bull trap' that would leave shorts with a trade (to the 20-day MA).

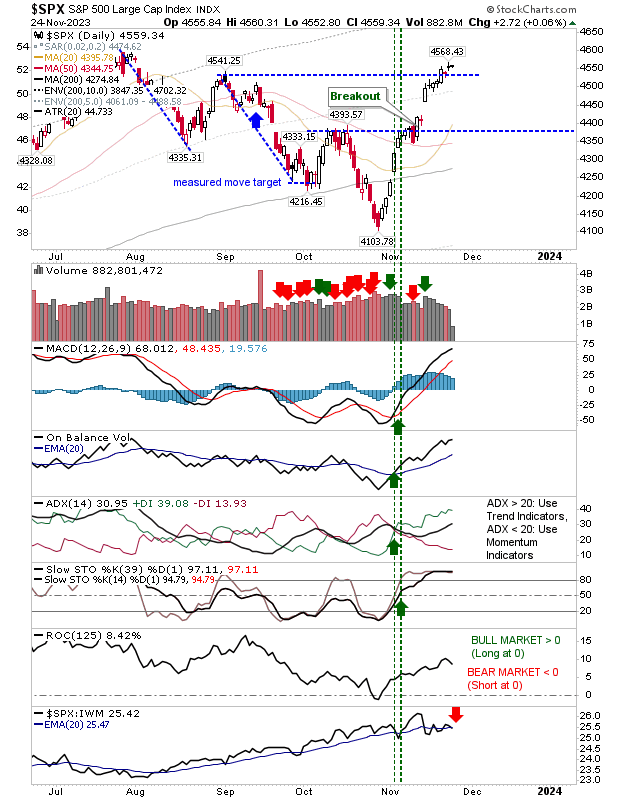

Likewise, for the S&P 500, we have August swing high to play as support, but I don't see this former resistance level has having been sufficiently breached to think buyers will step in to defend it should sellers make a run at this level.

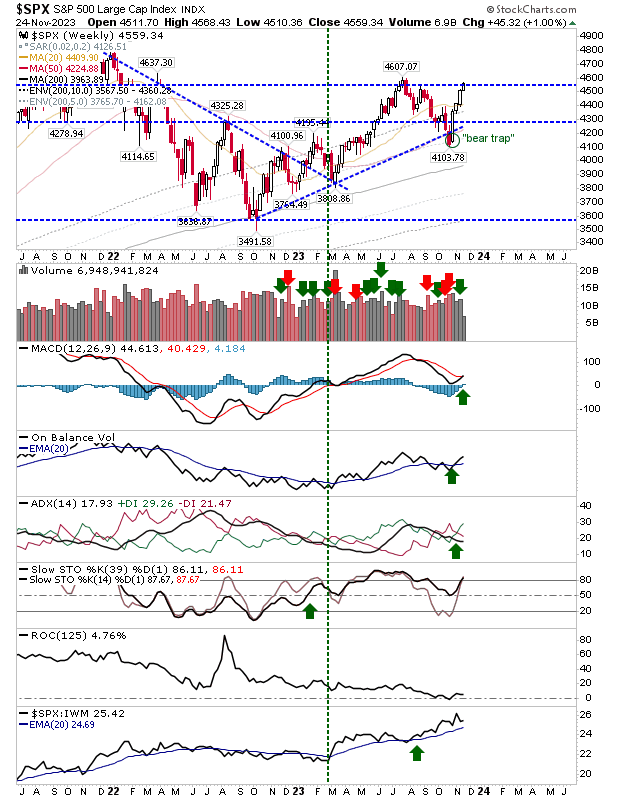

Another reason to expect selling in the S&P 500 and Nasdaq is that both indices are sitting on weekly timeframe resistance.

So we have a tale of two cities; a Russell 2000 that's ready to break higher and a S&P and Nasdaq ready to head lower, at least on a temporary basis.