By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

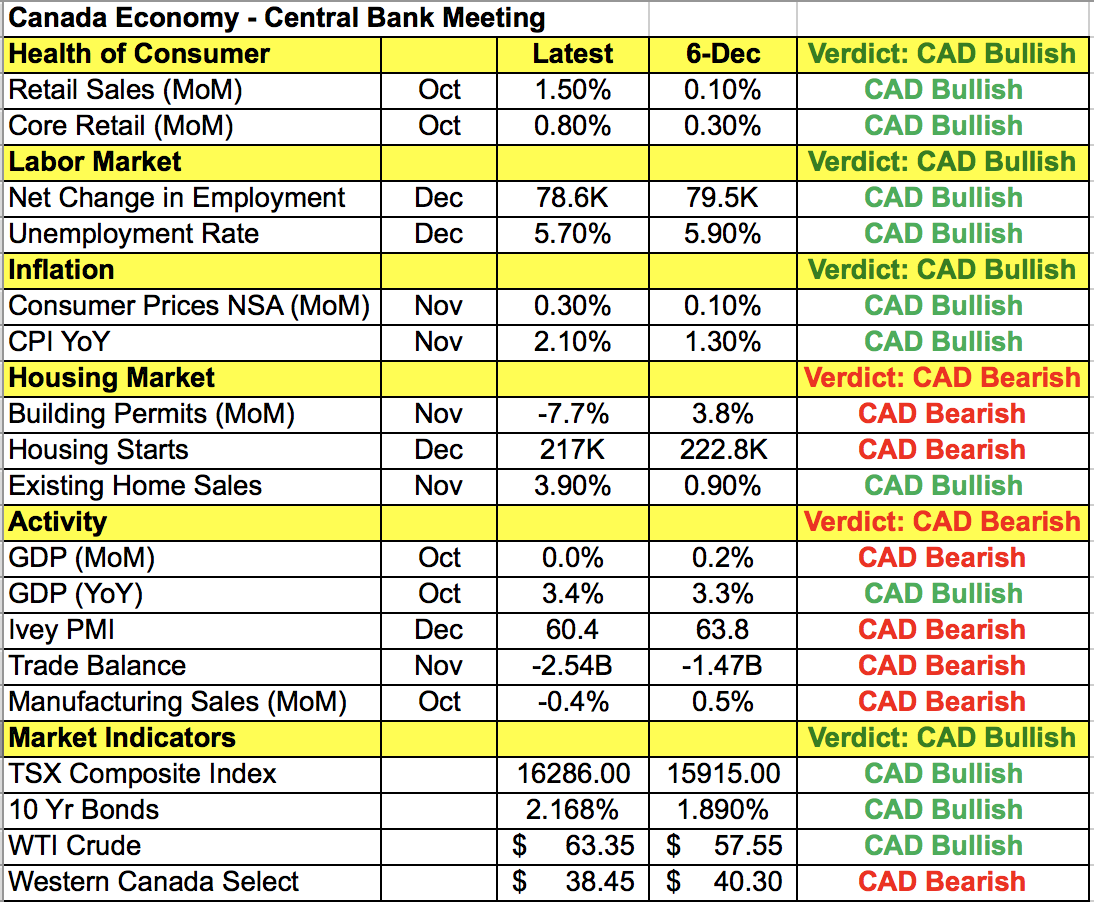

Wednesday’s Bank of Canada monetary policy meeting is the most important event risk this week and according to interest rate futures, investors are currently pricing in 90% chance of a 25bp rate hike, which would take interest rates to 1.25%. Many believe that a rate hike is a done deal but we are skeptical because as shown in the table below, Canadian oil prices and housing activity weakened since the last policy meeting. Manufacturing sector growth also slowed while the trade deficit ballooned. There’s no question that the economy in general has improved with retail sales, GDP growth, CPI and employment activity improving significantly since early December. Yet the BoC has more options than to raise interest rates immediately. These 3 possibilities could have distinctly different outcomes for the Canadian dollar:

- Scenario 1: 25bp hike but BoC downplays the move by suggesting future hikes are data dependent

