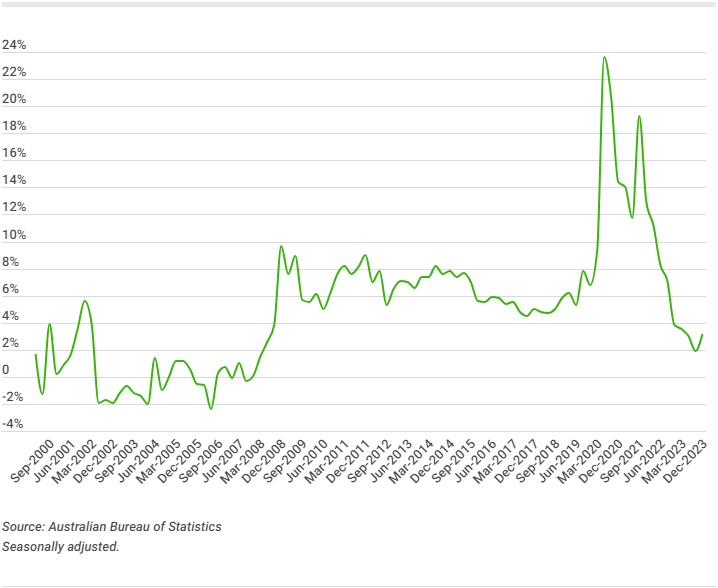

Measured by current prices, GDP growth through the year to December was 4.4%, but this doesn't take into account that prices rose 4.1% over the same time.

- GDP growth was 0.2% through Q4, but declined 0.3% per capita.

- High interest rates and the elevated cost of living continue to slow the Australian economy.

- Many are calling for rate cuts well before the end of the year to stimulate growth.

In chain volume measures which adjusts for price changes, annual GDP growth was 1.5% but with annual population growth around 2.5%, Australia remains in a per capita recession.

The December '22 quarter was the last time the Australian economy expanded on a per capita basis.

Consumer spending rose just 0.1% through the quarter, essentially at a standstill, with much of the growth that did occur coming from Government spending (up 0.6%), private business investment (up 0.7%) and trade balance.

Although exports fell by 0.3%, imports dropped by 3.4%, which moved Australia back into an overall trade surplus of 0.6% after a deficit by the same amount in September.

Westpac economist Andrew Hanlan said high inflation and contractionary monetary policy is clearly biting across the board.

"The economic slowdown broadened over the second half of 2023 from broadly flat consumer spending, which has been evident since the December quarter 2022, to other parts of the economy," Mr Hanlan said.

Household saving improves

The household saving ratio rose from 1.9% to 3.2%, despite the RBA raising rates on Melbourne cup day in the measured period.

Households have seemingly began to adjust to high interest rates and the elevated cost of living, which has been made clear by household spending figures which have shown a steady decline in discretionary spending.

Through the year to December, discretionary spending dropped 0.6%, despite price increases.

Wage growth was also likely a factor in the improved outlook for everyday Aussies, with wages growing faster than prices in the December quarter, the first time since March 2021.

Katherine Keenan, ABS head of national accounts, said extra assistance from the Government was another factor.

"Government payments were raised with increases to the base rates of payments across a variety of benefits such as JobSeeker and youth allowance; an increase in commonwealth rent assistance; and the standard indexation of benefits that occurs in late September," Ms Keenan said.

The RBA view

The 1.5% annual GDP growth through the year to December was what the RBA were forecasting in the most recent Statement on Monetary Policy.

The unemployment rate is above these forecasts though, at 4.1% in January, so Michele Bullock and the board will still be paying close attention to ensure the Australian economy avoids a full blown recession.

Rate cuts are widely expected towards the end of this year, with Westpac and CommBank economists predicting September will be when they begin.

One bit of positive news the RBA will take from the National Accounts for December was that labour productivity continued to improve.

GDP per hour worked increased 0.5% through the quarter, down from 1% in September, but that was after three consecutive quarters of contractions.

Labour productivity improving after weak outcomes recently is one of the assumptions underlining RBA modelling that inflation will be back at the midpoint of the target range by 2026.

However, a recent report from the Productivity Commission found Australian workers were 3.7% less productive in the 22/23 financial year, which was largely driven by a 7% decline in hours worked.

"Australian economy grew 0.2% in Q4" was originally published on Savings.com.au and was republished with permission.