- Scenario 2: No hike this month but BoC acknowledges improvements in the economy and signals plans to tighten in March

- Scenario 3: 25bp hike with signal of more to come

Scenarios 1 and 2 are most likely and depending on BoC chooses, the reaction could be very different. If it hikes but downplays the move and refrains from suggesting there’s more to come, USD/CAD will break 1.24 and potentially test 1.2350, but then recover quickly. If BoC passes but prepares the market for a March hike, USD/CAD could jump to 1.25 but retreat from that level aggressively. A quarter-point hike coupled with a hawkish guidance will see USD/CAD down to 1.23.

Since the last policy meeting in December, the Canadian dollar appreciated 2%, which is significant but also restrained ahead of a potential rate hike. With less than 24 hours to go before the rate decision, we have not seen material demand for the loonie, which indicates that traders are cautious about buying the currency so there could be significant room to the downside for USD/CAD.

As for the dollar, U.S. traders are back from their holidays and they are marking the occasion by taking stocks to fresh record highs, sparking talk of Dow 30K. But the rally wasn’t sustained and so turnaround Tuesday took on new meaning when stocks and high-beta currencies gave up their gains. Outside of profit taking on short dollar positions, there was no specific catalyst for the moves in USD/JPY. NY manufacturing activity slowed in January with the Empire State index slipping to 17.7 from 19.6. Although inclement weather in the NY region may have played a role in the pullback, it is at its weakest level in 6 months. The only explanation for USD/JPY’s recovery is the improvement in risk appetite but U.S. stocks have been rising almost every day this month and only now have we seen a response in the greenback. However with USD/JPY turning lower by the end of the NY session, the downtrend remains intact as long as the pair trades below 112. U.S. yields are also falling making it difficult for the dollar to rally, especially as investors eye budget negotiations and the risk of a government shutdown in the U.S. The Beige Book is scheduled for release on Wednesday followed by speeches from Fed Presidents Evans, Kaplan and Mester. Of the 3, only Mester is a FOMC voter this year and as a hawk, she is expected to support the case of March tightening.

In contrast, the pullbacks in euro and sterling have fundamental drivers. The Social Democrats are still giving German Chancellor Merkel trouble. The leaders of the SDP are willing to form a grand coalition but regional branches refuse to back the deal as they watch their approval ratings slump. They have until the weekend to gain enough support before delegates to a special SDP party congress vote on Sunday to decide whether their leadership should be allowed to begin formal coalition talks with Merkel. If they fail, Merkel has to choose between new elections or a minority government. Either way, the initial impact will be euro-negative and unless there is newfound support between now and then we could see further profit taking in EUR/USD before the weekend. Data wise, German consumer prices were confirmed at 0.6% but wholesale prices dropped -0.3%. Eurozone consumer prices are due for release Wednesday but as final numbers, they are not expected to have a significant impact on the currency.

After selling off post data, sterling ended the NY trading session unchanged against the greenback. According to the latest consumer price report, inflationary pressures are easing ever so slightly. In the month of December, CPI grew by 0.4% up from 0.3% but the annualized rate dropped to 3% from 3.1%. The decline was more significant for core prices, which slowed to 2.5% from 2.7% YoY, the lowest level in 4 months. While discouraging at 3%, price pressures are still very strong and well above the Bank of England’s target so for these reasons, the impact on GBP/USD has been nominal. More importantly, despite a willingness by some nations to accept a soft Brexit, the EU is still playing hardball with the U.K. by asking to maintain immigration rights and current trade agreements during the transition.

Lastly, the Australian dollar ended the day unchanged while the New Zealand dollar pulled back slightly despite higher dairy prices. For the second auction in a row, dairy prices increased, this time by 4.9%. The rise was fueled by dry weather and reports from Fonterra (AX:FSF) that there was a “significant” 6% drop in milk production last month. There were no economic reports released from Australia but consumer confidence and home loans were due Tuesday evening. Both currencies are vulnerable to corrections but whether that happens hinges on the market’s appetite for U.S. dollars.